Is Silver becoming the next Gold? XAG/USD hits new all-time highs

- Silver surges into fresh all-time highs, fueled by intense macro demand, tight supply, and synchronized metals momentum.

- Catalysts include rate-cut expectations, industrial demand resurgence, and investors rotating into precious metals as hedges.

- Technical forecast: A breakout continuation remains likely while above short-term demand, but a failed expansion could trigger a deeper retracement.

Silver’s explosive rally: Why XAG/USD is suddenly acting like Gold

Silver isn’t just following gold anymore - it’s behaving like its own bull market.

In the last several sessions, XAGUSD printed a powerful parabolic structure, clearing long-standing resistance and pressing into fresh all-time highs near $58.95.

The broader metals complex has been bullish for months, but silver’s pace has accelerated beyond typical correlations. The key reason? Silver is no longer being valued solely as a precious metal - but also as an industrial necessity. You’re seeing a unique blend of macro + micro fundamentals converging at the same time.

Where gold is driven mainly by fear, liquidity, and central-bank behavior…

silver is being driven by fear and real-world demand.

And that combination creates stronger upside velocity.

The catalysts behind Silver’s strength

1. Rate-cut expectations are fueling precious metals

Markets have swung again toward renewed rate-cut bets, after weeks of uncertainty. Lower interest rates weaken the dollar and reduce the opportunity cost of holding metals.

Gold is benefiting - but silver is reacting even more aggressively because:

- Silver is cheaper and more volatile,

- Traders view it as a high-beta version of gold,

- Precious metal baskets often overweight silver during early easing cycles.

Silver becomes the “leveraged” safe-haven play when rate cuts return.

2. Industrial demand is booming - Especially in solar

Silver is a critical input for:

- Solar panels

- EV production

- Batteries

- Semiconductors

- Electrical components

The global solar industry hit record installations in 2025, and silver’s industrial demand pushed inventory levels to decade lows. Unlike gold, silver’s demand can’t be substituted easily - and production can’t ramp up quickly.

Tight supply + rising industrial demand = aggressive pricing pressure.

3. Spot supply is thinning - Refiners are paying premiums

Physical premiums have risen sharply across Asia and Europe, signaling:

- Immediate spot demand

- Short-term supply shortages

- Refiners struggling to secure inventory

This tightness is not priced into futures yet, which is why spot prices are leading.

4. Safe-haven rotation as geopolitical risks rise

Investors continue to hedge against:

- Middle-East tensions

- U.S.–China trade anxiety

- Europe’s slowdown

- Uncertain global growth outlook

While gold is the primary hedge, portfolio flows often spill into silver when momentum accelerates. Silver offers higher percentage upside, which is why speculative demand increases once macro flows turn bullish.

