My allergy to linear thinking

S2N spotlight

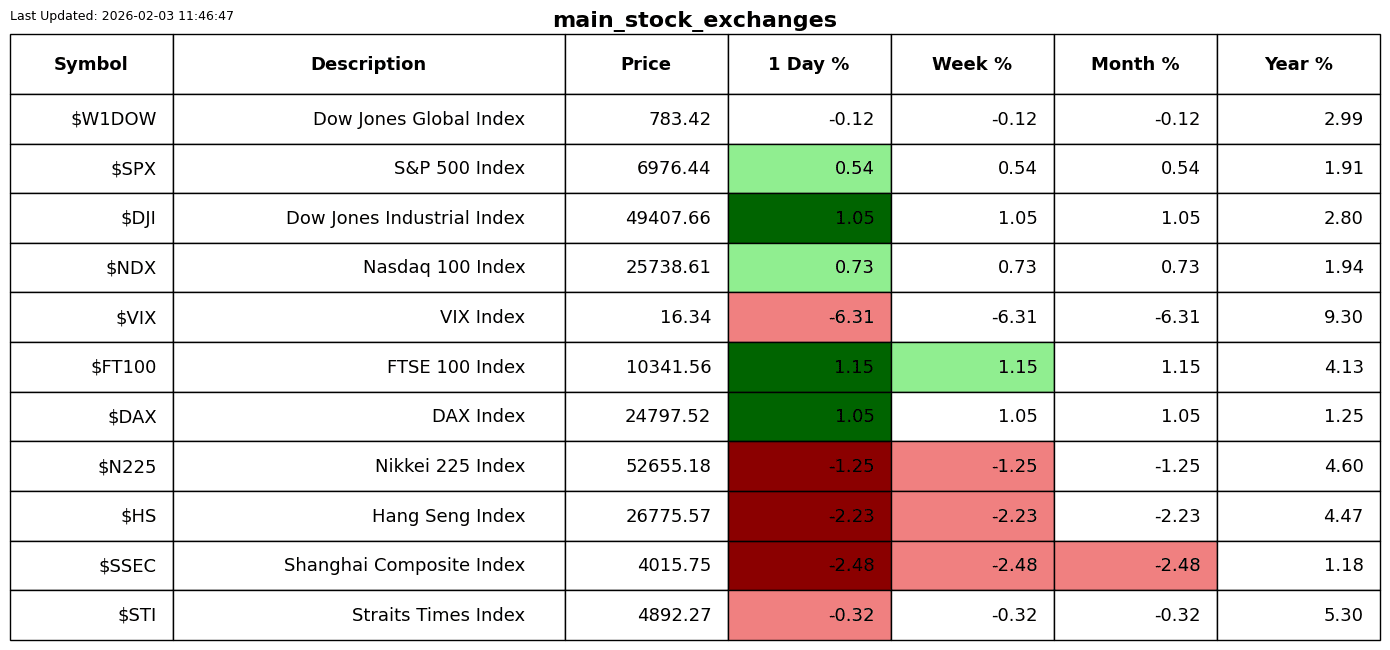

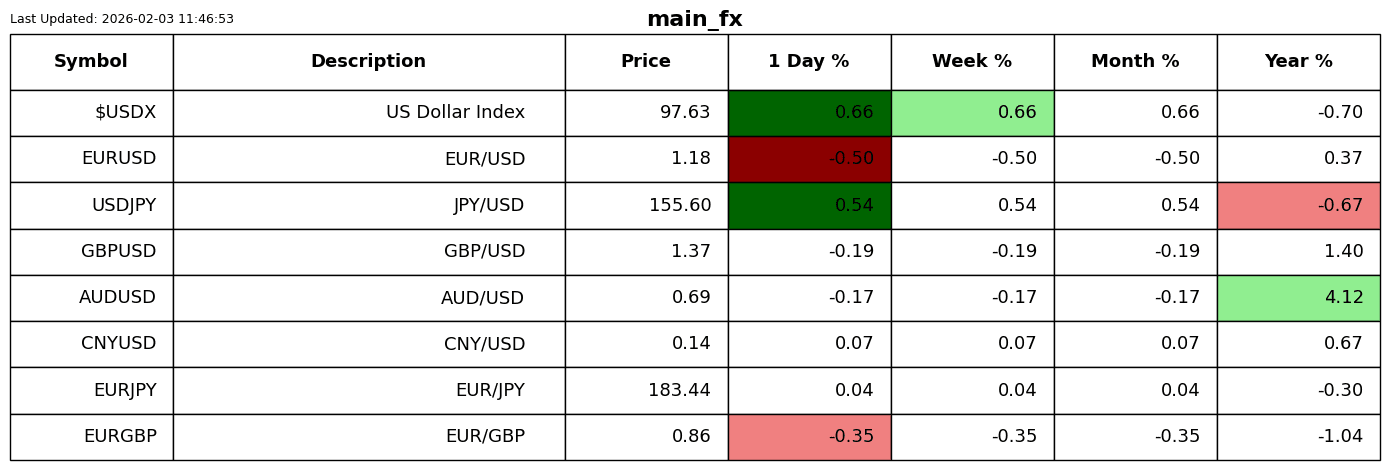

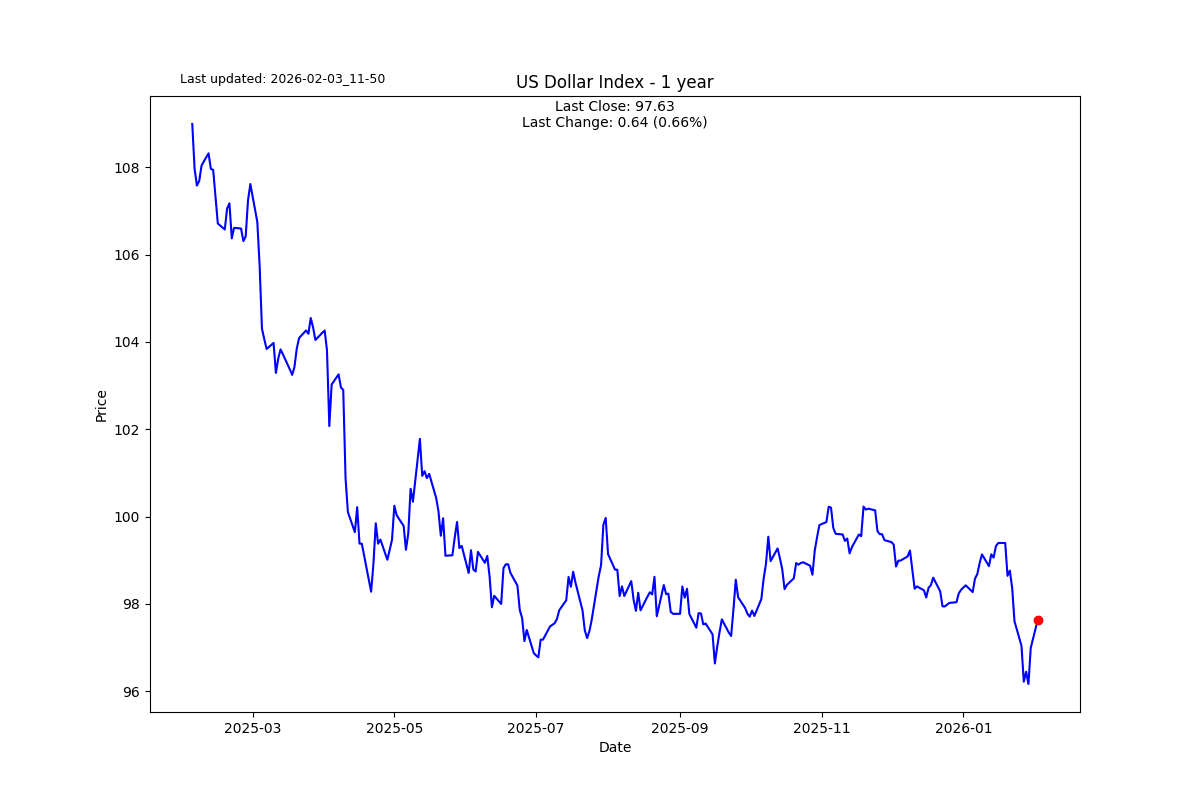

There is a terrible tendency for people to say the Dow went up 500 points or gold went down $500; in the scheme of investing, it has very little relevance.

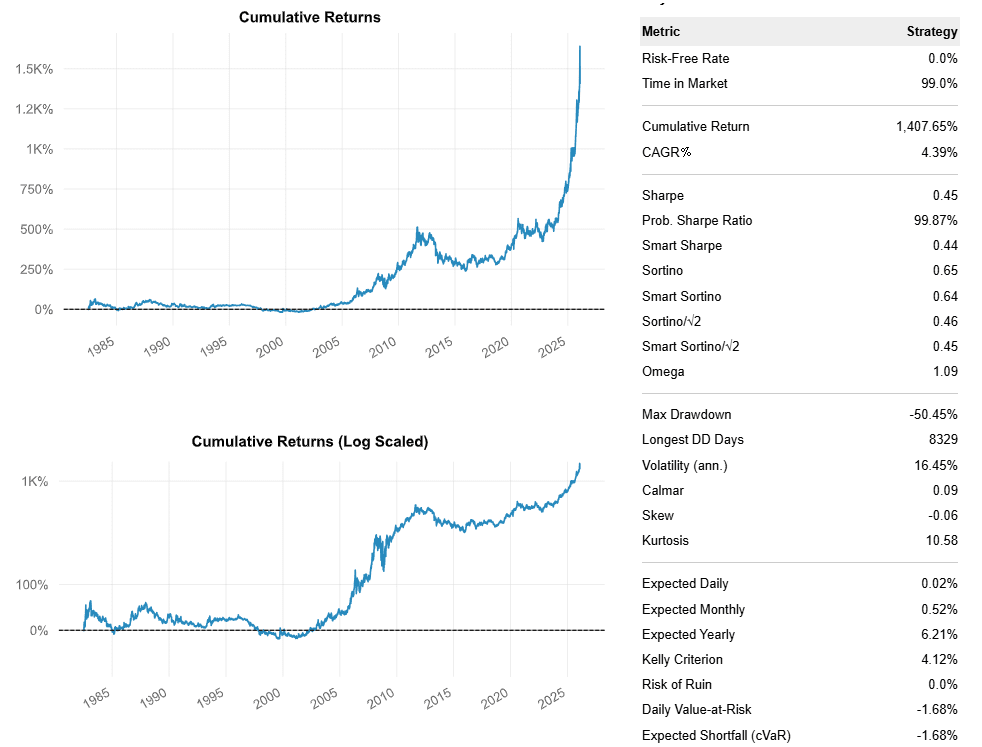

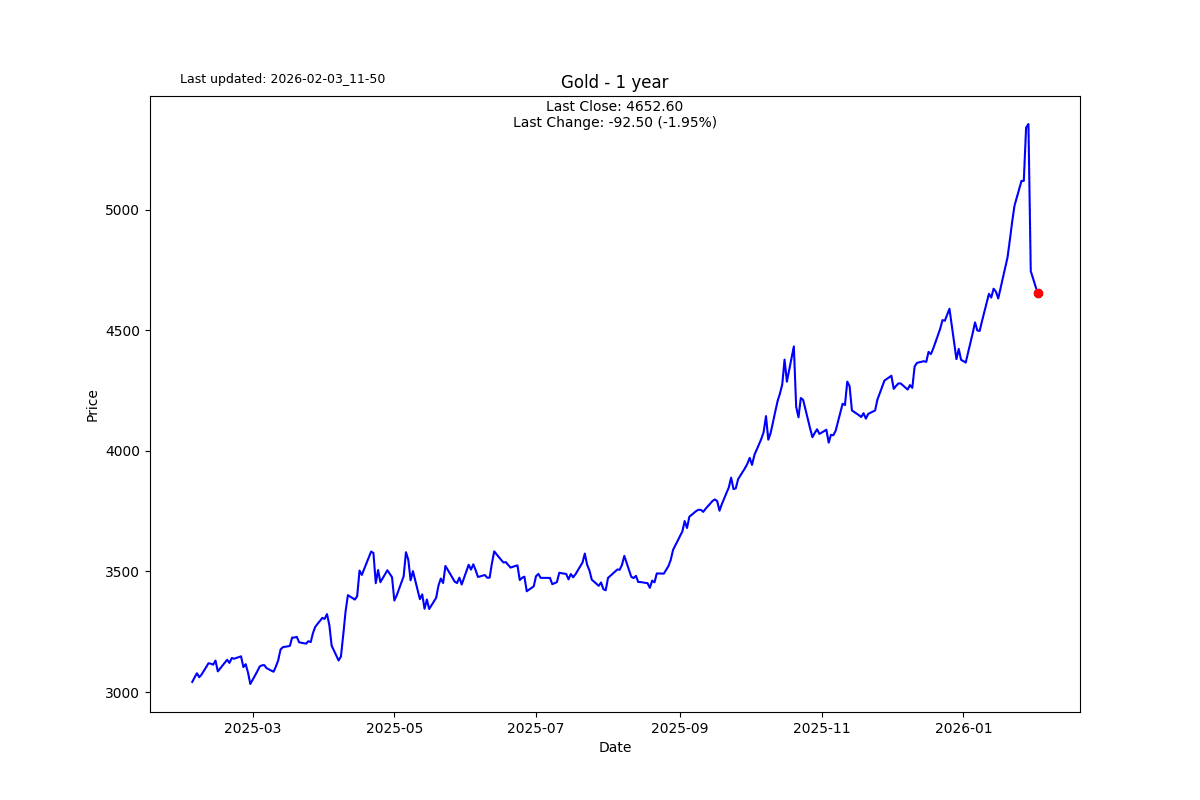

Take a look below at gold’s cumulative linear returns versus its cumulative returns in log scale. Two different pictures but the same asset. Looking at the top chart, gold is terribly extended, making it like it has nowhere left to go but down for a while. Looking at the log scale, there is plenty of room to move. None of this is meant as a forecast; it is just a small but important distinction worth considering.

