Life with and after COVID-19

When we first became aware of the coronavirus, it seemed to be a localized infection that would interrupt some Chinese factories for a few weeks. Any impact on the global economy was widely thought to be short-lived.

When the coronavirus struck America with a vengeance in mid-March, many of us were encouraged to decamp from the office and work remotely. I didn’t bother grabbing much from my desk; it was assumed that we needed to weather a brief surge, and that we’d be back before long.

Now homebound for almost five months, I realize how persistently I underestimated the power of the pandemic. (The fact that I was not alone in this misjudgment is hardly comforting.) Our forecasts have been ripped up and rewritten more times than I care to admit—and they will likely undergo further revision as the virus runs its course.

In this issue, we wanted to step back and give thought to some of the potential longer-term impacts of COVID-19 on the economy. Some aspects of our lives will take longer than we anticipated to return to pre-pandemic norms, and some may never do so.

Ahead of us are two phases. The first, which we are feeling our way through, is the interval prior to the perfection of a vaccine. Epidemiologists are working at warp speed toward this goal, aided by digital advances in medical research. News of promising developments has cheered markets, but the process of trial still takes time, and sometimes results in error.

Experts anticipate a durable solution will still take some months to develop and test. From there, additional time will be required to manufacture, distribute and administer prevention. We are likely to be well into 2021 before all of these steps are completed. And the process is likely to be uneven across countries and communities within countries.

Until then, populations will remain vulnerable to renewed outbreaks. COVID-19 has shown a penchant for lying dormant and re-emerging when given the opportunity. Most of the world is not equipped to perform contact tracing, so restrictions on movement will remain the primary means of arresting spread. COVID-19’s mortality rate is substantially higher than more common viral infections (currently 3.5% for the United States, more than 300 times the rate for seasonal influenza), so we are assuming public officials will remain cautious.

“The pandemic will have a range of long-term economic consequences.”

The establishment of comprehensive vaccination will initiate the second phase, which could be described as a new normal. Even in this state, caution may linger. Vaccination may not be universal in many places (some people are already voicing objections to it), and public trust of its effectiveness may take some time to establish. Consumers may therefore remain collectively cautious and never entirely return to pre-pandemic patterns.

And so as households and businesses orient themselves for life after COVID-19, here are some of the themes we’re expecting to see. Some are novel; others represent areas in which the pandemic is accelerating trends that were already underway. We’ll certainly be covering these topics more extensively in the months ahead.

A Tec(h)tonic Shift

Interest in automation and the usage of robots was manifested long before COVID-19 struck the world. Shocked by the pandemic, businesses will only speed their adoption of automation.

Japan’s robot makers saw rising demand in the first quarter despite most industrial activity tumbling off a cliff. Businesses are deploying robots to cut the number of workers physically present at work sites. Robots are scrubbing floors in the U.S. and dispensing sanitizer and checking temperatures in South Korea. On the services front, artificial intelligence is increasingly capable of substituting for teachers, fitness instructors and financial (not economic) advisers.

About 60% of production work worldwide is in areas that can easily be automated. In China, about 40% of jobs can be replaced by machines. Widespread adoption of automation could raise alarm among labor supporters, triggering a backlash. South Korea, Japan and Germany serve as examples of nations that have achieved higher industrial automation without higher unemployment.

Back in 2017, McKinsey & Company had predicted that a third of workers in the U.S. would be replaced by automation and robots by 2030. An event like the pandemic will only speed up the need for a workforce that doesn’t get sick or locked down for weeks, months or potentially years.

Open Your Tablet And Say, “Ahhhhh…”

For millennia, the practice of medicine has been tactile: direct contact between the afflicted and the healer was required to diagnose and treat.

COVID-19 made trips to medical offices a riskier proposition. Many clinics actively discouraged patients from entering their offices, even though it lost them visitation fees. For those who needed care, telemedicine became a viable option. In March, the U.S. Medicare system was authorized to broaden reimbursement for virtual care; claims jumped from ten thousand a week to well over a million a week in a month’s time.

“In health care and education, we'll have to get better at doing things from a distance.”

Health care is a huge industry in the U.S., but one in which digitalization has had trouble getting traction. Doctors and clinics value having some ownership of their patients; any American who has changed providers knows how challenging the process can be. The economics of many facilities are dependent on having a certain level of traffic or occupancy.

Telemedicine is not for all afflictions, or all patients. While some simple observations and metrics can be generated remotely, others cannot. There are concerns about the possibility of misdiagnosis, or that the transactional nature of some virtual visits will leave doctors without adequate background on patients. Others fret that providers will push too many patients to the virtual channel in an effort to control expenses, forcing some practices and clinics out of business.

But the convenience and cost of distance medicine is becoming more apparent. The diagnosis for the health care industry: disruption may be at hand.

Education Goes Viral

Most of today’s businesses have contingency plans in place to survive times like these. Unfortunately, education systems were not equipped to deal with extended disruptions.

The pandemic is forcing educational institutions to switch to virtual delivery of learning. But the research and evidence shows that the method is far from desirable. Extended school and university closures will have a detrimental impact on student outcomes (social relationships, achievement levels and dropout rates) and in turn, on students’ long-term earnings and value to the economy. Skill development needs workshops and labs (e.g. chemistry experiments require laboratories), and most teachers were never trained to lead virtual instruction.

