Musk-Trump spat sparks volatility

- European markets struggle amid weak industrial production data.

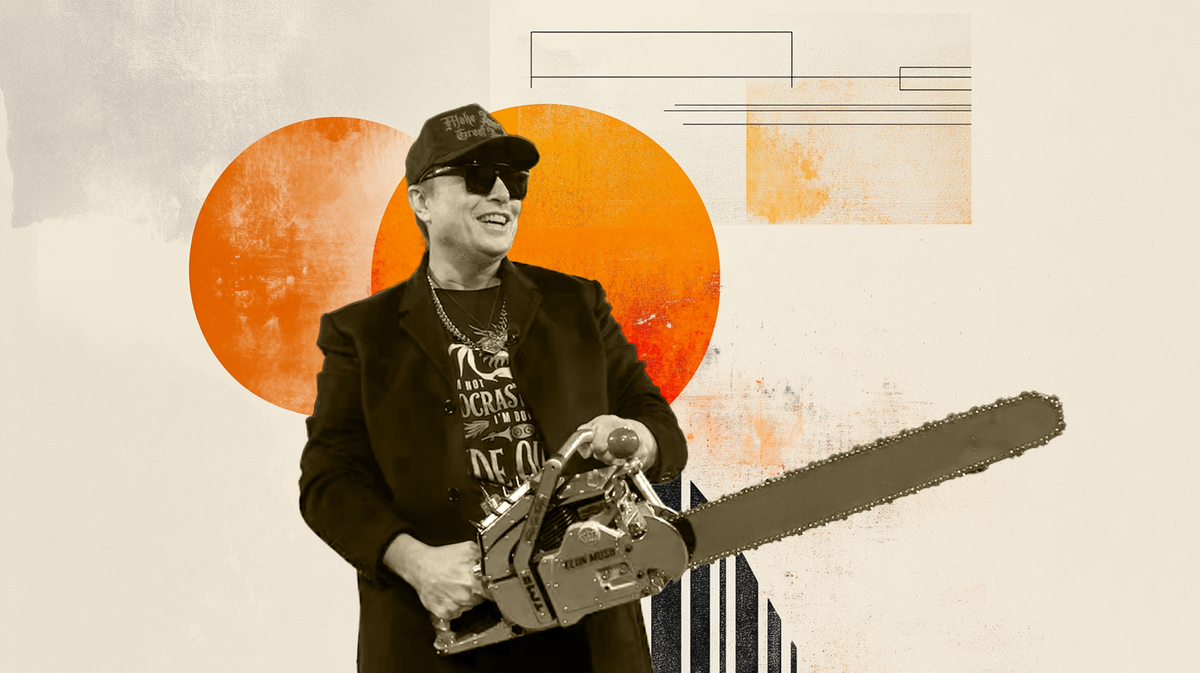

- Musk-Trump spat sparks volatility.

- Jobs report lookahead.

A mixed start in Europe this morning as traders hunker down ahead of today’s US jobs report volatility. Coming hot off the heels of yesterday’s German factory orders beat, things are less optimistic today thanks to declining industrial production figures from Germany (-1.4%) and France (-1.4%). Meanwhile, a weaker-than-expected retail sales figure wrapped up a morning that did little to lift hopes of an economic boom in the eurozone. Coming in the wake of yesterday’s ECB meeting, the committee will wonder whether they need to cut further to stimulate growth or perhaps the onus should now shift to the politicians to use their fiscal levers.

Donald Trump and Elon Musk may well wake up wondering if yesterday was just a dream, after the world watched a very public spat between the richest person on earth and the sitting US President. Understandably, it was Tesla shares that took the brunt of the market impact, falling 14% as Trump warned that the removal of EV tax credits could be followed up with the cancellation of Musk’s government contracts (putting $22bn worth of SpaceX contracts at risk). Curiously the crypto space also took a hit, with Bitcoin falling to a four-week low around $100k. However, with Trump apparently scheduling a call with Musk today, the rebound we are seeing for crypto highlights optimism that this spat provides traders with a somewhat leftfield buying opportunity.

Looking ahead, today sees a focus on the jobs report, with the economy balancing on a tightrope. Job growth has clearly slowed under the weight of persistent tariff uncertainty and political infighting, yet not enough to trigger immediate Fed intervention given ongoing uncertainty over the path for US inflation and trade. With businesses stuck in a quagmire of political and economic uncertainty centering around the White House, it will come as no surprise to see them hold off on hiring new employees until they get clarity over the long-term lay of the land. The longer we have this uncertainty, the more the US will likely lose momentum, and the inability of firms to plan ahead appears to be taking its toll. With wage growth holding steady and unemployment flat, the Fed has the luxury of patience - for now. But make no mistake: the longer this fog of policy unpredictability lasts, the greater the risk that today’s slowdown becomes tomorrow’s downturn.

Author

Joshua Mahony MSTA

Scope Markets

Joshua Mahony is Chief Markets Analyst at Scope Markets. Joshua has a particular focus on macro-economics and technical analysis, built up over his 11 years of experience as a market analyst across three brokers.