Technical outlook

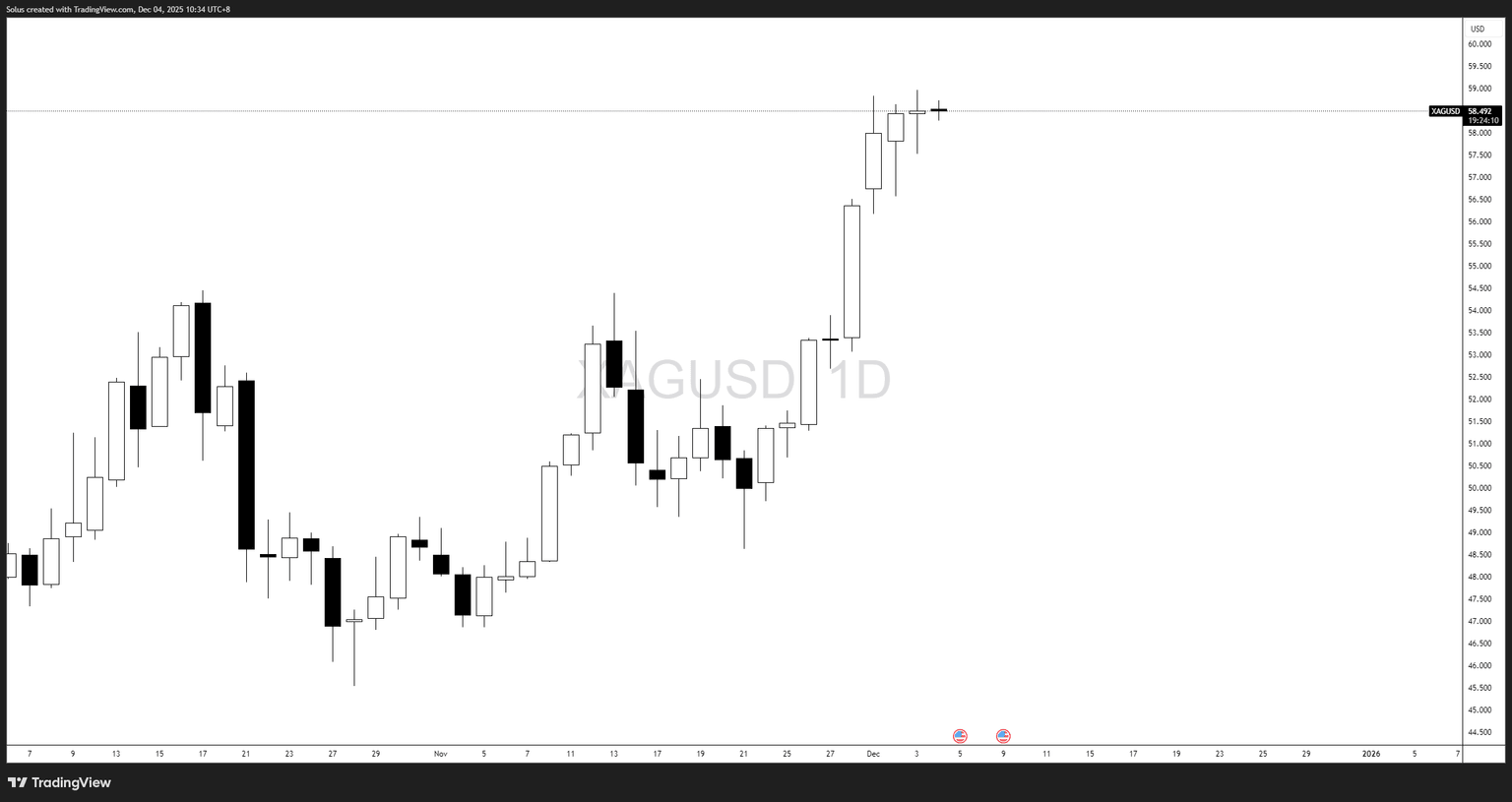

Silver’s daily chart shows an unbroken sequence of strong bullish displacement, confirming trend continuation. Price is currently consolidating just under the $58.96 all-time high, forming a tight range - a typical “re-accumulation at premium” structure before another expansion.

