New Home Sales continue to surge

New Home Sales As Reported

The Commerce Department reports New Home Sales declined 0.3% in October but that does not factor in a significant upward revision in September.

Sales of new single-family houses in October 2020 were at a seasonally adjusted annual rate of 999,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development.

This is 0.3 percent below the revised September rate of 1,002,000, but is 41.5 percent above the October 2019 estimate of 706,000.

New Home Sales Seasonally Adjusted Annualized

Seasonal Adjustments Annualized

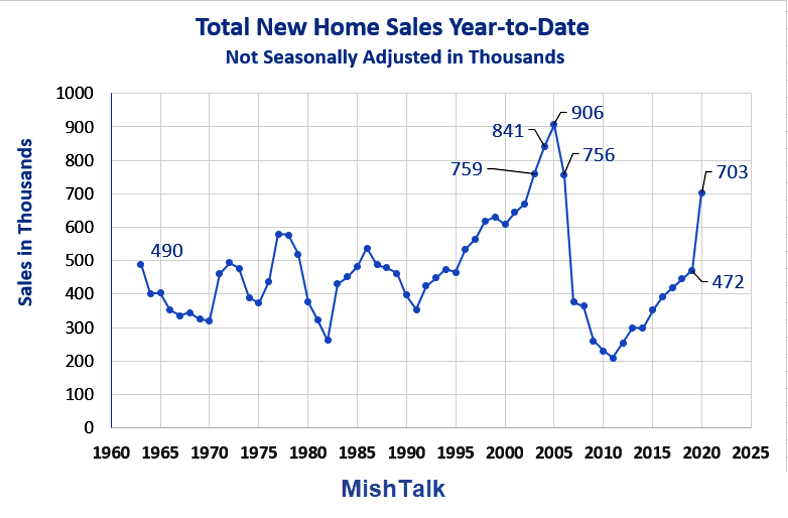

Note reported sales of 999,000 for October alone when the actual year-to-date total (January Through October) is 703,000.

Year-to-Date Analysis

From 2007 through 2019, year-to-date total sales for 10 months were less than in 1963.

Think about population growth and let that statistic settle.

Sales then surged in 2020 exceeding all but the bubble years of 2003-2006.

How the Housing Bubble Was Reblown in 20 Cities

Prices are through the roof thanks to Fed stimulus and suppressed interest rates.

For discussion, please see How the Housing Bubble Was Reblown in 20 Cities

Meanwhile, please note that Without a Deal 12 Million Will Soon Lose All Unemployment Benefits.

It's a tale of two recoveries, one for the haves and none for the have nots.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc