Is $SLV ready to turn higher in the larger cycles?

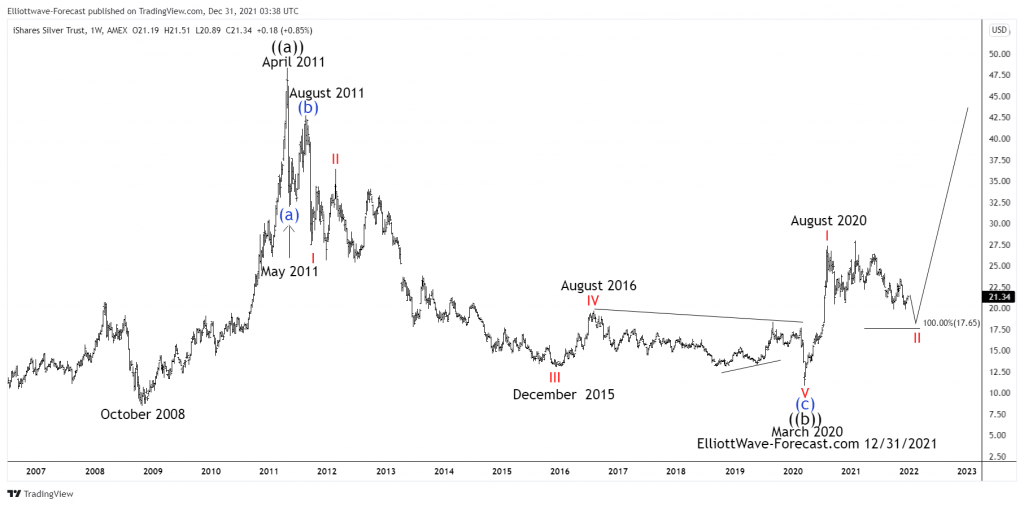

Firstly there is data back to when the ETF fund began in 2006 as seen on the weekly chart shown below. The fund made a low in 2008 at 8.45 that has not since been taken out in price. This analysis assumes from the October 2008 lows to the April 2011 highs was a larger degree impulse cycle up from the all time Silver lows.

Secondly, the decline from the April 2011 highs down to the May 2011 lows was five waves. Price held below the April 2011 highs during the bounce from the May 2011 lows to the August 2011 high.

The analysis continues below the weekly chart.

Thirdly, the cycle from the August 2011 high now appears complete. The red wave I, expanded flat wave II bounce & wave III decline to the December 2015 lows best looks as two Elliott Wave impulses. The bounce to the August 2016 high was strong enough to suggest it had corrected the cycle from the red wave II highs in February 2012. From the August 2016 high the sideways to lower decline appears to be an Elliott Wave triangle structure. This ended the wave “E” at the February 2020 highs. From this point in time the instrument printed another Elliott wave impulse lower into the March 2020 lows at 10.86.

In conclusion. Down from the April 2011 highs SLV exhibits qualities of an Elliott Wave zig zag structure that now appears complete. This is due to the bounce from the March 2020 lows. It was strong enough and apparently in a five wave impulse. This suggests the cycle lower from the 2011 highs had ended. Also the correction of the cycle up from the all time lows had completed at the March 2020 lows. While below the November 2021 highs the metal can see another low before a larger degree turn higher again.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com