Liquidity drives markets — But not how you think

S2N spotlight

I always enjoy relooking at relationships that seem as clear as mud.

One such relationship is liquidity and stock price action. It is very tempting to infer that these two time series are closely related. I believe they are related—but not as closely as you might think. If you look at the correlation of global liquidity, based on an index created from the top three central banks (China’s data is less reliable, so it is not included), you will notice that the rolling 12-month correlation is around zero.

Now, I am not so naive as to think that global liquidity isn’t a major driver of market price trends. It clearly is. But it is not a linear driver. Liquidity acts more like a climate regime than a day-to-day catalyst. Month-to-month changes in balance sheets tell you very little about whether the S&P 500 will be higher next month—which is why the rolling return correlation oscillates around zero—but the big turns in liquidity almost always coincide with the big turns in markets.

Put differently: liquidity doesn’t tell you what happens next, but it often defines the environment in which things happen.

This is why traders obsess over central bank balance sheets even though the statistical relationship looks weak: liquidity is a regime-setter, not a timing tool.

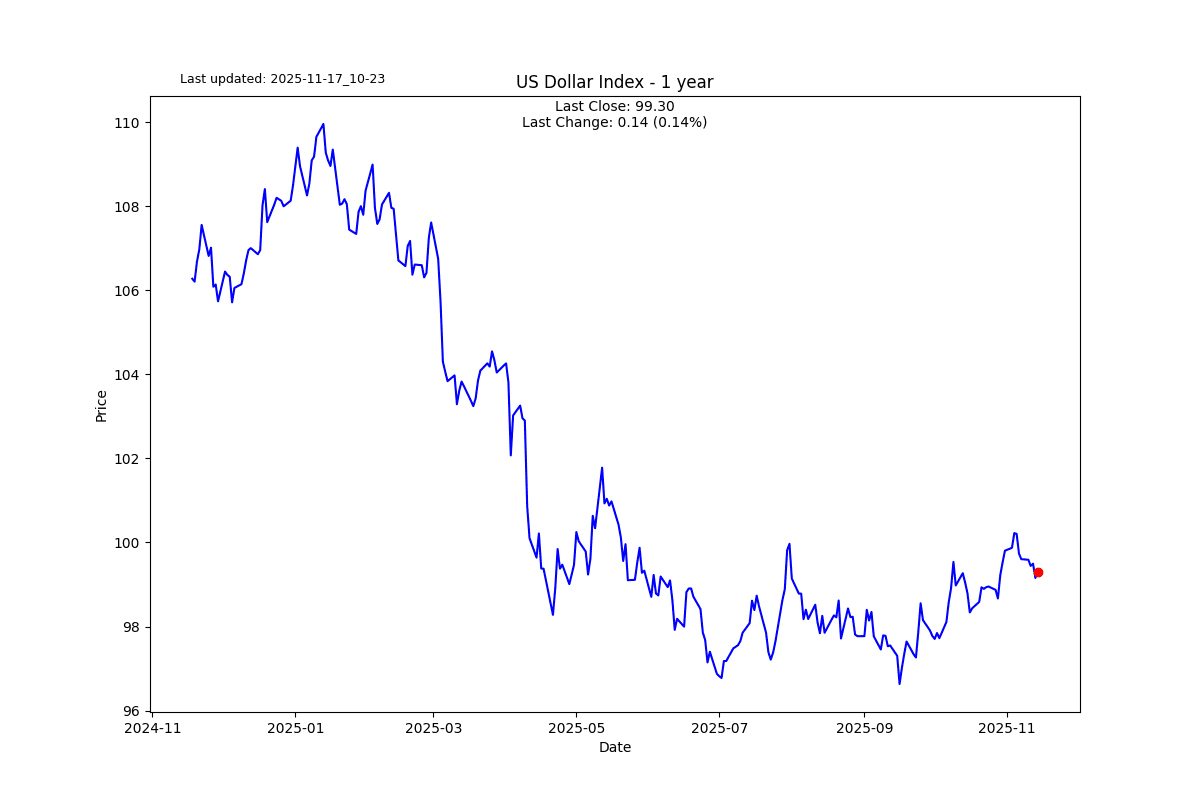

So one of the big things to focus on now is whether the current downtrend in liquidity will continue, or whether, after the Fed’s completion of quantitative tightening, global liquidity is finally ready to turn higher. Over the last three to four years, we have witnessed a very clear disconnect between equity prices and liquidity, with markets powering higher even as the monetary backdrop has quietly tightened.

And that brings me to the real lesson here: the misunderstanding is often behavioural, not mathematical. Investors anchor to narratives—“liquidity drives markets”—and then look for tidy, linear confirmation. But liquidity’s influence is cyclical, nonlinear, and deeply regime-dependent. It shapes the background climate rather than the next print on the tape. Right now, those background conditions are still tightening, even as price action behaves as if they are easing.

Understanding that tension—rather than forcing a neat story—is where the real edge lives.

S2N observations

I have been very vocal about my feelings towards MicroStrategy (MSTR) and Michael Saylor. I have mentioned that the premium MicroStrategy was trading at relative to Bitcoin was nonsense and it would end at a significant discount. Well, the premium is no longer, and we have a small discount. I still see plenty of room in this ratio as MicroStrategy tries to continue to sell a house of cards to investors mesmerised by financial jargon and accounting gymnastics. Saylor was quoted saying that if Bitcoin dropped to $1000, they would simply buy more.

I am waiting to see more confirmation, but I have heard that Grayscale, the largest crypto fund, has sold a massive amount of their Bitcoin holdings with huge outflows. I also read about some major liquidations on crypto exchanges on the weekend. This will be an action-packed crypto week.

I think a crypto winter now will be a major catalyst for global stock markets to turn bearish. Watch this space; it is either going to get extremely dark in crypto land, or we are going to witness another massive buy-the-dip moment. I think we are going to see a lot of strong hands fold.

S2N screener alert

Gold and Silver gave up their big gains with 4 sigma drops on Friday.

The US Dollar weakened dramatically against the Taiwan Dollar on Friday. I have no clue why.

S2N performance review

S2N chart gallery

S2N news today

Author

Michael Berman, PhD

Signal2Noise (S2N) News

Michael has decades of experience as a professional trader, hedge fund manager and incubator of emerging traders.