Millennials screwed again, this time on Unemployment

Millennials Hard Hit Twice

Millennials were hit hard in the Covid recession and the Great Recession as well.

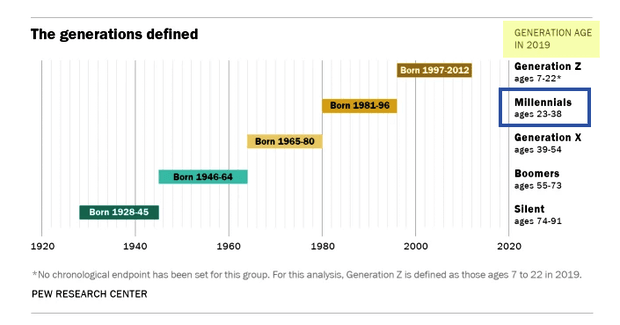

Generations Defined

The above chart from Think Tank - Defining Generations

- In 2019 Millennials were ages 23-38

- In 2009 in the Great Recession they were 13-28

- The corresponding BLS age groups during the great recession were 20-24 and part of 25-34.

- The corresponding BLS age groups now are 25-34 and a part of 35-44.

Unemployment Rate by Age Group 2007-2020

In 2008-2011 the oldest millennials were fresh out of college seeking employment in the worst jobs market since the Great Depression.

They are now 10 years older. The youngest millennials are now fresh out of college in the midst of a Pandemic shutdown.

But even the older millennials are faring poorly.

The worst two groups in terms of unemployment are age groups 20-24 and 25-34.

Millennials, the Screwed Generation

In April of 2018, I noted Millennials, the Screwed Generation, Blame Boomers For Making Their Lives Worse.

51% of millennials claim boomers make their lives worse. Only 13% of millennials say boomers make their lives better.

Screwed Generation

- Consider Obamacare. It was purposely designed to make millennials overpay for healthcare. Millennials subsidize boomers who are better off financially.

- When I went to the university of Illinois, tuition was $250 a semester. One realistically could have worked summer and part-time jobs to pay for an education. Now kids are graduating from college with mountains of debt and no way to pay it back.

- Social security is projected to be bankrupt by the time millennials can collect. Benefits must drop.

- A pension crisis looms. The boomer solution has been to kick the can down the road, always raising taxes. Those tax hikes go nearly 100% to pension funding. What do millennials get out of it? Nothing!

- Millennials are likely to be the first US generation in history that is no better off than their parents, if not worse.

Payback

Within a decade Millennials will be running the country and they may not exactly be sympathetic to the pension plight of boomers.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc