Tech sell off and commodities gain ahead of today’s data

Market News Today – The stock markets sold off across Asia. Inflation concerns have hit tech stocks in particular, and the rise in commodity prices has seen the 5-year break even inflation rate lifting to the highest level since 2006, according to Bloomberg calculations. China CPI climbed to a 0.9% y/y clip in April, more than double the 0.4% y/y from March. The jump in commodity prices has sparked concern over extended valuations in equities and JPN225 corrected -2.4% and -2.1% respectively. The ASX sold off -1.0% and the Hang Seng is currently down -1.8%. Mainland China bourses outperformed despite a higher than expected PPI reading that reflected surging commodity prices worldwide.

While demand for Treasuries will be supported by safe haven flows, Eurozone peripherals, which outperformed yesterday, may well feel the chill this morning. GER30 and UK100 futures are down -1.3% and -1.2% respectively and a 0.7% correction in the tech heavy USA100 is leading US futures lower.

In FX markets, the USDJPY is little changed at 108.95, with the US Dollar and Yen both struggling. Cable stabilised at high levels after yesterday’s surge – currently at 1.4124, as the UK BRC retail sales figures confirmed a surge in demand as the country continues to re-open. EURUSD meanwhile lifted to 1.2143. USOIL eased back to $64.33, as traders keep a wary eye on the impact of the cyber attack that led to pipeline closures.

Today – Today’s data calendar has German ZEW investor confidence, which is expected to move higher.

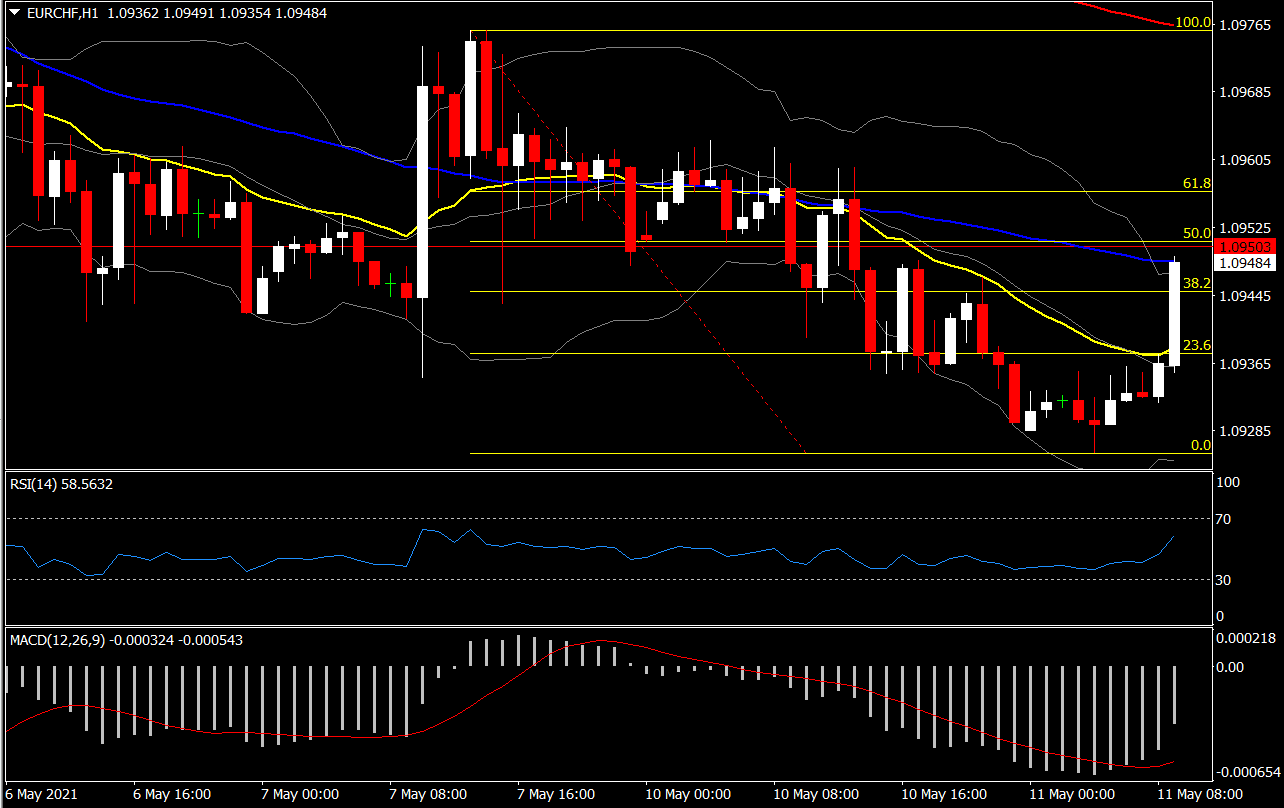

Biggest (FX) Mover @ (07:30 GMT) EURCHF (+0.66%) reversed more than 40% of its 3-day decline from 7-week highs at 153.30 today. Faster MAs remain aligned higher, but RSI is close to 50 and MACD histogram & signal line remain well below zero even though they are presenting decreasing negative bias. The intraday positive bias remains limited. H1 ATR 0.0006, Daily ATR 0.0038.

Author

Having completed her five-year-long studies in the UK, Andria Pichidi has been awarded a BSc in Mathematics and Physics from the University of Bath and a MSc degree in Mathematics, while she holds a postgraduate diploma (PGdip) in