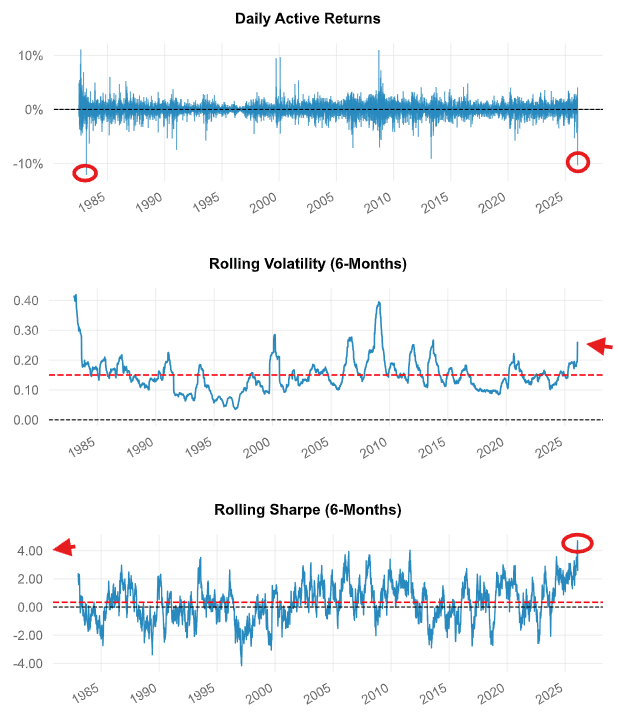

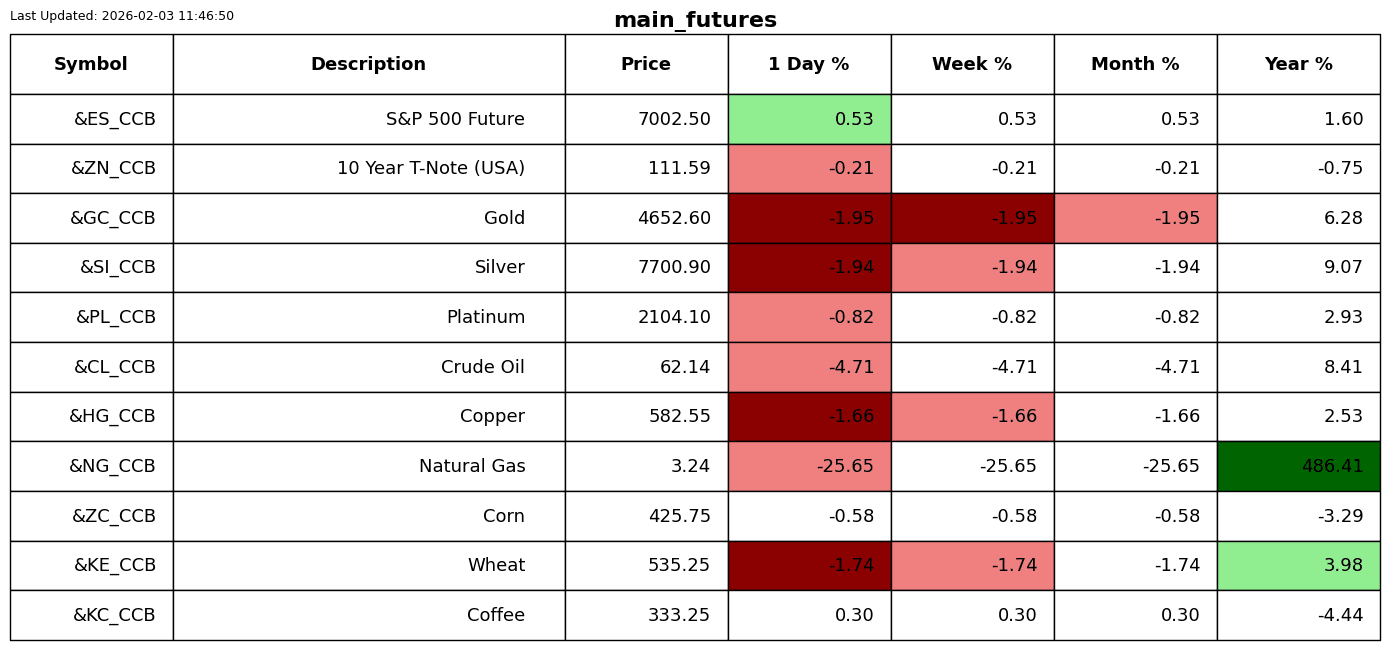

The next group of charts is very interesting. The drop on Friday last week was the second biggest drop in % terms since the early 80s. -10% is a massive move.

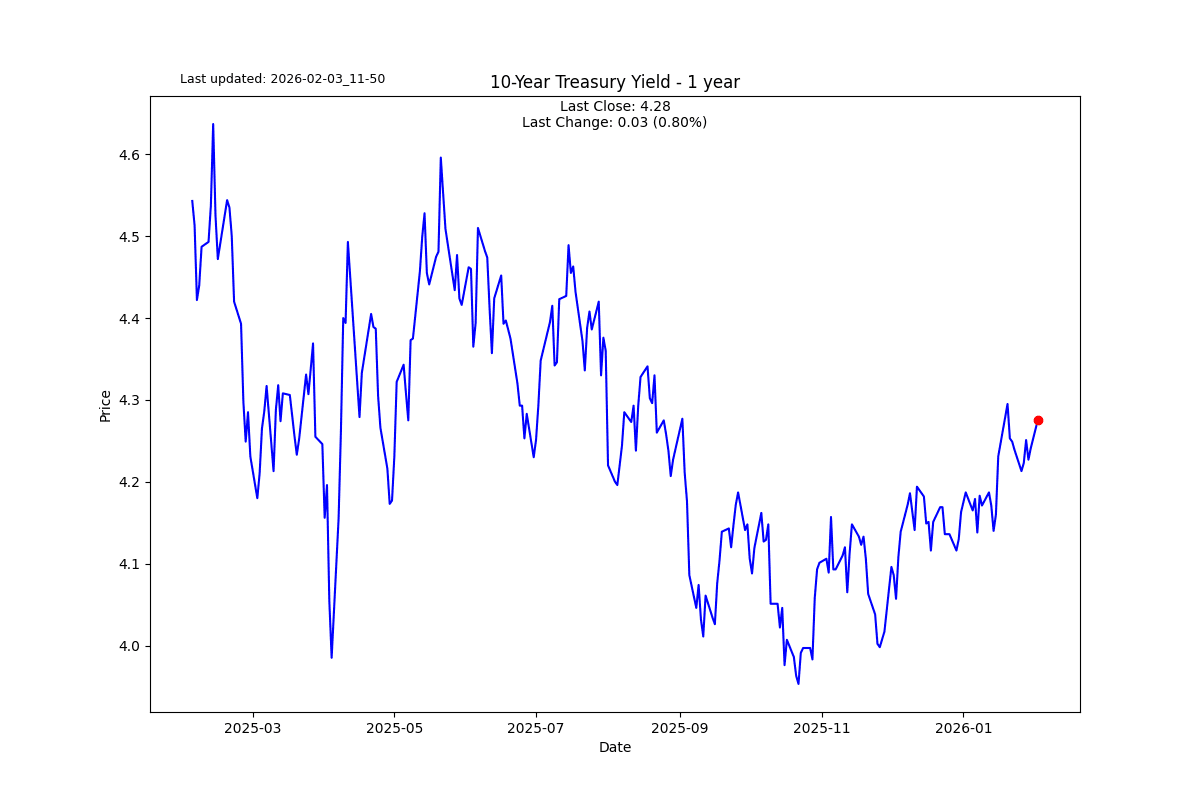

The rolling volatility is not as volatile as we have seen in the past, but it could be just the beginning; we will need to wait and see.

Tightly correlated with the low volatility is the crazy run in the rolling Sharpe Ratio to a record 4. If there was one tell that this market was due for a correction, it was the 6-month rolling Sharpe. The 45-year annual Sharpe Ratio is 0.45, so this was tracking way above average.

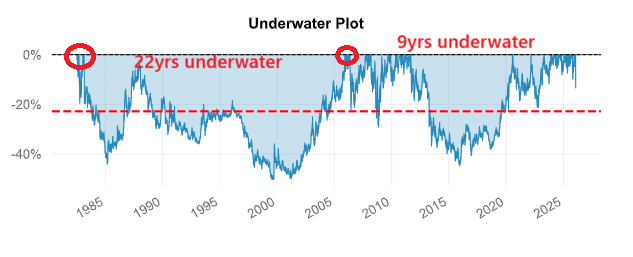

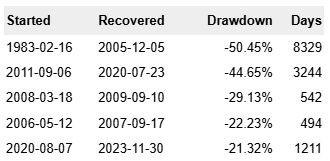

Finally, I wanted to share one chart and statistic that no doubt would have shaken most investors. The gold bul

ls who found religion overnight have no idea of the pain and questioning that came from worshipping at the altar of sound money.

