Manufacturing activity ticked up in August, but unlikely to be sustained

Summary

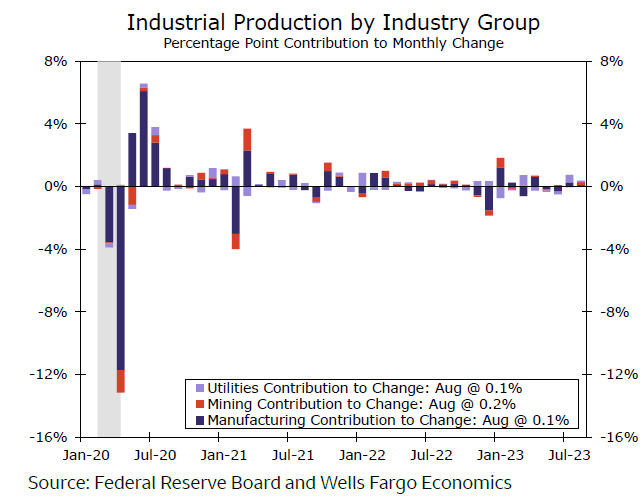

Industrial production surprised to the upside in August, with a pop in mining output accounting for half of the 0.4% gain in overall production. Manufacturing activity was stronger than the 0.1% monthly gain would suggest, as autos held back activity. Still, we are cautious to expect this will be sustained as unfavorable conditions will limit a recovery in manufacturing for some time.

Upside surprise traced to mining, but manufacturing stronger

While most data continue to point to a U.S. industrial sector that is stalling or in contraction, the August industrial production data surprised to the upside, with total output rising 0.4%. That, however, comes after downward revisions to the prior month (now up 0.7% from a previously reported 1.0% rise) and is somewhat explained by a pop in the volatile mining industry. Mining output rose 1.4% last month (due to a +3% gain in oil & gas extraction specifically), or by the fastest in seven months and was responsible for half of the overall gain in output (chart). But gains were fairly broad based in August. Utilities also registered a decent gain made more impressive on top of a blow-out July, rising 0.9%. Manufacturing, which is by far the biggest component of industrial production representing nearly three-quarters of output, was up a modest 0.1%.

But manufacturing activity was held back by autos output specifically. Motor vehicles & parts production slid 5% in August, nearly reversing the jump a month prior, and when excluding autos from the manufacturing data, production rose 0.6% or by the highest in seven months. Manufacturing production thus saw somewhat of a reprieve in August with the largest gains coming from aerospace & miscellaneous transportation equipment (+3.3%), machinery (+2.0%), primary metals (+1.6%), miscellaneous (+1.5%) and printing & support (+1.3%) output. While production remains lower than peaks experienced last year, the gain in activity is welcome news to producers (chart).

Author

Wells Fargo Research Team

Wells Fargo