Mozambique: debt crisis despite Eurobond restructuring

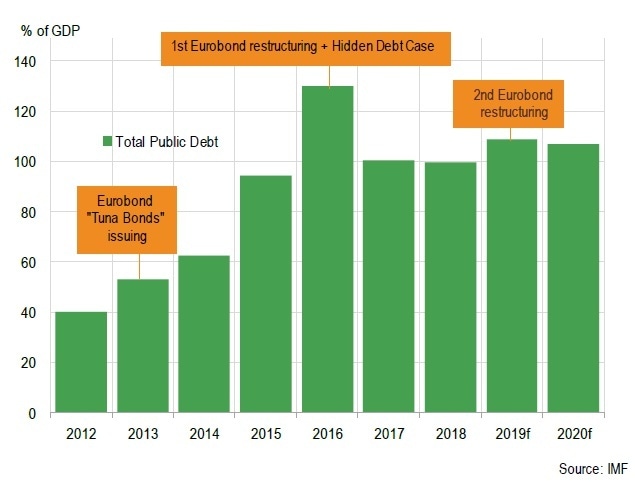

Mozambique urgently needs to resume a medium-term agreement with the IMF, the latter having suspended its cooperation in 2016, after discovering a hidden debt of around 1.2 billion dollars. Already, a first default of a Eurobond issued on 2013 for an amount of 850 billion dollars, in order to finance patrol vessels, had led to a first restructuring. Following a second default in January 2017, a new restructuring agreement for about 900 billion dollars has been reached last September.

Nonetheless, the Mozambican state creditworthiness remains very fragile. A part of the hidden debt (around 8% of GDP) remains in default and a judicial battle is underway against Mozambican's state. The latter is asking for the deletion of one of the two state guarantees issued. Total external debt still represented 109% of GDP at the end of 2019. Without IMF support, new defaults are to be expected in the medium term.

Author

BNP Paribas Team

BNP Paribas

BNP Paribas Economic Research Department is a worldwide function, part of Corporate and Investment Banking, at the service of both the Bank and its customers.