Natural Gas slips as winter risk premium fades

Natural Gas is entering a new phase of winter pricing. The market is no longer being driven by fear of scarcity. It is being driven by the disappearance of urgency.

In previous seasonal episodes, the gas complex tended to move in sharp waves, rising quickly on cold weather forecasts and collapsing just as fast once storage comfort returned. The 2026 winter has followed a different pattern. The risk premium has not exploded, it has slowly bled out.

That change matters because it reshapes positioning. When the winter story shifts from panic to normalization, rallies lose quality. Buyers become tactical rather than structural. Volatility remains, but it becomes less directional.

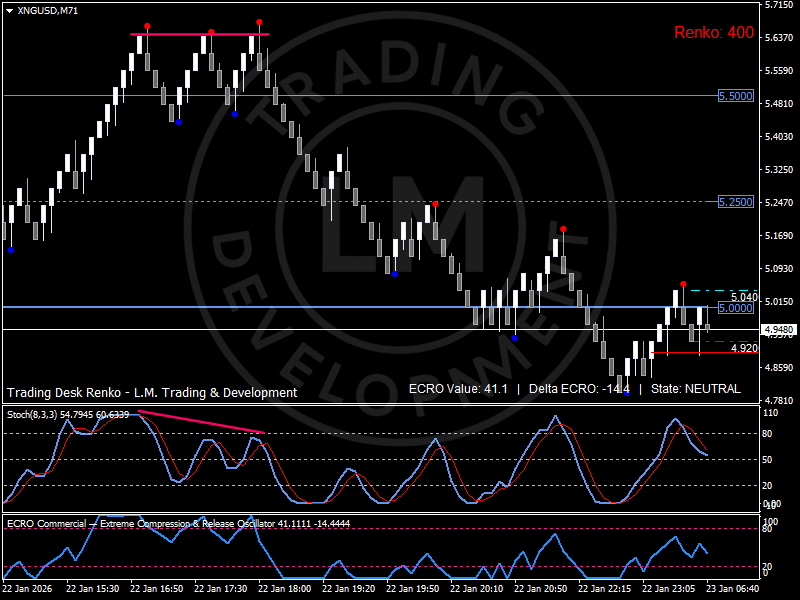

This is exactly what the Renko structure is now showing.

The winter narrative is changing from shortage risk to timing risk

The European gas market began winter in a stronger position than past years. Storage entered the season high, infrastructure is broader, and LNG flows remain relatively resilient. Even when geopolitics adds noise, the physical system has more buffers.

In the United States, supply remains structurally strong and production is flexible. Even with periodic weather volatility, the market is less exposed to systemic imbalance.

The result is a winter defined less by scarcity and more by timing. Weather still matters, but it has to be sustained. Short cold bursts are no longer enough to justify aggressive repricing.

That is why the market increasingly reacts to volatility but struggles to trend.

Why the risk premium is fading

Three forces are driving the fading premium.

First, storage comfort reduces urgency. When inventories are healthy, the market requires repeated stress signals to keep the upside pressure alive. One cold forecast is not sufficient.

Second, LNG logistics are no longer the single dominant constraint. Europe has diversified import channels and the system can absorb moderate disruptions without immediate dislocation.

Third, positioning is shifting. As winter progresses, traders become less willing to chase prices higher. Upside becomes more fragile because buyers need confirmation.

That psychological transition is often visible before it becomes obvious in the data. It shows up first in price quality.

Natural Gas is now showing that shift.

The Renko structure confirms distribution and a failed recovery

The Renko chart of XNGUSD captures the regime transition with precision.

Price previously built a triple top above 5.50, followed by a sequence of reversal bricks that signaled weakening trend strength. That triple rejection is not random. It reflects a market that attempted to extend the winter risk premium but failed to attract follow through demand.

From there the market moved into a clear downtrend, with a series of lower swings and repeated rejection attempts.

The most important technical signal is the behaviour around the 5.00 level.

Price tried to rebound into that zone, but the recovery lost momentum quickly. The market did not rebuild structure. Instead, it formed a short consolidation and then rolled over again.

This is typical of a market where premium is fading. When premium fades, the market does not spike lower immediately. It grinds down through failed rallies and lower highs.

That is exactly what is happening here.

Key levels to watch: 5.00 pivot, 5.25 ceiling, 4.92 trigger

The structure highlights three levels that define the tactical map.

The first is 5.00, the psychological pivot. Price is currently trading below that level and struggling to reclaim it. As long as 5.00 caps, the market remains in downside control.

The second is 5.25, a prior structural level that acted as a mid zone during the distribution phase. A break back above 5.25 would be required to change the tone meaningfully.

The third is 4.92, the near term downside trigger. It is the level that marks the current base. If price fails to hold that area, the next leg lower becomes likely, as the market will be confirming that the consolidation was not accumulation but pause.

The larger ceiling remains 5.50. That is now the boundary separating winter panic pricing from normalization pricing. It is far above current levels, and the distance itself is informative. It shows how much premium has already been removed from the market.

Momentum signals reinforce the loss of upside quality

Momentum is not collapsing but it is not strong enough to rebuild trend.

Stochastic has rolled from elevated readings and is now moving lower, consistent with the idea that rallies are being sold rather than accumulated.

ECRO sits in neutral with negative delta, which aligns with a market that is no longer releasing higher. It is rotating without expansion. In practice, that translates into choppy price behaviour with a mild bearish bias.

This is not a collapse structure. It is a grind structure.

For traders, grind structures are dangerous because they generate false signals. That is why levels become more important than indicators. The market will reveal intention only when it breaks the boundaries.

Fundamental catalysts: Weather and LNG spreads still matter, but they need confirmation

Even if the risk premium is fading, Natural Gas can still spike.

A sustained colder pattern across Europe and parts of the United States could quickly revive demand tension. LNG competition with Asia can still tighten marginal cargo flows. Any geopolitical shock that interferes with logistics can still trigger repricing.

But the market has changed. It now requires sustained confirmation.

That is the difference between panic and normalization. Panic prices the worst case immediately. Normalization prices only what becomes persistent.

This suggests that rallies may occur, but they may struggle unless supported by repeated catalysts.

Outlook: A range market with bearish bias unless 5.00 is reclaimed

The technical message is straightforward.

Natural Gas is in a correction regime where winter premium is being removed. The structure remains bearish as long as price stays capped below 5.00.

For the downside, 4.92 is the key short term threshold. Below it, the market would likely slide into the next support zones, driven by liquidation of remaining winter premium.

For the upside, the bulls need more than a bounce. They need a reclaim of 5.00 and a break above 5.25 to show that the market is rebuilding rather than fading.

Until then, the market looks like a slow repricing lower, interrupted by volatility bursts driven by weather headlines.

Conclusion

Natural Gas is exiting the winter panic phase and entering a normalization phase. The risk premium is no longer expanding. It is being removed through failed rallies and lower highs.

The Renko chart confirms that transition. The double top above 5.50 marked a rejection of premium pricing. The failure to reclaim 5.00 confirms the loss of upside quality.

In this environment, the key is simple. 5.00 is the pivot. Above it, the market regains winter momentum. Below it, the premium continues to fade, and the path of least resistance remains lower.

Author

Luca Mattei

LM Trading & Development

Luca Mattei is a market analyst focusing on FX, metals, and macroeconomic trends. He develops trading tools for retail and professional traders, coding indicators and EAs for MT4/MT5 and strategies in Pine Script for TradingView.