$MTX: MTU aero engines started a new larger cycle higher

MTU Aero Engines AG is a German aircraft engine manufacturer. It develops, manufactures and provides service support for civil and military aircraft engines. Founded in 1934 and headquartered in Munich, Germany, it can be traded under the ticker $MTX at XETRA in Frankfurt. MTU is a part of DAX30 index.

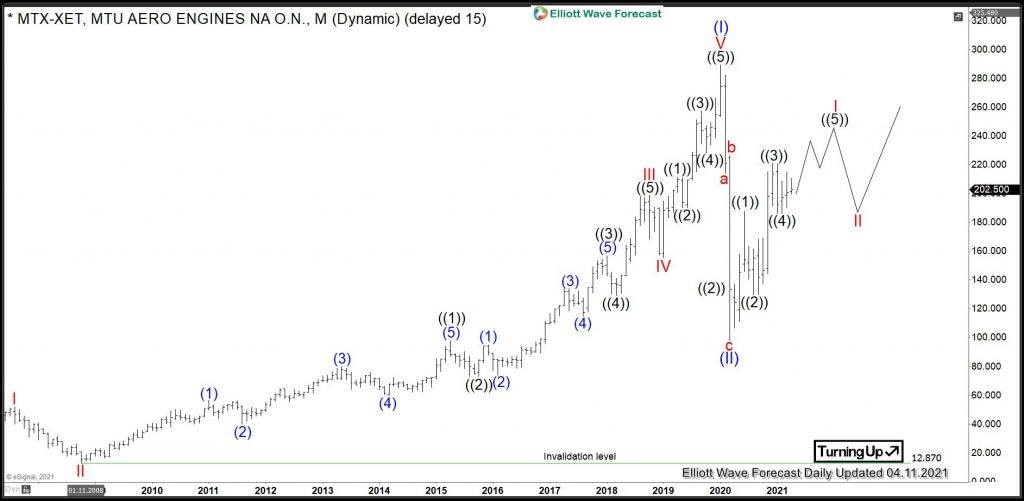

MTU Monthly Elliott Wave Analysis 04.13.2021

The monthly chart below shows the MTU stock $MTX traded at XETRA in Frankfurt. From the all-time lows, the stock price has developed a cycle higher in blue wave (I) of a super cycle degree. MTU has printed the all-time highs in January 2020 at 289.30. Without any doubt, the advance is a textbook quality impulsive move up in 5 waves. From January 2020 highs, a sharp straightdown correction in the blue wave (II) has retraced 2/3 of the price. An important bottom has been printed in March 2020 at 97.76 low. From there, a new cycle in wave (III) might have started. Investors can be expecting MTU stock to reach into the new all-time highs. The target will be 388-568 area.

MTU Daily Elliott Wave Analysis 04.13.2021

The daily chart below shows in more detail the advance in red wave I of blue wave (III) from the March 2020 lows at 97.76. Hereby, one can clearly see 3 swings higher. Therefore, one should expect at least another swing higher to form a 5 waves move ending wave I. Once accomplished, a pullback in red wave II should find support in 3, 7 or 11 swings against the 97.76 lows. Then, an acceleration higher in red wave III of blue wave (III) should happen.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com