Modest gain at factories offset by production cuts at utilities and mines

Summary

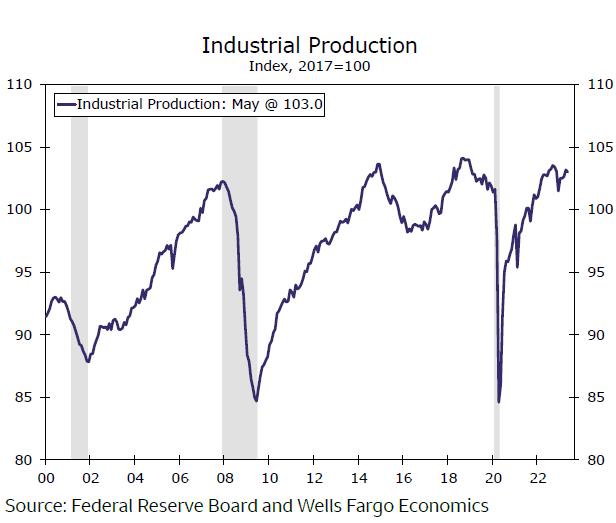

Industrial production fell 0.2% in May owing to a sharp drop in utilities output and a more modest dip in mining activity which swamped a scant 0.1% gain in production in the much larger manufacturing category. Meanwhile, mixed signals from regional Fed surveys muddy the outlook.

Making sense of the crosscurrents

Industrial production fell 0.2% in May (chart). Manufacturing production, which comprises roughly three quarters of all output, actually eked out a scant gain of 0.1%. The headline decline was a result of a steep decline of 1.8% in utilities production as well as a more modest drop of 0.4% in mining activity (chart).

There are most definitely cross-currents in today's manufacturing sector and that was on full display in this morning's batch of economic data which started with the release of regional Fed surveys just before the industrial production report. The Empire Manufacturing Index rose to 6.6 in June, an unexpected rebound after coming in at -31.8 the prior month. New orders climbed back above breakeven, indicating manufacturing orders across New York State have edged higher. Down I-95, the Philadelphia Fed Business Outlook Survey index slipped further into contraction territory coming in at -13.7 in June, but current shipments and expectations for new orders both broke above zero.

The conflicting storylines in today's data make a little more sense when you dig into the details of the industrial production report. The parts of manufacturing tied to consumer and business equipment spending are evidently under pressure. The production of consumer goods and business equipment both declined. But amid government-supported construction of new factories to support the domestic production of semiconductors as well as ongoing infrastructure spending, construction output posted the largest gain of any major market group.

Author

Wells Fargo Research Team

Wells Fargo