New Zealand Dollar sinks on soft GDP

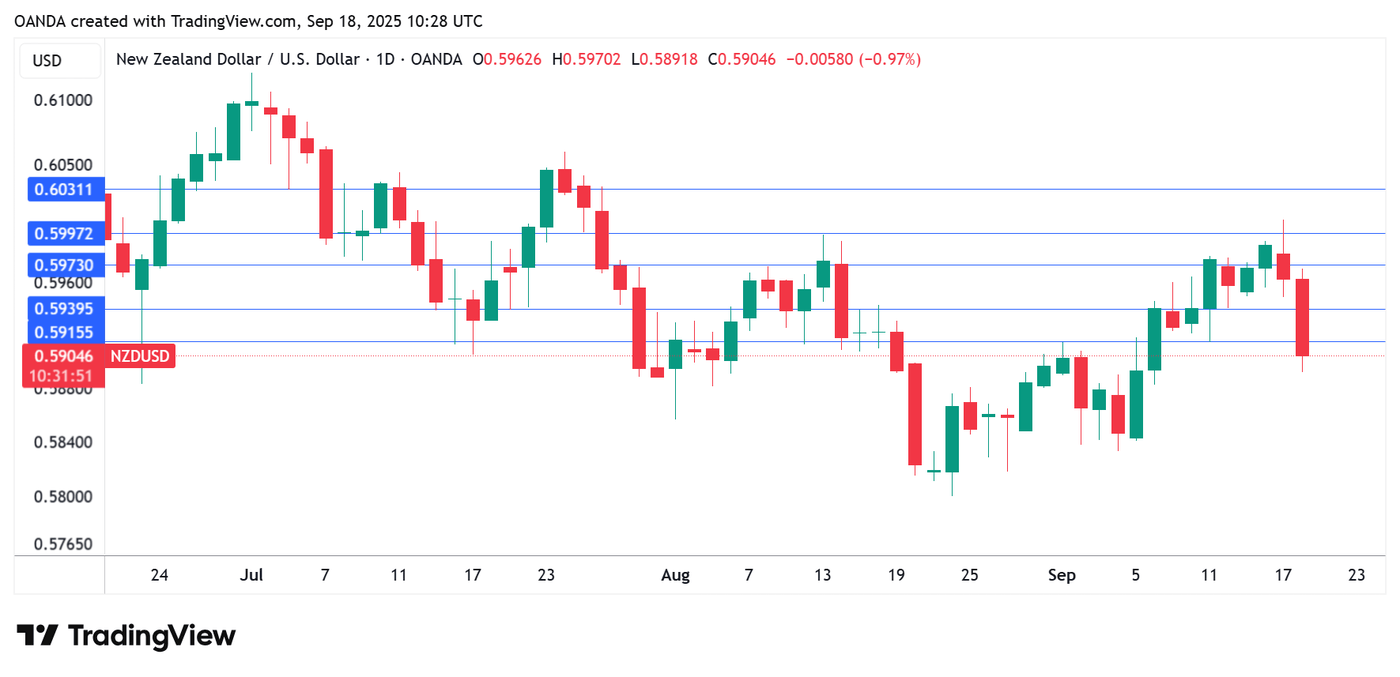

The New Zealand dollar has posted sharp losses on Thursday. In the European session, NZD/USD is trading at 0.5904, down 0.97%.

New Zealand's GDP slides by 0.97%

New Zealand's economy took a tumble in the second quarter, declining 0.9% q/q. This was a sharp downturn from the Q1 gain of 0.9% and below the market estimate of -0.3%. The economy has contracted in three of the last five quarters. Annually, GDP declined 0.6%, unchanged from the first quarter and well below the market estimate of 0%. The New Zealand dollar is down 1% on the soft GDP reading.

The GDP report showed broad weakness across the economy as construction and manufacturing posted declines and services were flat. The economy has been hurt by weak global demand and US tariffs on New Zealand, which have been set at 15%.

The weak GDP data will put pressure on the Reserve Bank of New Zealand to lower rates before the end of the year. The RBNZ meets next month and the markets have fully priced in a rate cut, with an 82% chance of a a quarter-cut and an 18% likelihood of a half-point reduction.

Fed delivers with rate cut

The Federal Reserve lowered rates by a quarter-point on Wednesday. The decision, which was widely expected, was the first rate cut since December 2024. For the second straight time, the vote was not unanimous, as one member voted for a half-point cut.

The rate statement pointed a finger at the cooling labor market as the main reason behind the cut. In his press conference, Fed Chair Powell reiterated concern about the deteriorating job market and said that the risk of higher and more persistant inflation have eased.

Perhaps the highlight of the meeting was the 'dot plot', which charts the expected rate path of members who participated at the meeting. The dot plot indicated that most members expect two more rate cuts before the end of the year.

NZD/USD technical

- NZDUSD has pushed below support at 0.5973 and 0.5939 and is testing support at 0.5915.

- There is resistance at 0.5957 and 0.6031.

Author

Kenny Fisher

MarketPulse

A highly experienced financial market analyst with a focus on fundamental analysis, Kenneth Fisher’s daily commentary covers a broad range of markets including forex, equities and commodities.