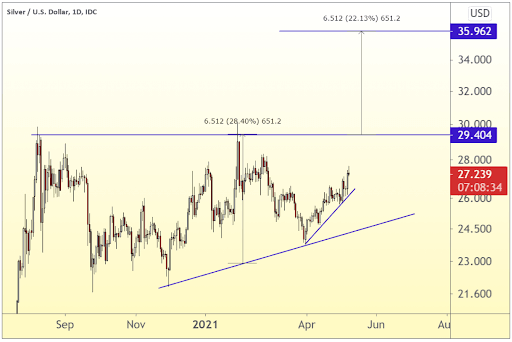

Lateral trading in silver prices might soon come to an end

Silver prices have effectively been trading sideways since August 7, 2020. But from a technical point of view, that might come to an end over the next few weeks. The fundamentals are also supporting higher prices for now.

J.P.Morgan Global Composite PMI reaches 11-year high

The latest reading of the Global PMI index suggests that the world economy has not grown as fast as it did in April for more than 11 years. The UK and USA lead the way, and the surge is strong as production was almost non-existent due to the pandemic.

New orders are also surging, suggesting that the world economy will be strong in the months ahead. The EU will also come back online in a few months, which will further boost economic growth and inflation expectations.

The jump start in the world economy, the massive amounts of monetary and fiscal stimulus, and bottlenecks everywhere are causing inflation to pick up. Crude oil prices are already up sharply, and soft commodities are following. Corn prices have surged by 50% year to date.

I think that much of the surge in growth and inflation expectations will slow by the end of the 2021 and that we will not have permanently higher inflation. The Federal Reserve is thinking in the same lines, and as long as they stick with this view, it is giving silver traders a greenlight to accumulate silver on fears of higher inflation in the months ahead. The technical outlook is also supporting this view.

An ascending triangle suggests that silver could be about to reach 35.96 on a break to the 29.40 level. But for that to happen we probably need to wait a few more weeks.

Daily silver price chart

Author

Alejandro Zambrano is ATFX’s Global Chief Market Strategist. He combines extensive professional experience and a pragmatic attitude to trading, building clients’ understanding of the markets and the rationale behind investing.