Jobs picture stabilizing with renewed drop in claims

A decline in initial jobless claims for both regular and PUA benefits alongside a drop in continuing claims suggests the jobs recovery has not gone into reverse. Nevertheless, tomorrow's payroll report could be wild.

Cross-the-Board Improvement in Claims Figures

By a number of accounts the jobs recovery has lost momentum over the past month, but the latest jobless claims figures hint at conditions stabilizing if not improving once again. Initial claims fell to 1.19 million for the week ending August 1. Seasonal adjustment is tricky for the claims data in July due to the varying degree and timing of auto plant shutdowns, but the 4-week average on initial claims signaled some modest improvement on trend. Initial claims for the Pandemic Unemployment Assistance program also posted the biggest weekly drop since late May. Continuing claims for the week ending July 25 more than reversed the prior week's rise. In short, new layoffs and the ranks of the unemployed remain strikingly high, but today's report alleviates concern that the jobs recovery has gone into reverse.

Buckle Up For Another Wild Ride with Payrolls Tomorrow

Tomorrow's payroll report already looks a bit stale in light of the more timely jobless claims numbers. Initial claims rose the week ending July 18 (the survey week), but were down from the survey period in June.

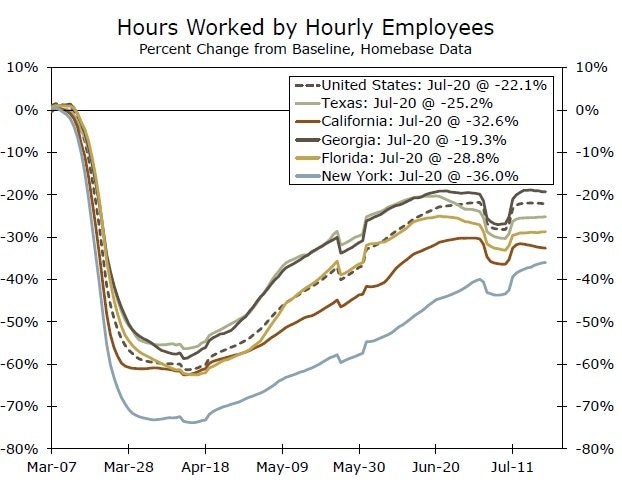

Claims data also reflect only part of the net hiring equation. While layoffs edged lower between the June and July survey weeks, gross hiring looks to have picked up bit further over the period. We estimate payrolls to have increased by 1.7 million in July. Homebase data show an increase in employment among hourly workers and more businesses opening between the first half of June and first half of July. Seasonal adjustment factors should also help support the headline gain; school closings this spring accelerated the timeline for summer layoffs in the education industry, so the usual job losses for the sector should be more modest this July.

That said, there remains a massive degree of uncertainty around estimates for payrolls tomorrow given the fast-moving and unprecedented scale of changes in the labor market in recent months. While the Homebase data point to another gain in payrolls between the survey periods, the series have stalled more recently (bottom chart). They also only capture hourly employees. As the pandemic continues and sales remain depressed, we fear growing pressure on jobs across functions and not just those with direct personal contact, which skew toward hourly workers and suffered the greatest losses early on.

Along those lines, the broad read on July employment from the ISM nonmanufacturing index, which reflects hiring in industries accounting for 91% of payrolls, showed employers shed workers at a faster pace. Meanwhile, the Census Bureau's experimental Household Pulse Survey showed the share of employed ticking down slightly between survey weeks. In short, a negative print tomorrow is within the realm of possibility, although we see a greater risk of that at the moment for August's payroll figures.

Author

Wells Fargo Research Team

Wells Fargo