That said, COVID-19 presents an opportunity to transform education systems. Students today are growing up in a truly digitized world. Switching or embracing innovative e-learning methods will go a long way in shaping their careers as, according to the World Economic Forum, 65% of primary-school children today will be working in job types that do not exist yet.

Institutions will have to pay close attention to helping the students who most need it, so that present inequalities in access and quality of education do not widen. Whenever in-person classrooms resume, online learning methods will certainly be more embedded into curricula. Technology will amplify the work of teachers, but is unlikely to replace them or the traditional educational institutions.

Life, Liberty, and Internet Access

Longtime technology users will remember the moment they gained access to broadband internet service. No more cumbersome dialing and occupying the home phone line to get online, and no more 60-second waits for pages to load. But that upgrade has not been universal. Hundreds of millions of users rely on slow connections, putting their economic prospects in peril.

The digital divide is not new, but the COVID-19 crisis has brought it to a head. Fast, reliable connectivity is now essential for work, education, healthcare and entertainment.

“Broadband access may become an essential utility.”

Reaching remote locations is a challenge, but it has been solved before with other groundbreaking technologies. In the U.S., bringing electricity to rural communities required substantial but worthwhile government investment. A small universal service fee has long subsidized telephone access for rural and low-income residents.

A widening array of wireless technologies will help bridge service gaps. 4G and forthcoming 5G networks may be more cost-effective ways to reach more people, while a new satellite network is being deployed to allow universal wireless internet access.

Countries from Finland to Taiwan have made universal service available to their residents. While the feat is easier in geographically smaller states, these countries have demonstrated the potential for a committed nation to ensure broadband access. Throughout its history, the internet has created innumerable opportunities and supported growth in an equitable way. In the post-COVID-19 world, we will spend more time online than ever before. No region can afford to be left behind.

Summer in the City

Until recently, we were witnessing a renewal in city living. More young residents were appreciating the convenience of urban lifestyles, leading many employers to open offices in central business districts. This sparked a virtuous cycle of demand for cities.

There is speculation that COVID-19 could reverse this trend. The professional jobs that were growing in cities are the ones that can most readily be performed remotely. If the work can be done from anywhere, why should workers pay high rents for small apartments and employers spring for premium office locations? Spacious suburban homes and office parks in lower-cost cities have gained new luster.

But moves of households and businesses alike should not be taken in haste. While professionals are getting their jobs done remotely, the soft side of business is now more difficult. Recruiting and training new hires has become impersonal. New connections are harder to make, and trust is harder to develop. And as our understanding of COVID-19’s transmission grows, it has become clear that city living is not necessarily more risky. Many cities curbed or prevented large-scale outbreaks, while medical resources in less-dense areas are stretched.

“Don’t count cities out just yet.”

So much of human history has taken place in cities, from Athens to Varanasi, Rome to Jerusalem. Humans are social animals that will seek to congregate and live in close proximity. The culture, connections, and communities found in urban areas cannot be recreated remotely. The nature and balance of work and leisure may shift, but in the long run, we will continue to live our lives in cities.

Cash Me Out

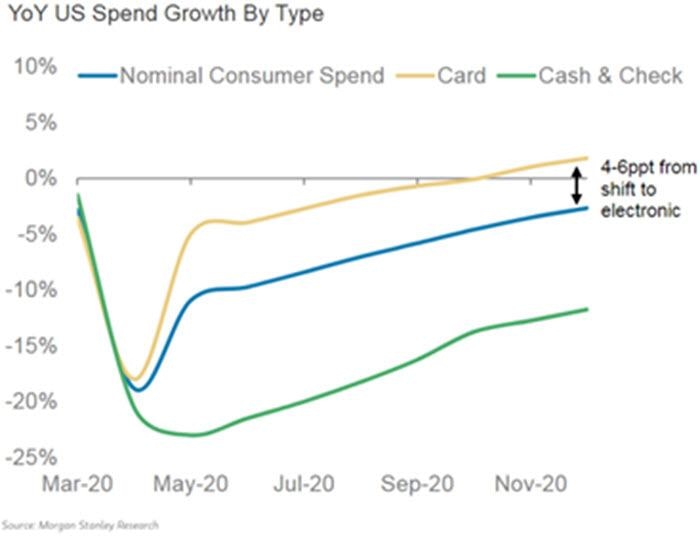

The pandemic may finally force the United States to move its payments system into the current century. Social distancing led to the temporary closure of many retail establishments and forced those that remained open to take safety precautions. This led to broader use and acceptance of touchless payment methods. Going forward, transactions will become more digital, more quickly.

Banks and payment processors will be pleased at the accelerated evolution. A recent study from Visa found that handling cash and checks costs businesses 7.1 cents of every dollar received, compared to 5 cents of every dollar collected from digital sources. (Having cash on the premises is also a temptation for thieves.) The use of credit and debit cards that require swiping or insertion at the point of sale is also inefficient; merchants have to bear the cost of the equipment, which have periodically been an avenue for fraudsters.

As a result of this transformation, more U.S. consumers will have to switch to digital wallets, obtain contactless cards or order items online. There will be frictions in this transition: some populations still don’t have access to the needed technology, or remain wedded to checks and currency. But while achieving 100% adoption will take time, the pandemic has increased the stakes for digital payment providers.

Author

Northern Trust Economic Research Department

Northern Trust