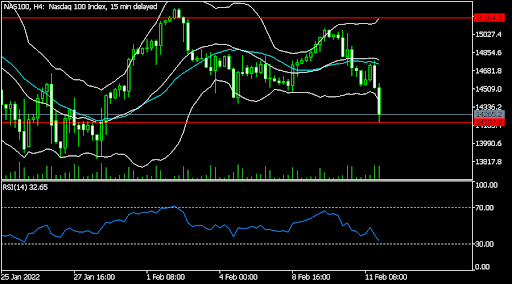

Nasdaq 100 retreats amid geopolitical tensions

US equities crashed sharply on Friday as investors reacted to the latest warning by the US intelligence on Russia’s activity near Ukraine. In a statement, the agencies said that Russia had amassed enough troops near the Ukrainian border and the Baltic Sea. They warned that an invasion could happen any time in the coming days. These were the latest revelations by the intelligence community. Two weeks ago, they warned that Russia was planning some fake attacks in a bid to provoke an invasion. Still, analysts believe that any geopolitical crisis in the region will have minimal impact on stocks. This partially explains why US futures pointed higher.

US stocks are also reacting to the ongoing earning releases. Most companies in the S&P 500 index have already published their quarterly results. According to FactSet, 72% of companies in the index have already published their results. Of these companies, 77% of them have published results that have beaten analysts’ forecasts. Earnings growth has been about 30%, marking the fourth straight quarter of over 20% earnings growth. The 12-month PE ratio of companies in the S&P 500 is at about 12 months. The next key companies that will publish their results are Airbnb, Roblox, Continental Resources, Vornado Realty Trust, and Arista Networks among others.

The price of crude oil jumped sharply as investors predicted a growing supply and demand imbalance in the coming months. On supply, there are signs that some countries like Nigeria and Angola are struggling to meet their quotas. Therefore, unless other producers boost their production, there is a possibility that prices will remain steady. There is also a risk that Russia’s oil industry will be sanctioned, leading to more challenges since it is the third-biggest oil producer in the world. At the same time, demand is expected to keep rising as the world reopens.

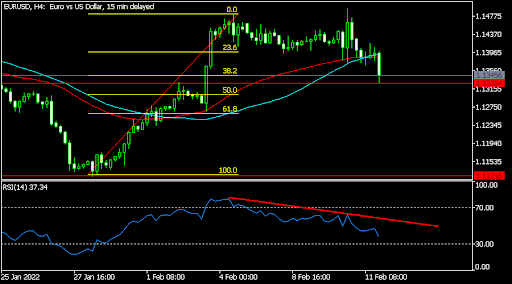

EUR/USD

The EURUSD pair declined to a low of 1.1328, which was the lowest level since February 3. The pair has managed to drop substantially from last week’s high of 1.1496. It has moved below the 38.2% Fibonacci retracement level. The Relative Strength Index (RSI) has also formed a bearish divergence pattern and moved below the 25-day moving average. Therefore, the pair will likely keep falling as bears target the key support at 1.1280.

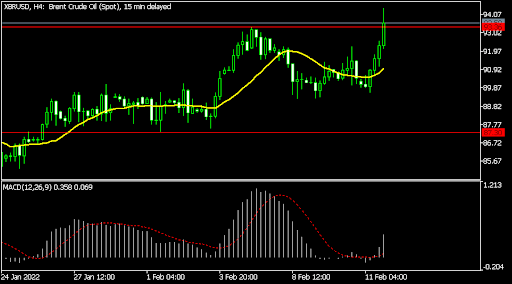

XBR/USD

The XBRUSD pair has been in a strong bullish trend in the past few months. The pair soared to a high of 95 last week. It is trading at 93.40, which is slightly above the key resistance level at 92. Additionally, the pair moved above the 25-day and 50-day moving averages while the MACD has moved slightly above the neutral level. Therefore, there is a likelihood that the bullish momentum will continue as bulls target the next resistance at 100.

Nasdaq 100

The Nasdaq 100 index declined to a low of 14,187 as geopolitical and Fed risks rose. That price was significantly lower than last week’s high of $15,184. On the four-hour chart, the pair moved below the 25-day and 50-day moving averages. It also moved to the lower side of the Bollinger Bands while the Relative Strength Index (RSI) has continued dropping. Therefore, the pair will likely keep falling in the coming days.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.