Old farts like me and the slightly more bombastic Peter Schiff have been wearing more egg on our faces than we would care to admit over the years. I think there is still more upside to go with gold, but there is consolidation that we now need to work through.

I recommend those new to the religion look at the underwater chart below and consider if they really understand what it takes to ride a gold bull before signing the conversion papers.

Only for the real believers.

S2N observations

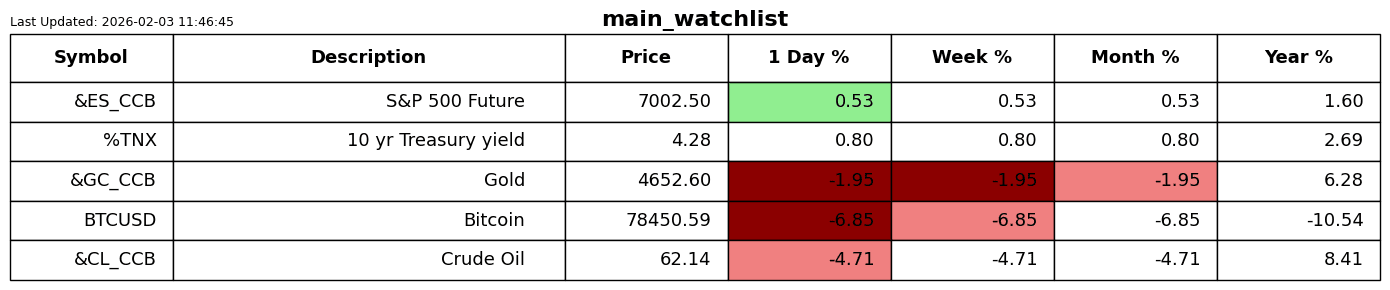

