Nasdaq March Futures Remain Structurally Balanced as Key Levels Guide Price Action

Nasdaq March Futures (NQH) — Daily and intraday structure desk

Market environment (Higher-timeframe context)

Nasdaq March futures remain in the early phase of contract development, with price behaviour beginning to define repeatable structural references on the daily timeframe. While directional conviction has yet to be fully established, the market is providing a clear structure-based context that continues to guide both swing and intraday decision-making.

At this stage, the focus remains on how price responds to structure, rather than anticipating directional outcomes.

Daily structure in focus

Based on the available daily data for the March contract, two near-identical price structures have emerged, offering a balanced framework for ongoing observation.

Both structures share a common central pivot at 25,405, which continues to act as a key reference around which price has been rotating.

- Upper micro structure (daily): 25,794 → 26,703.

- Lower micro structure (daily): 25,051 → 24,142.

This symmetry highlights a market still negotiating value, with neither side showing sustained acceptance beyond the broader structure.

Price is currently interacting near the centre of the structure, while also respecting the Micro-5 level at 25,051, where buyers managed to hold into recent closes.

As long as price remains above this level, the market retains scope to rotate back toward the upper microstructure. A failure to hold would shift focus toward the lower structure instead.

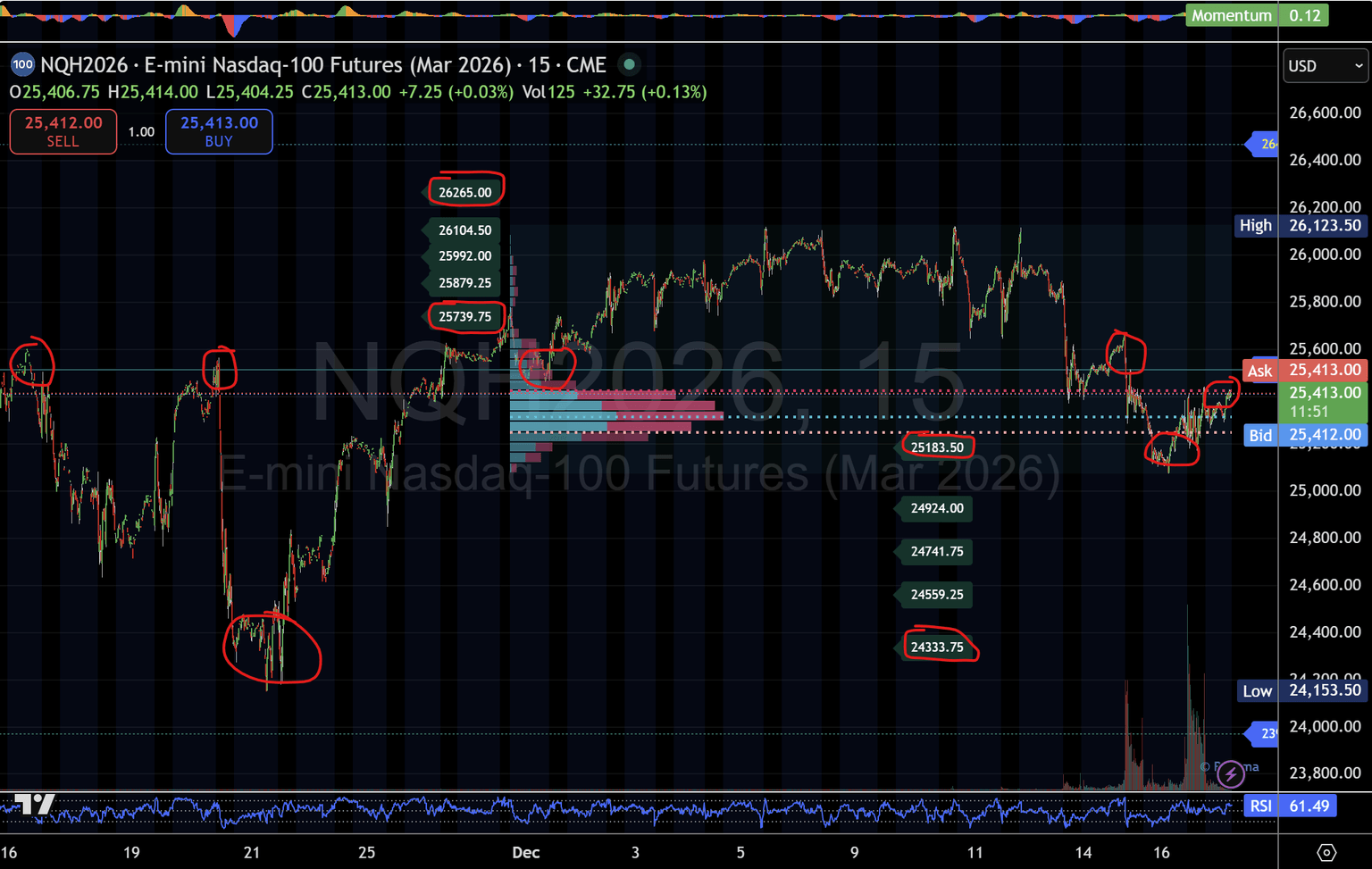

Intraday structure (15-Minute)

On the 15-minute timeframe, a clear two-way structure has also developed, aligned with the broader daily framework and defined using the same MacroStructure principles.

- Upper intraday micro structure: 25,739 → 26,265

- Lower intraday micro structure: 25,183 → 24,333

Over the past two sessions, price rotated lower but found responsive demand at the Micro-5 lower structure (25,183), where downside momentum stalled.

At the time of writing, heading into the London session, Nasdaq March futures are trading near 25,397, just below a key intraday pivot at 25,514.

Intraday levels and execution context

The 25,514 pivot continues to act as a short-term decision point, frequently guiding intraday rotation and order-flow shifts.

- Above 25,514:

Focus shifts toward the upper intraday micro structure at 25,739 → 26,265, particularly if acceptance develops. - Below 25,514:

Attention returns to the 25,183 Micro-5 level, with further downside framed toward the lower structure if acceptance builds.

These intraday levels are well-suited for short-duration, fast-moving price action, particularly when aligned with the broader daily structure. When daily and intraday references converge, the quality of execution context improves without requiring directional prediction.

Key levels to monitor

Daily reference levels

- 25,405 — Structural midpoint.

- 25,051 — Daily Micro-5 / buyer defence.

- 25,794 – 26,703 — Upper daily micro structure.

Intraday reference levels

- 25,514 — Intraday pivot.

- 25,183 — Intraday Micro-5 / support.

- 25,739 — Upper intraday Micro-1.

Desk takeaway

Nasdaq March futures continue to trade within a well-defined, two-way structural environment across both daily and intraday timeframes. Rather than directional conviction, the market is offering clear rotational behaviour around known reference levels.

By combining intraday execution levels with higher-timeframe structure, traders are better positioned to navigate short-term volatility while remaining anchored to the broader context.

Structure continues to lead. Price confirms. Narrative follows.

This analysis is for informational purposes only and does not constitute investment advice. Markets involve risk, and past performance does not guarantee future results.

Author

Denis Joeli Fatiaki

Independent Analyst

Denis Joeli Fatiaki possesses over a decade of extensive experience as a multi-asset trader and Market Strategist.