NZD/JPY: Still ready for a swing trade?

Despite the recent risk-off trading is the NZDJPY ready for gains? The risk to this trade is obvious. If the new variant is a major concern then that should continue to weigh on the NZDJPY pair. However, if the variant is found to be not a threat then NZDJPY could offer some value.

The basic story is that yield differentials should support further NZDJPY gains. It is simply a case of pairing strength against weakness The RBNZ have the highest cash rate among major central banks and look set to increase rates further. The RBNZ see the official cash rate at 0.94% in March 2022 (vs 0.86% previously, 2.14% in December 2022(1.62%), and 2.30% in March 2023 (previously 1.77%). That’s the positive news.

In contrast, the BoJ is not expected to raise interest rates any time soon. In fact, some people are hoping that the JPY carry trade is back and an extended period of JPY weakness could be ahead. The BoJ is certainly expected to stay on hold with rates for the foreseeable future.

Price is around key support on the daily chart and this seems a decent enough area for some good support. The NZDJPY needed to have a pullback to offer some support for medium-term buyers to stick with it. This area looks pretty solid and the 200EMA just above 77.50 should provide a final line of defence.

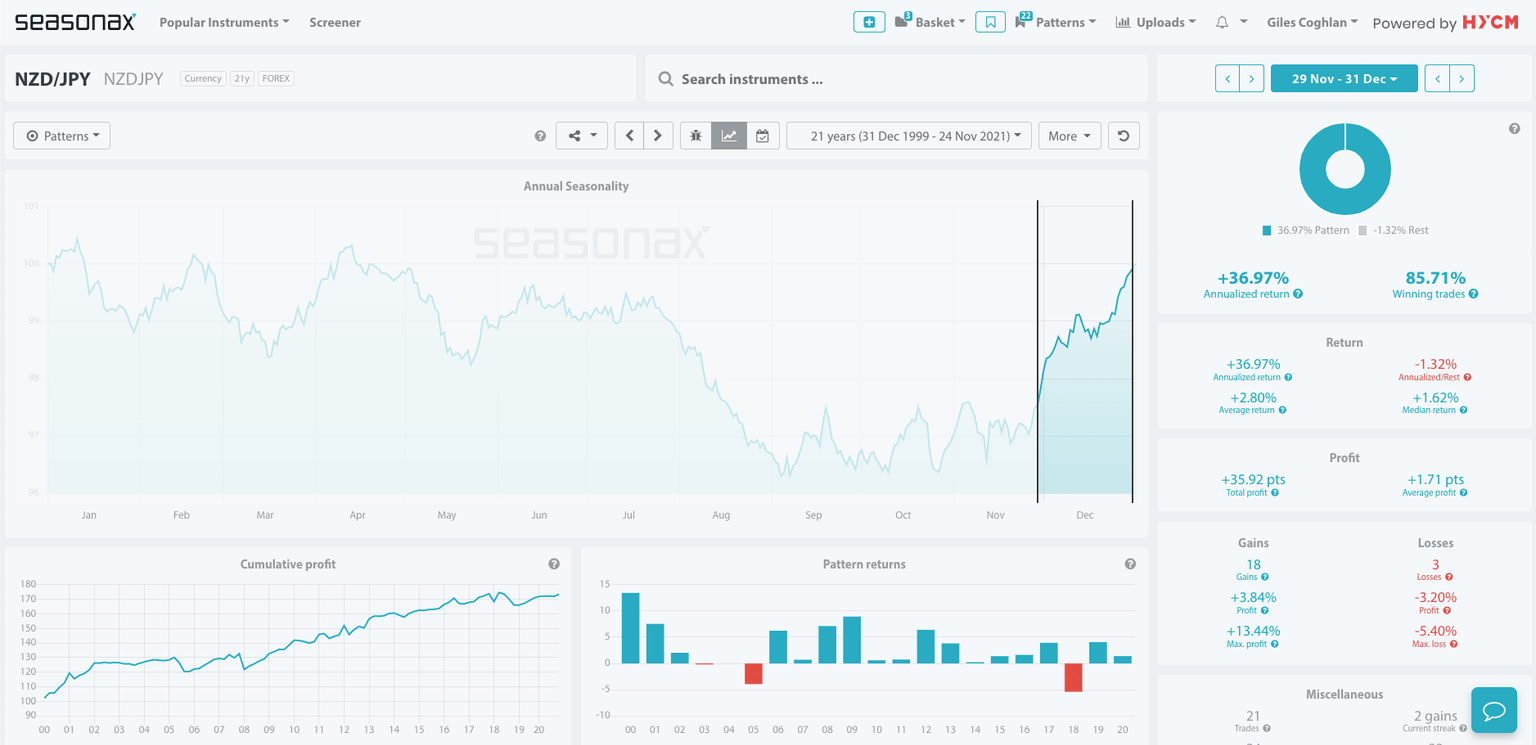

Don’t forget the seasonals

The seasonals are very solid for the NZDJPY pair. A deeper pullback is a great opportunity with tech, fundamentals, and seasonals all combined. The pair has an 85% winning streak over the last 21 years. Tax-loss selling higher tends to weaken the JPY and the NZD looks oversold now post the RBNZ rate meeting. They are, after all, set on a hiking spree for the foreseeable future.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.