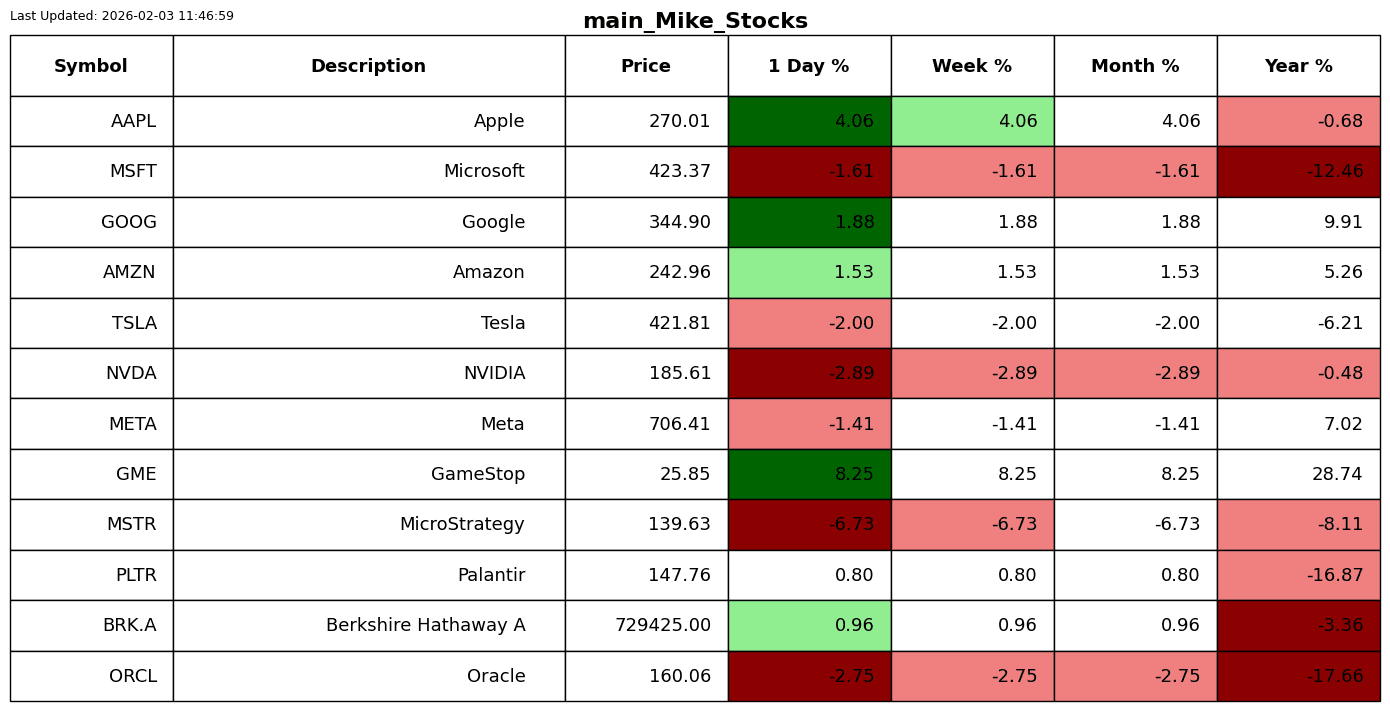

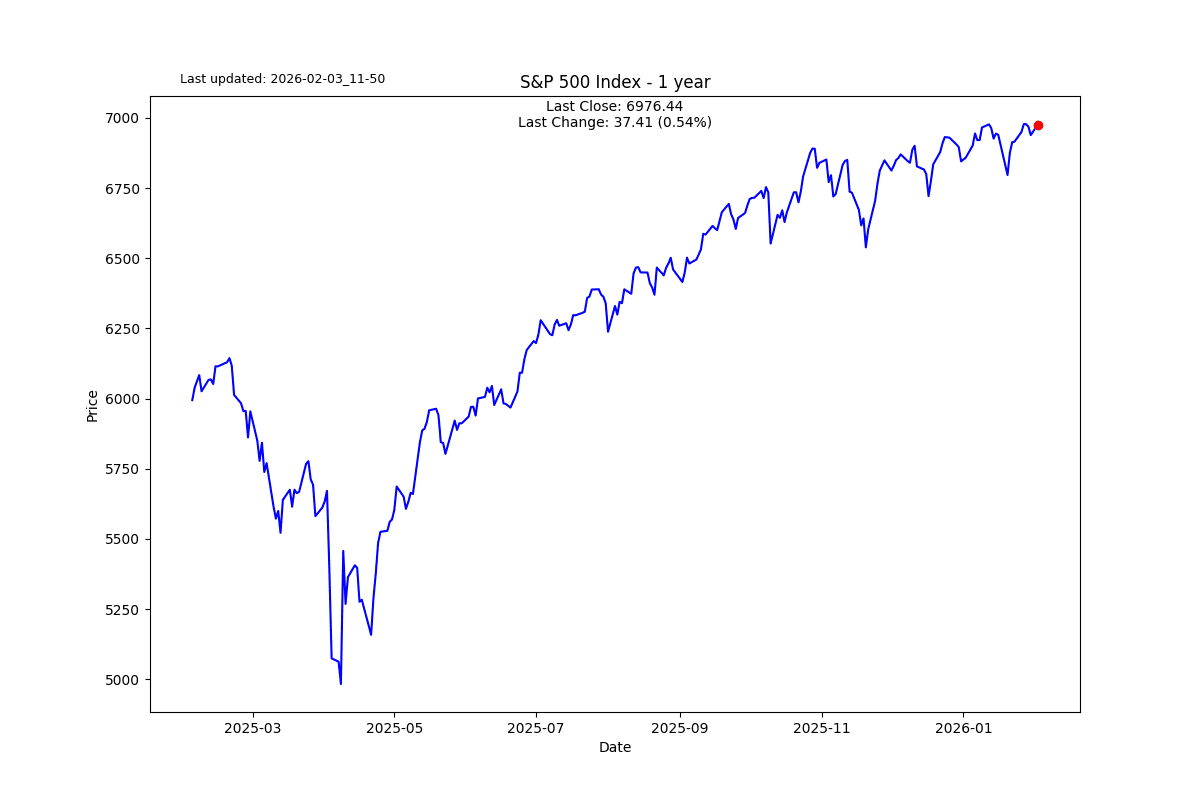

I have been writing for weeks now with a very defensive bent on equity markets.

I have been early as usual, but frankly anyone who thinks they can time these events consistently is living in an alternative universe or simply being fooled by randomness.

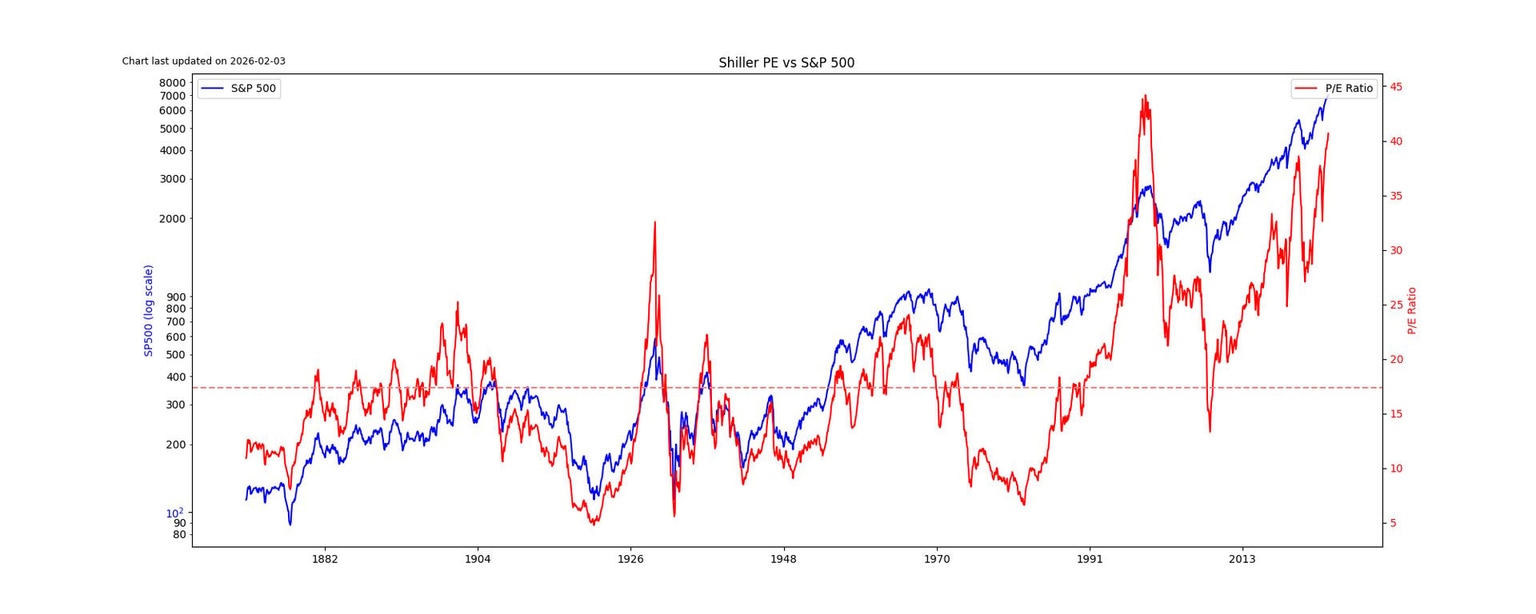

The market (S&P 500) is at all-time highs. We have only seen 10-year trailing earnings (Shiller PE) more expensive once in history, at the peak of the dot-com boom.

