Non-Farm Payrolls Cheat Sheet: Three stages of market reaction amid coronavirus confusion

- Headline Non-Farm Payrolls are set to determine the initial knee-jerk reaction.

- The political impact of the Unemployment Rate is set to shape the second move ahead of the long weekend.

- Core unemployment has room to impact stocks when the dust settles.

Coronavirus is upending everything – not only the labor market but also the Non-Farm Payrolls statistics. It is hard to capture a true snapshot of the employment market when it is moving so fast, impacted by rapid shutdowns and reopenings, and prone to classification issues due to furlough schemes. The Bureau of Labor Statistics acknowledges these issues – but markets are still set to react.

June 2020's NFP is due out on Thursday – ahead of the Independence Day weekend – and will likely see a three-pronged reaction.

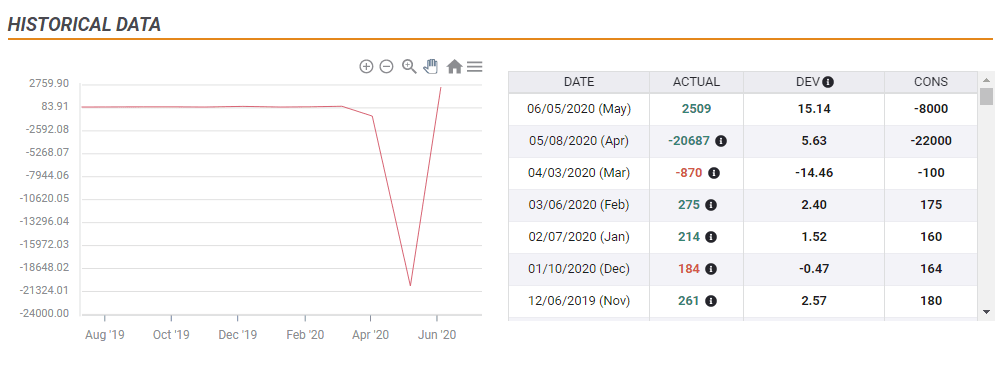

1) Headline – above or below three million?

The initial knee-jerk reaction is straightforward. Economists expect a second consecutive month of recovery, with three million jobs gained. Stocks are set to rise and the dollar to fall if the actual figure is higher while the opposite is on the cards if NFP misses.

As always, June's report includes a revision to May's figures – but traders are likely to respond only in reaction to the latest data.

2) Unemployment rate – for political reasons

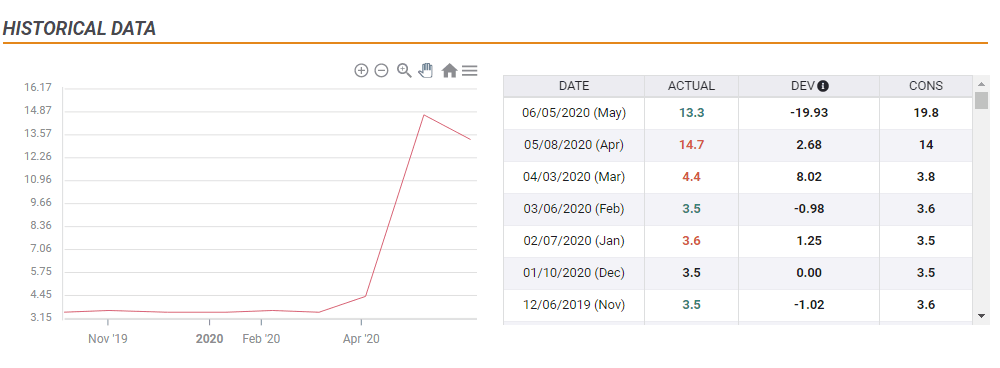

In pre-pandemic times, traders used to care about wages as a precursor of inflation and interest rate moves by the Federal Reserve. Salaries are skewed due to the disease and with the elections coming up, the headline unemployment rate becomes more interesting.

While investors are aware that the jobless rate fully depends on the participation rate – which plunged in April and bounced in May – that statistic has growing political importance. If it falls from 13.3% to 12.3% as expected – or even lower – President Donald Trump would be able to take a victory lap.

The incumbent is currently trailing rival Joe Biden in opinion polls by around nine points, with Democrats also having a shot at winning a clean sweep in Congress. Voters prefer Trump only on handling the economy. A potential drop in unemployment could mark a turning point from his recent descent in surveys – strengthening the narrative of being better for the economy.

After the initial reaction, stocks may rise and the dollar could fall if Trump improves his chances amid an improving labor market. An increase in joblessness could send equities down and the safe-haven dollar up. That reaction could last into the close of America's short trading week.

3) Core unemployment

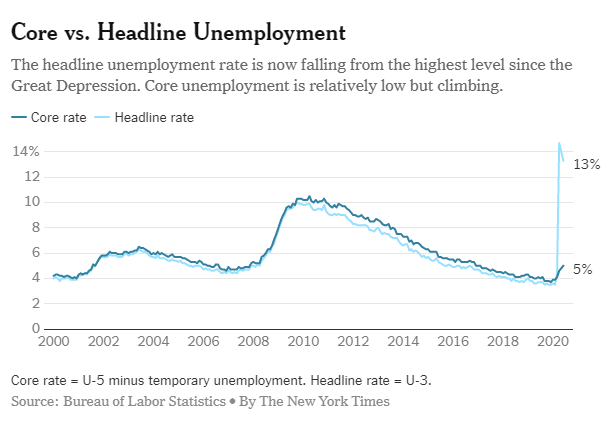

The third reaction may take more time – potentially for the following week. Economists are trying to figure out how many of those out of work are only temporarily at home and how many are there for the long term – core unemployment.

One such methodology is using the broader U-5 rate and subtracting temporary layoffs. This calculated core unemployment rate has been in tandem with the headline U-3 rate throughout the years, with a minor divergence in the first years after the crisis. The headline tended to be below the core rate.

The current situation – with stay-at-home orders and furlough schemes – triggered a gap. The headline jobless rate is now far above the core rate, which is only at 5% against 13.3% as of May.

Source: New York Times

Has core unemployment increased, stayed stable, or dropped? That may mark the third, longer-term, reaction. It will take time to reverberate.

Conclusion

June's COVID-19 influenced Non-Farm Payrolls may be confusing on many levels, but using the three-staged approach could provide a better guide at the potential market reaction.

More US Non-Farm Payrolls June Preview: The delicate art of prediction

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.