NZD/USD surges to fresh almost four-month peak [Video]

-

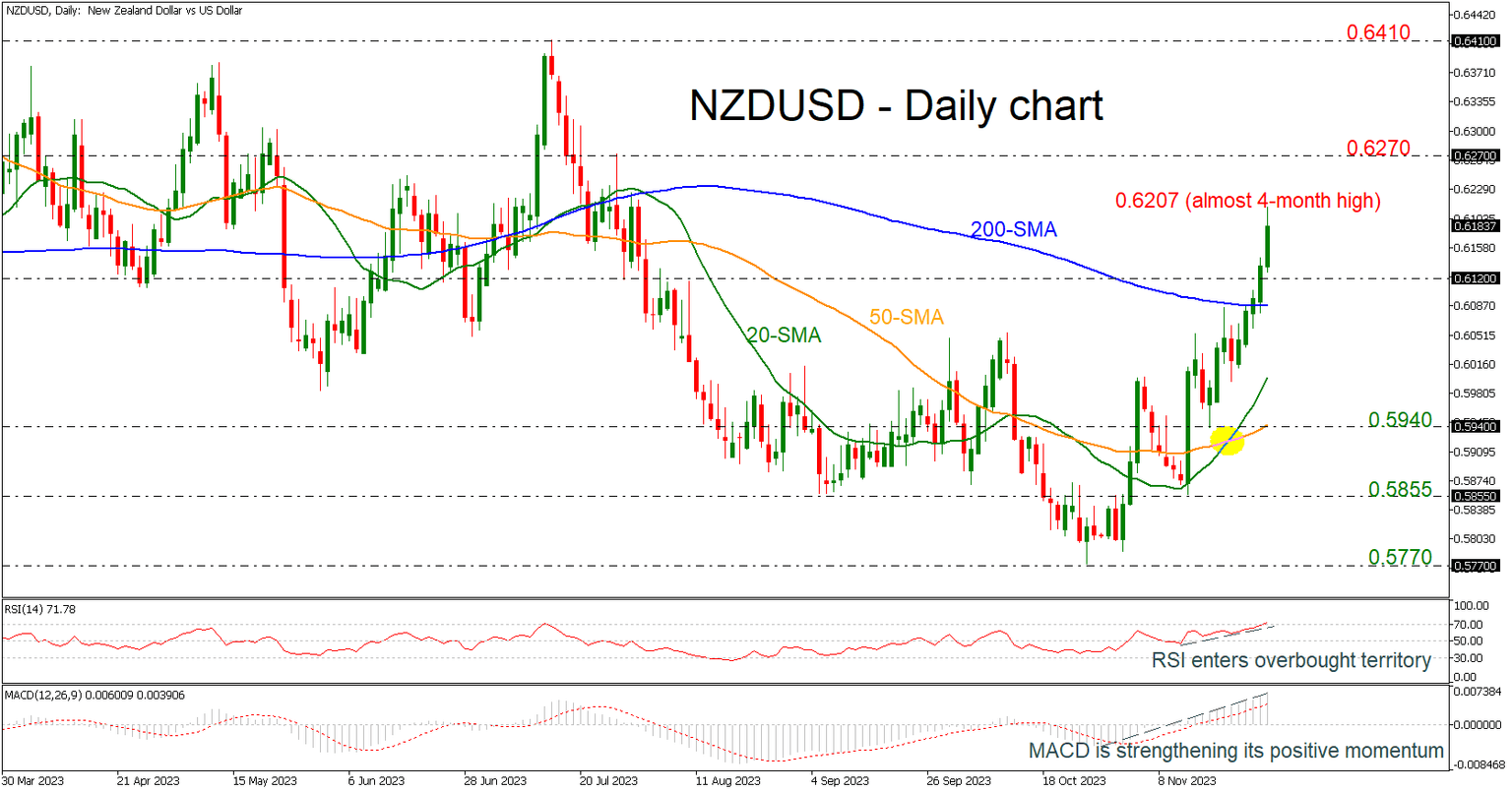

NZDUSD posts aggressive bullish rally.

-

Price penetrates 200-day SMA to the upside.

-

Technical signals are strongly bullish.

![NZD/USD surges to fresh almost four-month peak [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/NZDUSD/new-zealand-dollar-money-banknote-close-up-with-coins-46219248_XtraLarge.jpg)

NZDUSD skyrocketed to a fresh almost four-month high above the 0.6200 round number earlier today. The strong rebound off the 0.5770 barrier took the market well above the short-term simple moving averages (SMAs) and more importantly above the 200-day SMA, which is a bullish sign.

Technically, the RSI indicator is travelling towards the overbought territory with strong momentum, while the MACD is stretching its positive momentum above its trigger and zero lines.

If buyers stay in play, the door will open for the 0.6270 resistance, taken from the peak on July 27 before rallying towards the 0.6410 barricade. A jump above this line could endorse the bullish scenario, shifting the long-term outlook to bullish.

Should the bears press the price below 0.6120, the 200-day SMA at 0.6090 may prevent an aggressive downfall towards the 20-day SMA at 0.6000 and the 50-day SMA, which coincides with the 0.5940 support level. If the latter gives way too, the decline could continue towards the 0.5855 support line.

In a nutshell, despite the latest exciting rebound in NZDUSD, there are some obstacles to consider before a real bullish trend reversal takes place. The 0.6270 mark is currently in a target ahead of the 0.6410 barrier.

Author

Melina joined XM in December 2017 as an Investment Analyst in the Research department. She can clearly communicate market action, particularly technical and chart pattern setups.