Murrey math lines: USD/CHF, XAU/USD

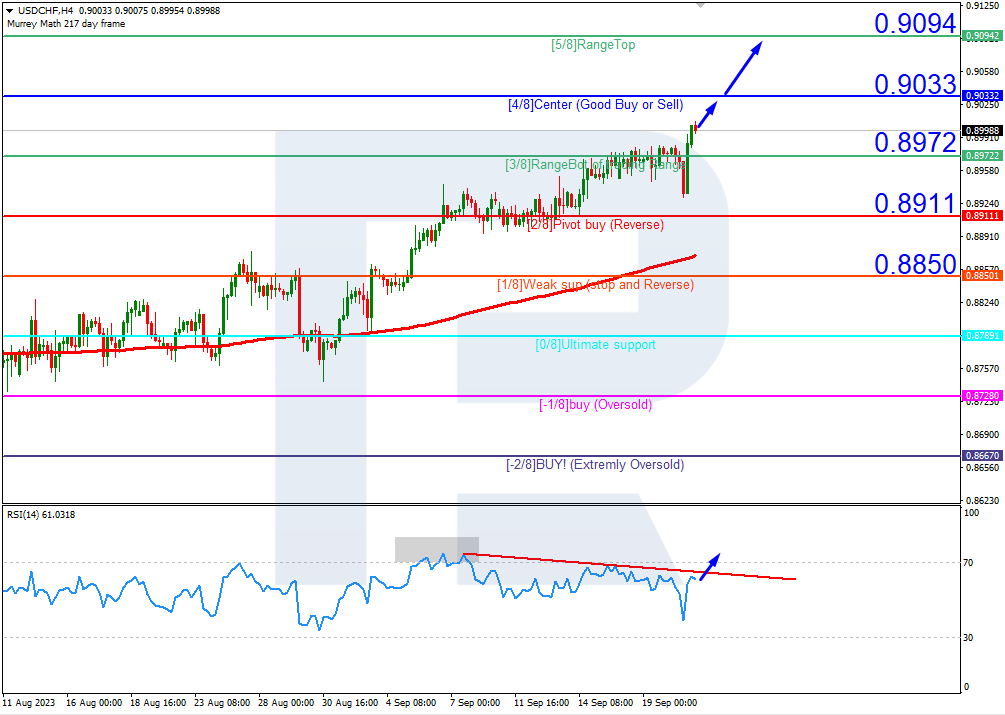

USD/CHF, “US Dollar vs Swiss Franc”

USDCHF quotes are above the 200-day Moving Average on H4, revealing the prevalence of an uptrend. The RSI is approaching the resistance line. In this situation, a test of 4/8 (0.9033) is expected, followed by a breakout of the level and a rise to the resistance at 5/8 (0.9094). The scenario can be cancelled by a downward breakout of the 3/8 (0.8972) level, in which case the quotes could drop to the support at 2/8 (0.8911).

On M15, the upper boundary of the VoltyChannel is broken, increasing the chances for a further price rise.

