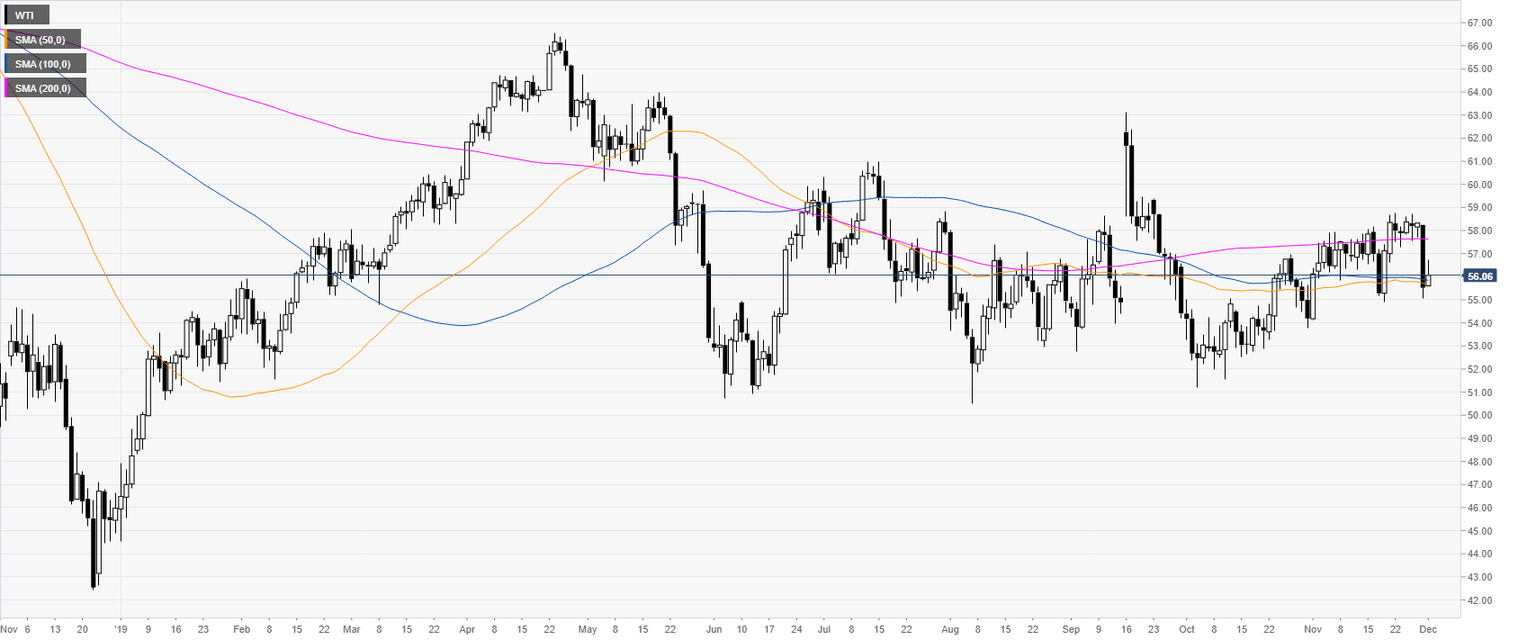

Crude Oil Price News and Forecast: WTI corrects from channel lows and target a break to the 21-DMA

Oil Technical Analysis: WTI correcting Friday’s drop near $56.00 a barrel

The crude oil West Texas Intermediate (WTI) is currently trading near $56.00 a barrel and the 50/100 DMAs consolidating Friday’s drop.

WTI is correcting the bear breakout below the 200 SMA on the four-hour chart. The market seems vulnerable to the downside. However, more consolidation might be on the cards in the medium term.

WTI corrects from channel lows and target a break to the 21-DMA

The price of a barrel of oil has been inching higher in recent trade, advancing 0.23% on the session from a low of $55.91bbls to a high of $56.18bbls in WTI. However, the moves do not reflect the bigger picture considering the slide from the close proximity of the $59 handle at the end of last month.

The outlook is a mixed one for oil. To start the week, oil prices were buoyed following a rebound in manufacturing activity for China as well as the potential for OPEC and its allies to agree on deeper production cuts ahead of this week's meeting.

Author

FXStreet Team

FXStreet