Is A Wave Of Risk-Off Building Up? [Video]

![Is A Wave Of Risk-Off Building Up? [Video]](https://editorial.fxstreet.com/images/Markets/Equities/Exchange_iStock_000002664244_Medium_XtraLarge.jpg)

Apple’s Warning Triggered Risk-Off

Safe havens thrived yesterday after Apple warned it will not meet its revenue targets due to the corona virus impact. It is not just the production that was running again, yet working with much less capacity than anticipated, but Apple is also suffering from China as market not consuming

The Virus Remains A Big Issue

While China’s president Xi said that China will continue to reach its 2020 economic targets the news we are getting don’t really agree with that.

For example picture the drop in visitors to HK alone to give you more of an idea of the magnitude of stillstand in China.

So far those news are still pointing to temporary disruptions but what if we reach a tipping point where the temporary disruptions turn into more permanent, full-year hits across different industries and countries?

It is estimated that the Chinese economy ran at 40%-50% last week as Bloomberg reports:

Remember Stagflation?

Another source to a possible increase in prices, especially consumer goods that would hit the hardest will be when prices for production in China rise in the aftermath of the coronavirus impact.

With more and more economies struggling, from heavyweights such as Japan or Germany to other economically relevant countries like South Korea the situation is turning negative globally.

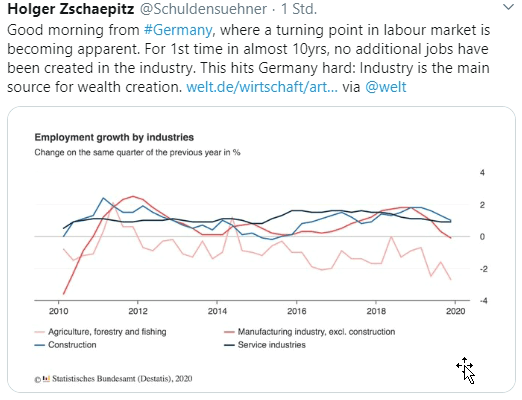

For example, the situation Germany is really bad, yesterday’s ZEW came in very weak and we now also start to see impact in the job market in the industry, Germany’s source of economic strength is weakening further:

Not even the USA is excluded from signs of further weakness. Walmart delivered a strong outlook but its recent results were not getting better either:

And rising mortgage defaults from NYC Hotels:

Can We Really Expect Growth In 2020?

US stock markets have more or less shrugged off the risk-off yesterday towards the end of the day as the persistent dip buying behaviour continued in the face of all the risks mounting up left and right.

FX

In FX USD remains king as currencies and commodities were much more responsive to the risk related developments than stock markets were.

The EUR dropped below the 1.08 to a 3-year low and may face further downside on the more and more weakening of the German economy in particular.

The GBP benefited from good unemployment data and in general it looks like the Pound has been much less reactive to global events and traded much more driven by its own domestic driving factor. Watch for CPI data out of the UK today for more important input.

Oil and Gold

Oil is pushing up on news of some reduction of oil production in Libya, but so far it is not anything I would see as a serious offsetting impact to oil prices trading back lower on the globally spreading economic contraction.

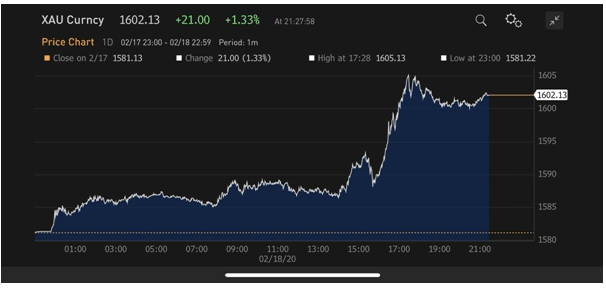

Gold jump above the $1,600 and moved exactly in line with our expectations yesterday. If stories of economic decline and more virus impact persist, the chance for the gold to rise further is absolutely given.

Even the price of Palladium continues to experience a record-breaking surge and showing a lot more reaction to risk-off dynamics than equities.

BTC

BTC jumped back to the $10k level that it is fighting to hold this morning still. We have to pay attention where we look to analyse the present situation on markets globally more accurately, if it was for the US stocks, everything would be fine, but with USD, Gold and BTC up we can clearly see the risk-off showing and BTC price movements continue to correlate with those of safe havens strongly. Should the $10k level hold on a daily close the price could see another leg to the upside sooner than later.

Author

Alexander Douedari

Independent Analyst

Alexander Douedari is an Award Winning Hedge Fund Manager and Selfmade 7-Figure Trader. Now Mentor for Students all around the world.