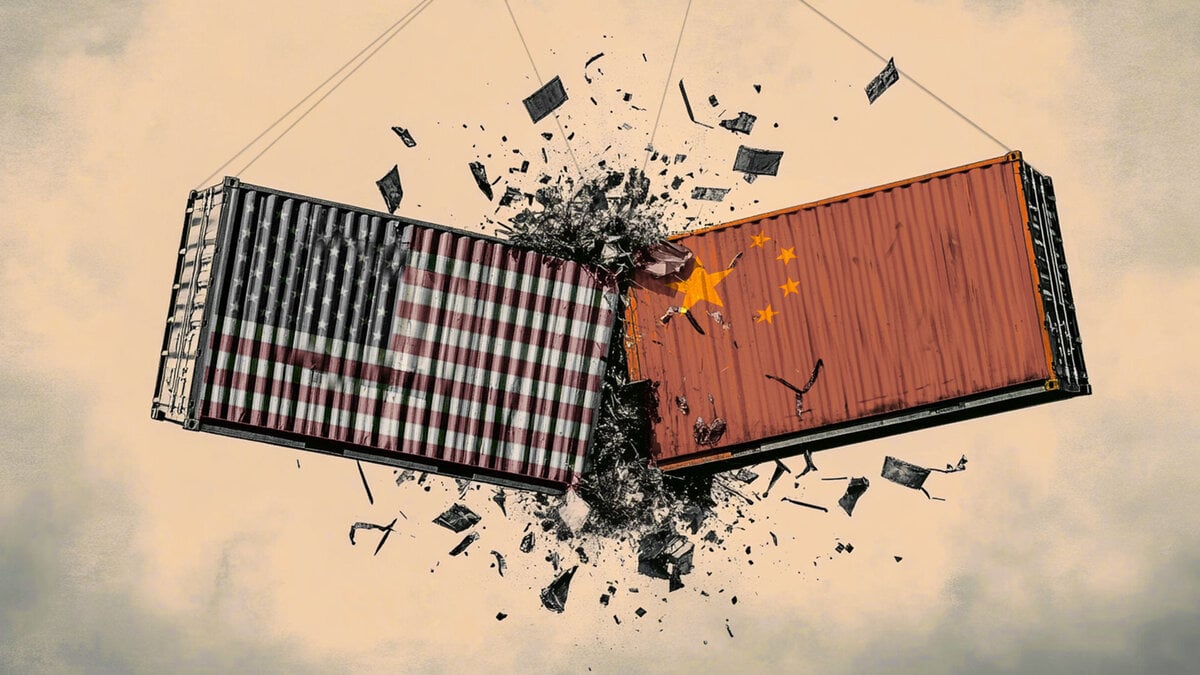

London talks, global stakes: US and China play nice, for now

Wall Street tiptoed into the new week like a cat burglar in dress shoes—deliberate, quiet, and fully aware that one false step could trip every alarm in the building. U.S. stocks eked out modest gains in a Monday session that felt more like the opening credits than the main act, as investors brushed aside the usual haze of policy gridlock and soft macro reads. The MSCI World index, unfazed, drifted to a fresh record high—gravity-defying risk appetite now the default setting, powered by tariff postponements and the growing perception that trade blows will be more featherweight than knockout.

On the surface, it was another yawner—low volume, tight leash, and the kind of range-bound churn that puts caffeine traders out of business. The S&P 500 drifted inside a paper-thin 40bps band, closing with all the enthusiasm of a shrugged shoulder—barely in the green at the bell, up less than 0.1% by 4 p.m. But beneath the surface, momentum is waning. The rally engine is still idling, but it’s starting to sound like it’s running on fumes.?

At the center of yesterday’s economic maelstrom was China’s May “data dump”—a reality check dressed up in mixed signals. Headline exports rose 4.8% year-on-year, but the real story was in the fracture lines. Shipments to the U.S. declined 34.4%—the most significant drop since the early COVID-19 crash—while exports to the rest of the world increased 11.4%. The message was unambiguous: the American consumer is no longer the gravitational anchor of China’s export galaxy. Released just as U.S.-China trade envoys squared off in London, the numbers underscored what markets have suspected for months—strategic decoupling isn’t a threat. It’s already happening.

The London talks themselves? Less détente, more diplomatic chess. There was some polite handshake optics. U.S. Commerce Secretary Howard Lutnick called the talks “fruitful,” while Treasury’s Scott Bessent gave the diplomatic thumbs-up, citing a “good meeting.” Trump, never one to undersell a headline, added from the White House lawn: “We’re doing well with China. China’s not easy… I’m only getting good reports.” Markets took the spin at face value—for now—though seasoned traders know that “fruitful” is often just code for nothing blew up… yet.

However, aiding the market, Trump even extended a conciliatory gesture to Elon Musk, resulting in a 4.5% boost for Tesla. In contrast, Apple—long considered the poster child for U.S.-China tech symbiosis—missed the AI opportunity at its developer conference, declining by 1% and highlighting just how sensitive this market is to perceived innovation gaps.

Despite the murky and deflationary China backdrop, Asia looks set to ride this sugar high of "progress" into Tuesday’s open—futures point to gains in Tokyo, Shanghai, and Hong Kong. Sydney, always the cautious cousin, is flatlining. Bonds rebounded after Friday’s NFP wage growth spook wore off, and the dollar backed off as traders repositioned ahead of Wednesday’s key CPI print.

The S&P 500 is still hovering about 2% below its February highs, and the Street is now split—whether the next leg up is powered by actual earnings beats or just the vacuum left by fading fear. The latest wave of bullish calls from Wall Street titans feels a bit like a weatherman forecasting sunshine while standing in a hurricane watch. Let’s be clear—this isn’t about fundamentals. It’s a pure play on tariff tail risk going quiet and the Fed cutting earlier than the dot plot wants to admit.

If you’re not buying the “fading fear ” narrative, then go take a long, hard look at the VIX. A 63% collapse over the past nine weeks—the steepest volatility crush on record—isn’t just a blip. It’s a signal that the market isn’t pricing risk, it’s ignoring it. Either we’re on the cusp of a miracle mile full round trip... or we’re dancing on a volatility time bomb with noise-cancelling headphones on. When fear gets this cheap, it rarely stays that way.

Make no mistake—this is still a market with its finger on the panic button. Tariff tantrums are on temporary mute, not cancelled. The Fed enters blackout mode ahead of its June 18 meeting, and any unexpected CPI twitch could set the whole house of cards fluttering. For now, though, bulls are dancing on a tightrope of tech hope, policy easing and trade theatre. Just don’t look down.

In FX, traders are still clinging to a glass-half-full worldview. Risk assets are riding the “ no fear “ narrative, with the MSCI World Index tagging new all-time highs The ongoing US-China trade talks in London are keeping the geopolitical temp in check—just enough to anchor the dollar in its recent range as we count down to Wednesday’s CPI print.

Over in Europe, the euro is starting to flash some tactical buy signals. It’s holding the line post-ECB, with Lagarde’s steady-hand messaging giving eurozone bulls a reason to stay long. The market’s only pricing one more cut—way out in December—and if whispers of German fiscal easing get louder when Berlin drops its new budget later this month, EUR/USD could find firmer footing. Don’t call it a breakout yet—but it’s starting to walk like one.

Author

Stephen Innes

SPI Asset Management

With more than 25 years of experience, Stephen has a deep-seated knowledge of G10 and Asian currency markets as well as precious metal and oil markets.