Market Update: More grief for the greenback

USDIndex, Weekly

My diary tells me it’s day 366 of 2020. I started my WFH campaign on March 11, when the USDIndex was trading at 96.40 and on its way to 103.80 by March 23. Today, as we close an unprecedented year, the USDIndex has posted another major-trend low, at 89.51, a level last traded in April 2018.

The Dollar has continued to correlate inversely with global stock market direction, with weakness today being concomitant with the MSCI Asia Pacific rising to a new record high in holiday-thinned conditions. The USA30 yesterday closed at a fresh record high on Wall Street. Oil and other commodities have, in contrast, remained directionally subdued. EURUSD remained buoyant on dollar weakness, although has so far remained just off from yesterday’s near-33-month peak. USDJPY remained heavy, though above yesterday’s two-week low at 102.96. Cable trades healthily above 1.3600 at 1.3660 in low, low volume trading. Both the Australian and New Zealand Dollars, which are living up to expectations for being outperformers in post-Covid recovery trade, rallied to fresh 32-month highs against the US Dollar. USDCAD edged out a 13-day low at 1.2734. The lack of direction in oil prices over that last 10 days or so has rendered the Canadian Dollar the underperformer of the dollar bloc pack.

Oil prices re-entered pre-Covid crisis ranges in recent weeks, while a combination of increasing OPEC and non-OPEC supply swelled global inventories, and demand-sapping Covid lockdowns and restrictions across many major economic areas in the northern hemisphere have taken the legs out of the bull trend.

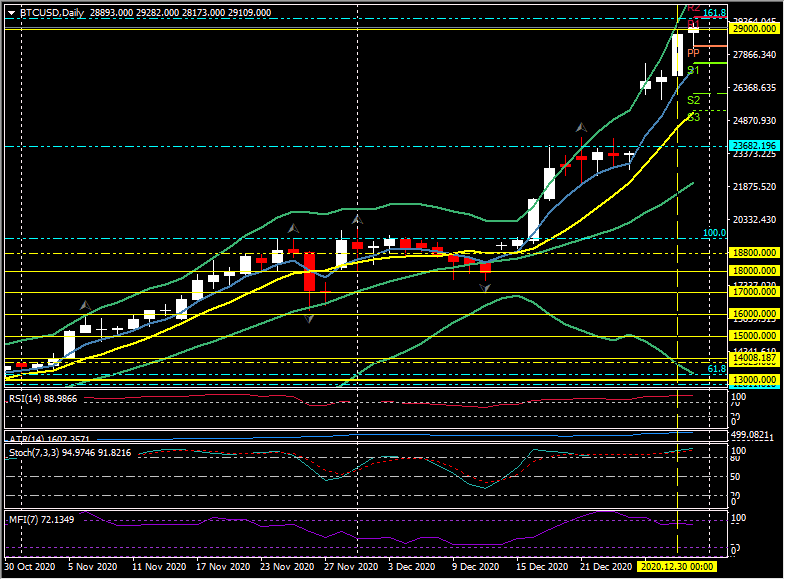

Elsewhere, Bitcoin rallied to yet another record peak north of $29,000. Cryptocurrencies look likely see much more upside amid signs that long-term institutional investment managers have been buying and holding bitcoin and other leading cryptocurrencies as an inflationary hedge. Assets held by Grayscale Investments, the world’s biggest crypto asset manager, is widely cited as a bellwether indicator of this, as it allows professional investors exposure to crypto currencies without having to store the assets. Grayscale reported yesterday that it had $19 bln in crypto assets under management, up from $16.4 bln last week.

European stock markets are lower – those that are open – with the UK100 down -1.3%, and the IBEX -0.5%. The 10-year Gilt yield is down -0.8 bp at 0.202%. A very quiet day with many European markets already closed for the extended New Year weekend. Many will be happy to leave a difficult year behind, but as vaccination programs continue it is becoming clear that it will take a while before they really have an impact. For now case numbers in many European countries still look pretty bad and it is likely to stay that way for another week, as caution was relaxed over the holiday period. European stocks are pretty near record highs as the year ends as there are also companies benefiting from stay-home orders and investors look ahead to the expected recovery in 2021.

Author

With over 25 years experience working for a host of globally recognized organisations in the City of London, Stuart Cowell is a passionate advocate of keeping things simple, doing what is probable and understanding how the news, c