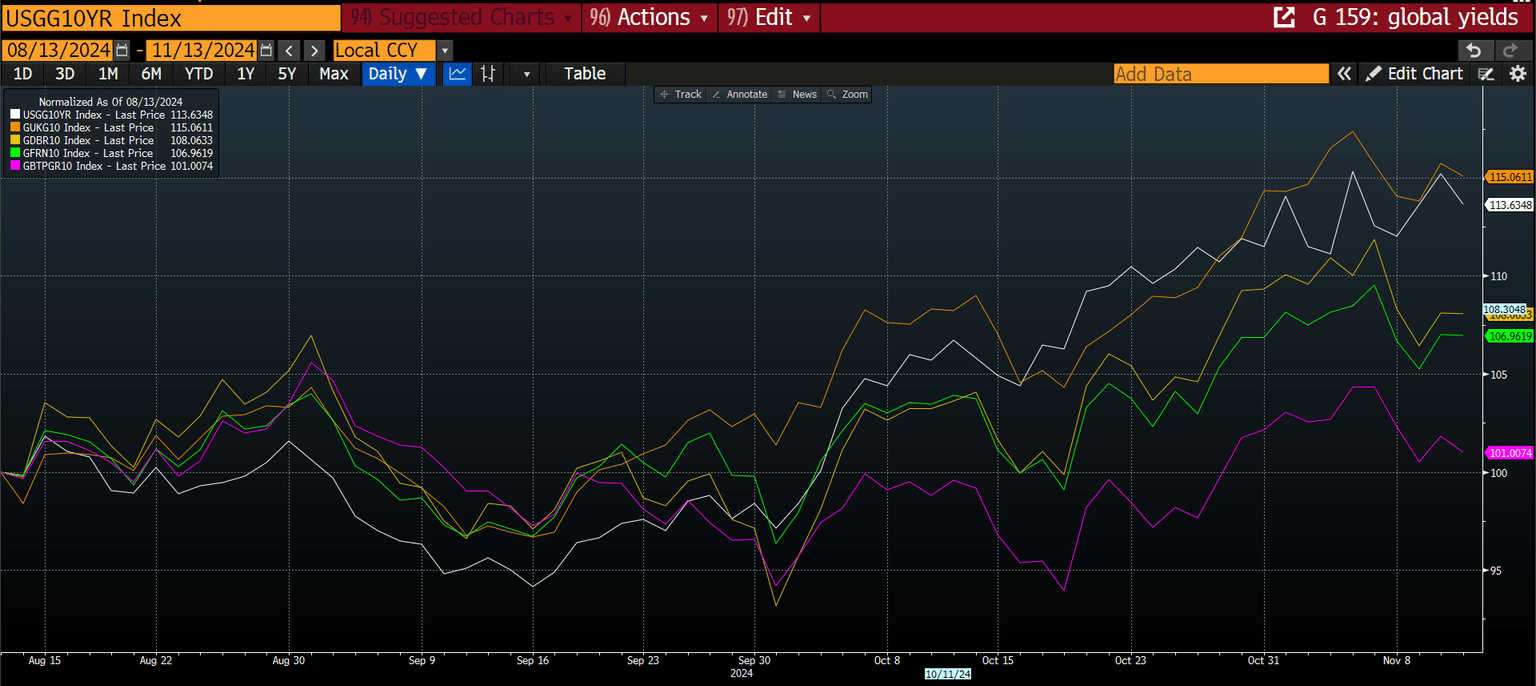

Marketwatch: UK yields follow the US, does it matter?

The bond market has been volatile in the aftermath of the Trump win. In the past month, 10-year yields have risen by 26bps in the US, 23 bps in the UK, and by a smaller amount across Europe.

An observation that we have made in recent days is that UK Gilt yields are moving in line with Treasuries, more so than European yields. On a long-term basis, the daily 1-year correlation between US 10-Year Treasury yields is 74% with UK Gilt yields, it falls slightly to 72% for German yields and 70% for French yields.

A shift in bond yield correlations

This pattern has continued for most of the year, however, since the start of this month, the correlation between US yields has fallen vs. the UK, Germany and France. The UK’s Gilt yield is now the only European bond yield with a statistically significant correlation to the US Treasury yield at 58%. The correlation between German yields and Treasury yields has collapsed to -0.01%, and the correlation between French 10-year yields and US 10-year yields has also declined to 29%.

This could highlight two things: 1, shifting expectations for monetary policy, with the ECB expected to cut more aggressively than the Fed or the BOE, which is bearish for the euro in the long term. 2, It may also reflect better growth fundamentals for the US and the UK relative to Europe. We still have to see how Trump’s tariffs will impact global trade, but there is a whisper in financial markets that Trump may favour the UK over Europe. If so, this could protect growth, and justifies UK yields rising at a faster pace than European yields.

We will be watching to see if these correlations persist, for example, the weakness in the pound comes even though UK yields are outperforming European yields. We should not forget what the bond market is telling us, and its message at this stage is that Europe could see lower interest rates than the US and the UK.

US, UK and European 10-year sovereign bond yields

Source: XTB and Bloomberg

Author

Kathleen Brooks

XTB UK

Kathleen has nearly 15 years’ experience working with some of the leading retail trading and investment companies in the City of London.