Caution is advised; you have been warned.

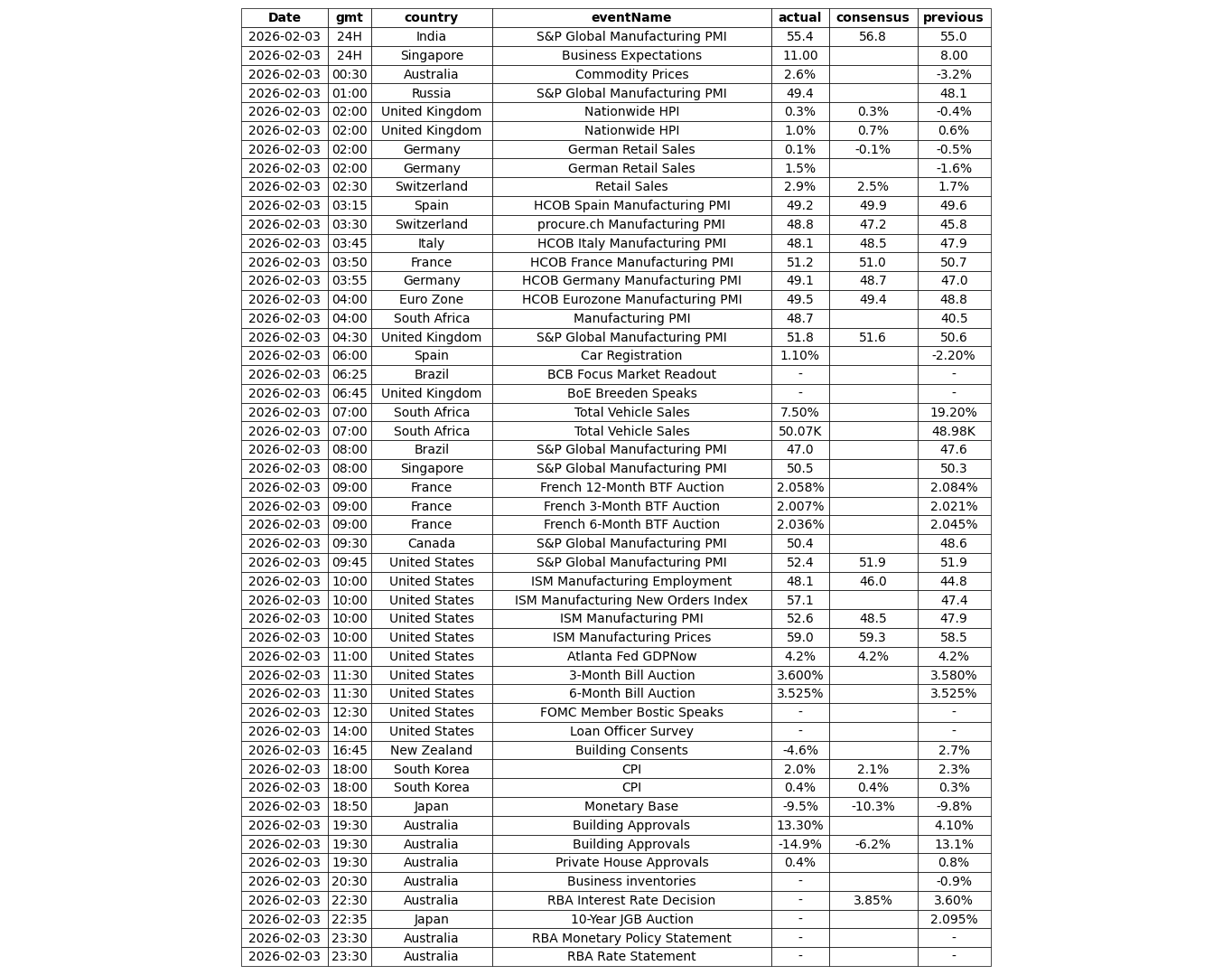

S2N screener alert

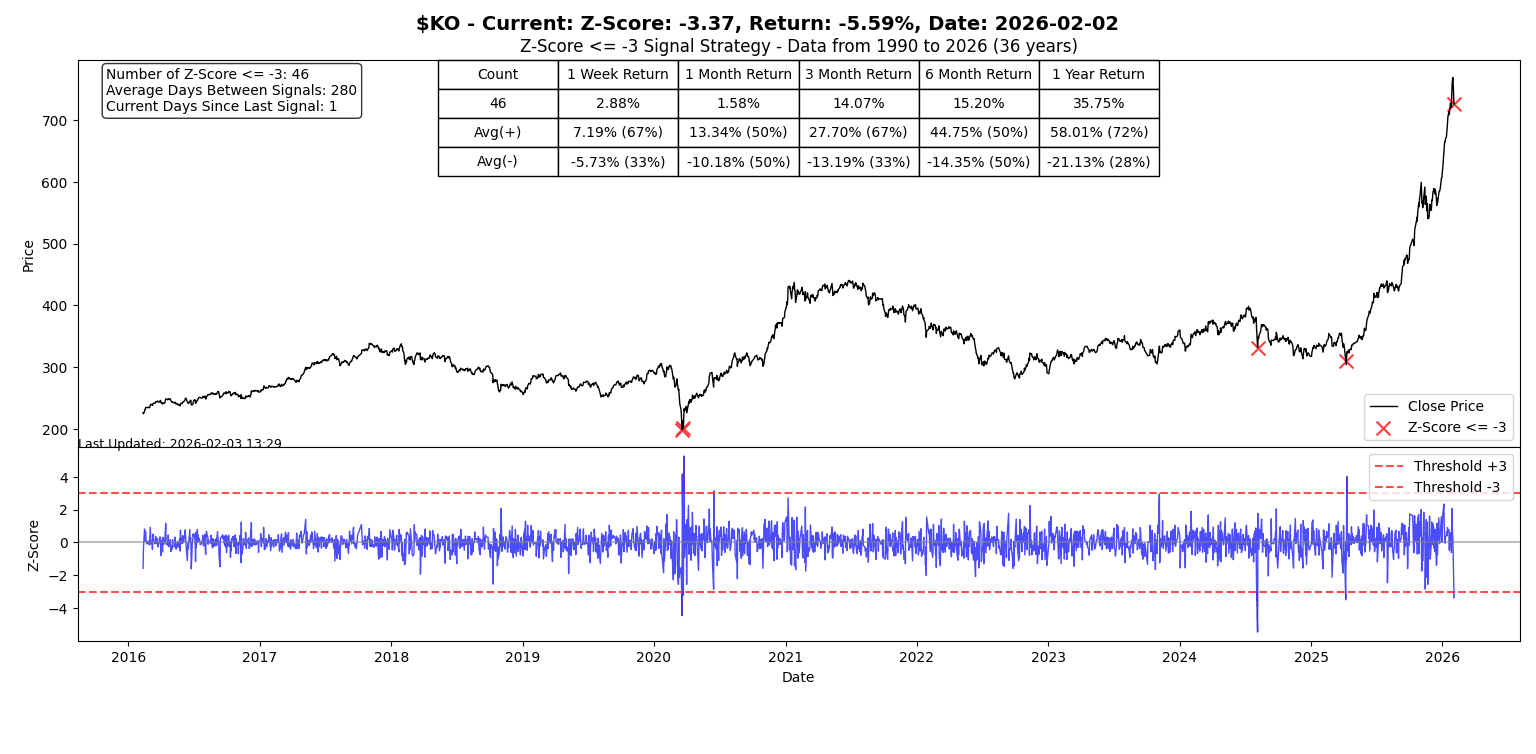

Palm Oil futures (KO), otherwise known as vegetable oil, dropped -5.59% to trigger my 3-Z Score alert.