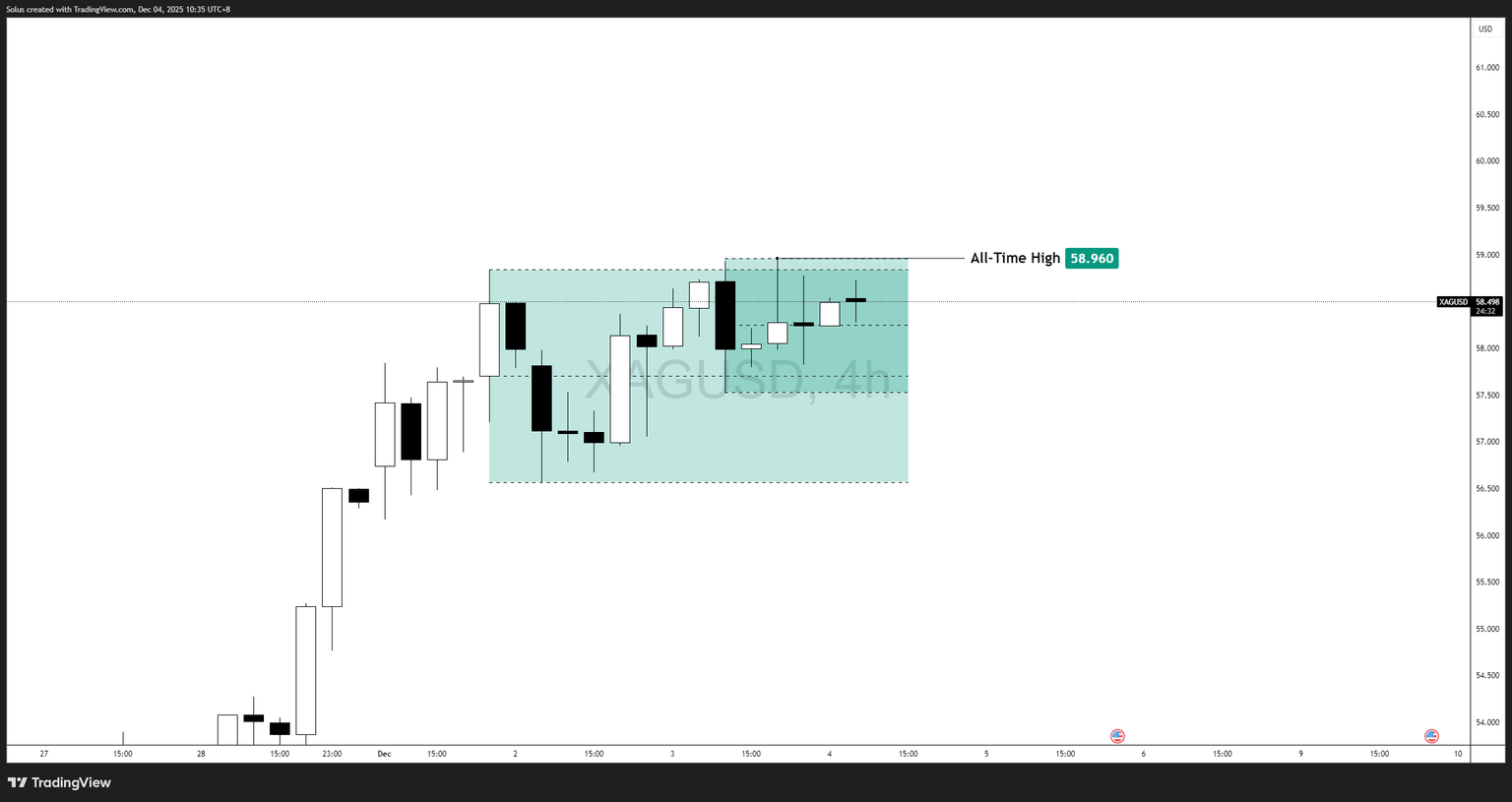

This aligns with the recent 4H price action, where silver has been:

- Building a tight consolidation box,

- Maintaining bullish structure,

- Compressing volatility against resistance.

This type of compression near ATHs often results in strong directional moves - either a breakout or a sharp rejection.