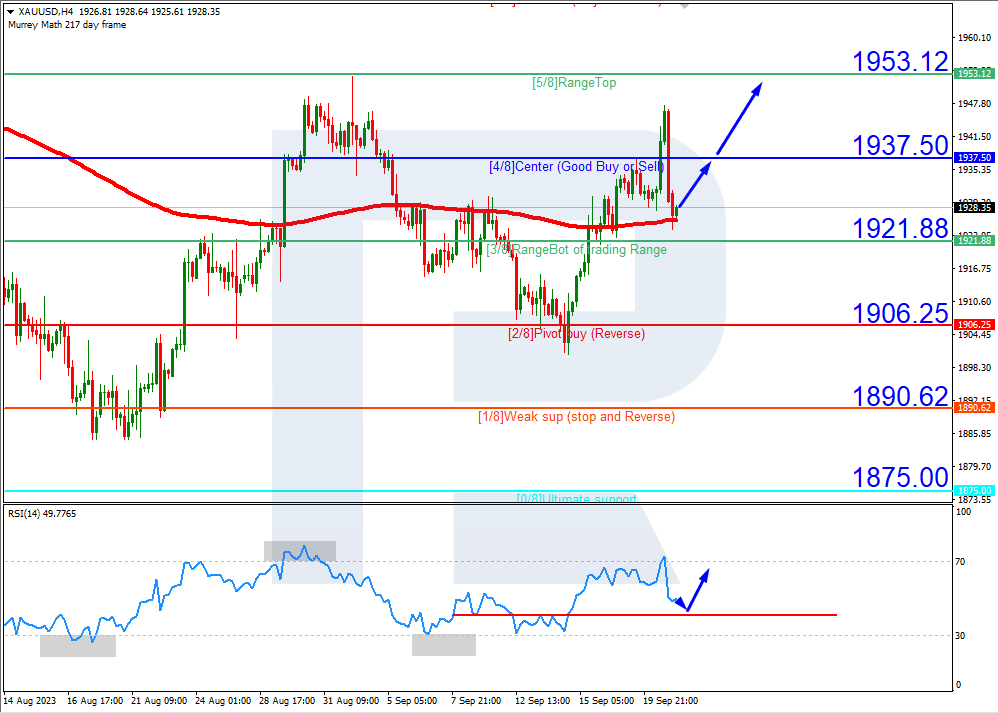

XAU/USD, “Gold vs US Dollar”

Gold quotes are above the 200-day Moving Average on H4, revealing the prevalence of an uptrend. The RSI is approaching the support line. In such circumstances, gold price is expected to break the 4/8 (1937.50) level, rising to the resistance at 5/8 (1953.12). The scenario can be cancelled by a downward breakout of 3/8 (1921.88), which might reverse the trend and let the quotes drop to the support at 2/8 (1906.25).

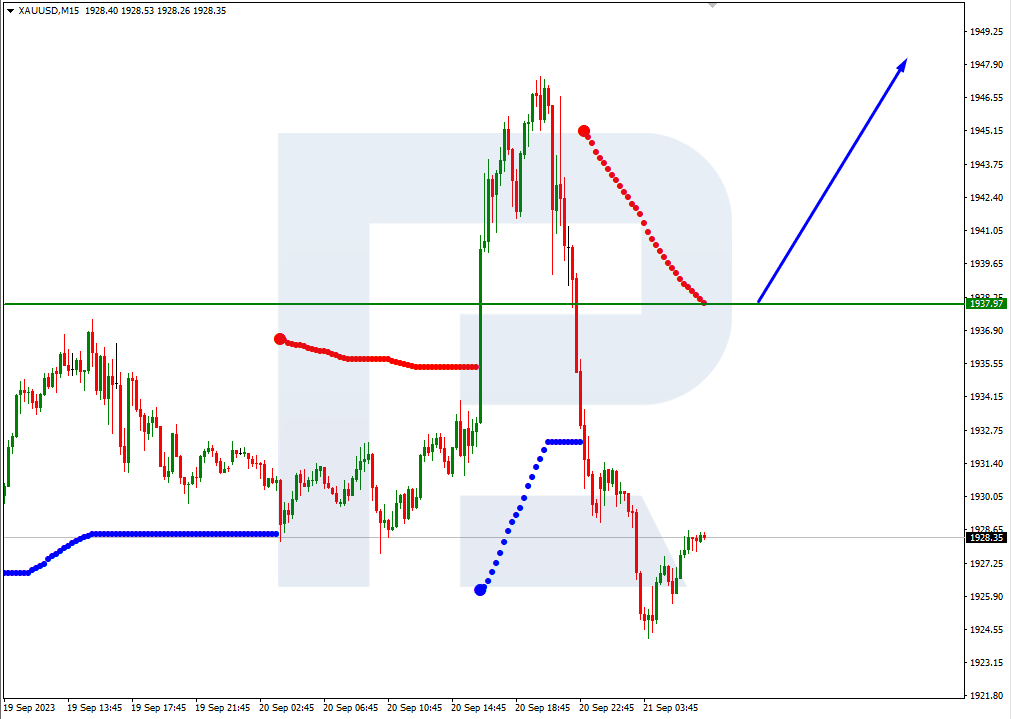

On M15, price growth could be additionally supported by a breakout of the upper boundary of the VoltyChannel.

Author

RoboForex Team

RoboForex

RoboForex Team is a group of professional financial experts with high experience on financial market, whose main purpose is to provide traders with quality and up-to-date market information.