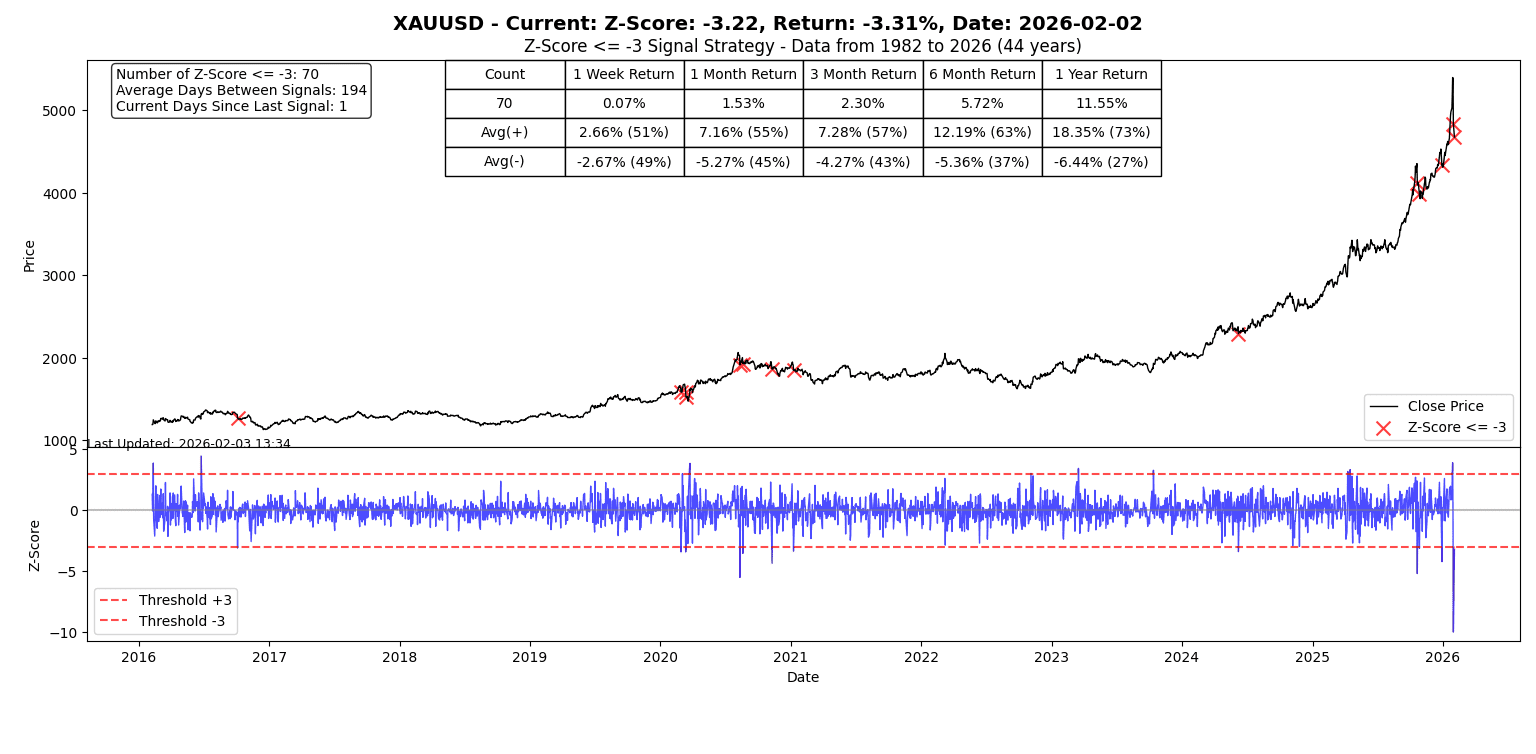

Gold also triggered the 3 sigma alert a day after triggering the mother of all moves.

S2N performance review

S2N chart gallery

S2N news today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.