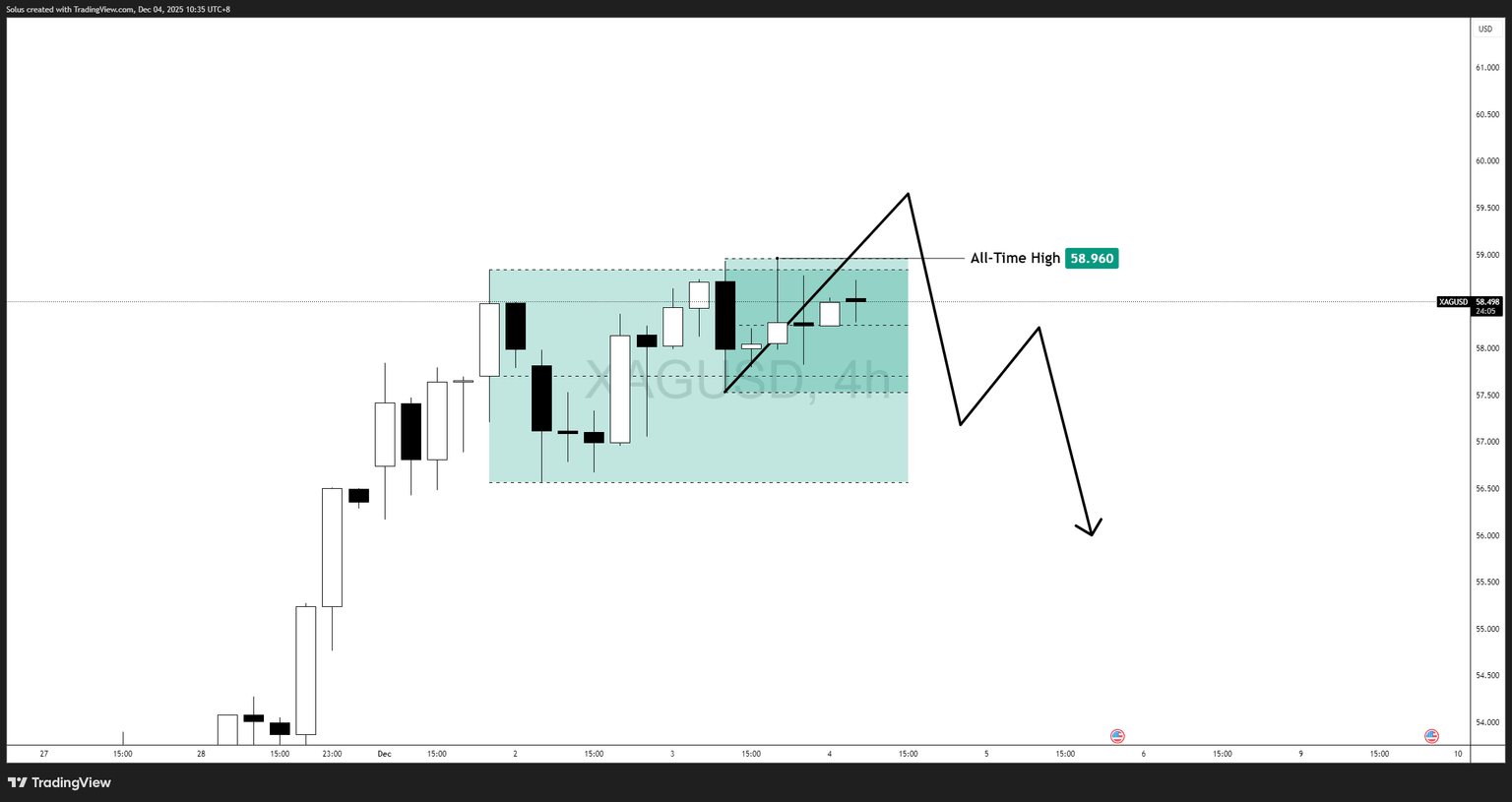

Bullish scenario: Breakout above all-time high

A bullish continuation is favored if price:

- Breaks and sustains above $58.96,

- Confirms a higher-timeframe expansion,

- Shows clean displacement through the upper 4H consolidation range.

If this occurs, the next legs higher could target:

- $60.50

- $62.00

- $65.00 psychological expansion

Momentum remains intact as long as silver holds above the short-term demand inside the 4H range.

Bearish scenario: Rejection from premium and deeper retracement

A bearish shift only emerges if price:

- Sweeps the all-time high,

- Fails to hold above it,

- Breaks back below the 4H range midline.

A breakdown would likely target:

- $57.00

- $56.20

- $55.00 deeper retracement into demand

This scenario remains secondary unless price fails aggressively above ATH.

Final thoughts: Is Silver becoming the next Gold?

Yes - and in some ways, silver is becoming an even stronger macro asset than gold.

Gold is driven by monetary fear.

Silver is driven by monetary fear + industrial reality + supply tightness.

This combination is rare - and historically leads to multi-quarter rallies, not short-term spikes.

As long as the catalysts remain intact (rate-cut cycle, tight supply, green-tech demand), silver may continue to lead metals higher.

Author

Jasper Osita

ACY Securities

Jasper has been in the markets since 2019 trading currencies, indices and commodities like Gold. His approach in the market is heavily accompanied by technical analysis, trading Smart Money Concepts (SMC) with fundamentals in mind.