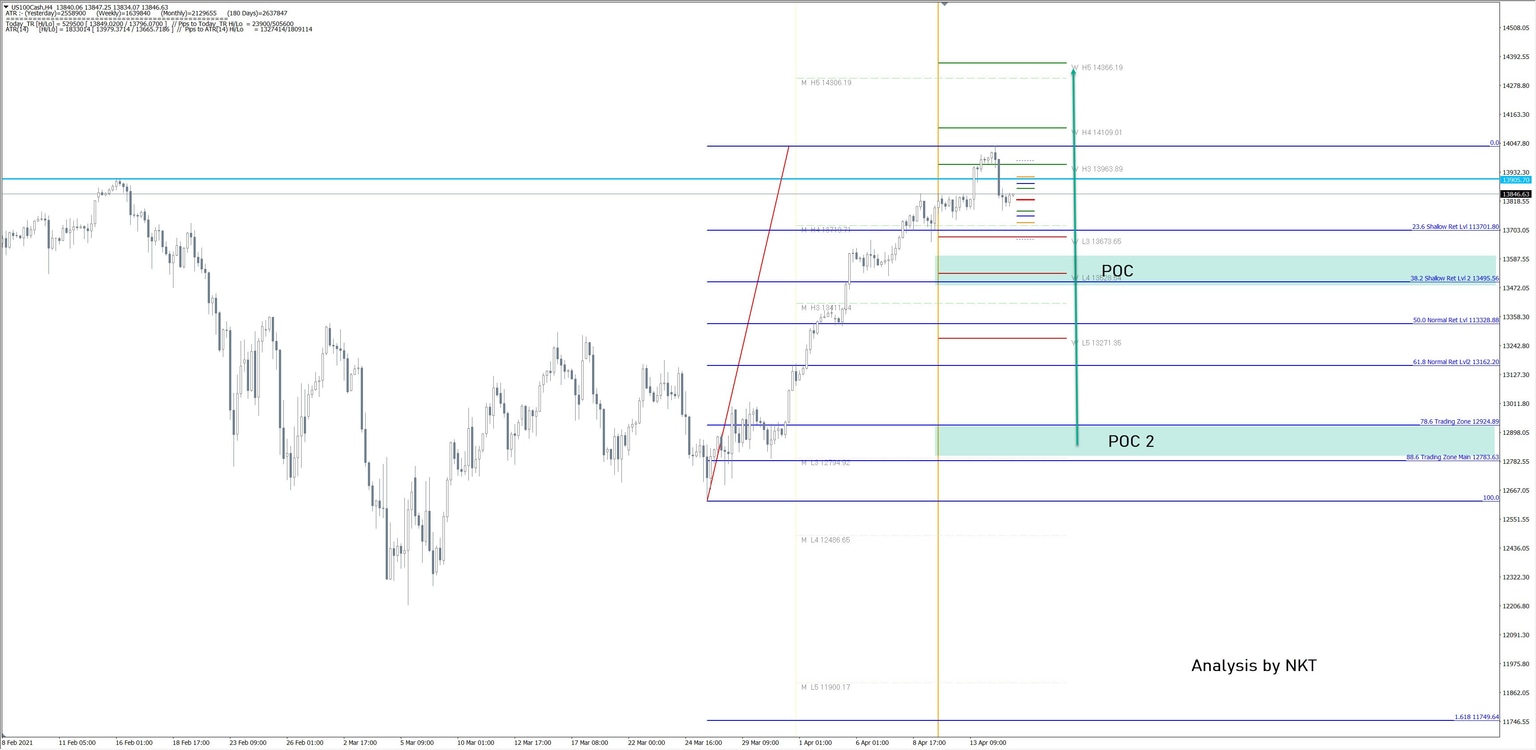

Nasdaq at highs but watch for a retracement

The US100 - NASDAQ has been trading in an upper range indicating a strong uptrend. This is the case partially to Yen getting weaker.

We can spot 2 POC zones. The first zone 13495-13600 is a shallow retracement, usually seen in strong trends. 38.2 Fib is making a confluence with W L4. On the other hand, we can see POC2 at 88.6/M L3 at 12794. Watch for rejections in any of the zones towards 14050 followed by 14109 and 14300. Breakout will happen above 14050. W H5 is 14366 which is the weekly target after a breakout.

The analysis has been done with the CAMMACD.Core System.

For more daily technical and wave analysis and updates, sign-up up to our ecs.LIVE channel.

Author

Nenad Kerkez

Top-XE