Intraday market analysis: Yen’s rally gains traction

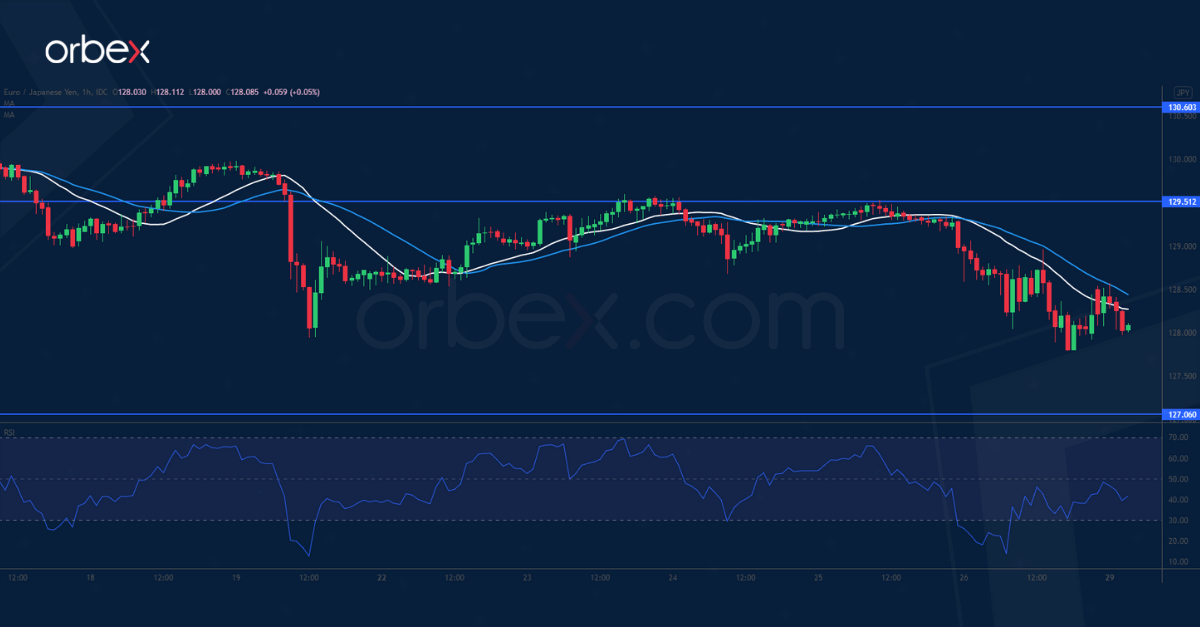

EUR/JPY breaks double bottom

The safe-haven Japanese yen soars on news of a vaccine-resistant covid variant. A bearish MA cross on the daily chart indicates weakness in the euro’s previous rebound.

The pair has closed below last September’s low at 127.90, a major floor to keep price action afloat in the medium term. This is a bearish signal that the sell-off is yet to end with 127.00 as the next support.

The RSI’s double bottom in the oversold area may attract some buying interest. However, the bulls will need to lift 129.50 before a reversal could take shape.

GBP/USD struggles to bounce back

The pound continues on its way down against the US dollar over divergent monetary policy. The pair is hovering near a 12-month low around 1.3280.

Sentiment remains bearish after a failed rebound above 1.3420. A bullish RSI divergence suggests a deceleration in the downward momentum.

1.3390 is the first hurdle ahead. Its breach would prompt the short side to cover and open the door to the daily resistance at 1.3510. Otherwise, a bearish breakout would send the price to 1.3200.

GER 40 to test major floor

The Dax 40 plunged as investors fret that new lockdowns could wreck the recovery. The gap below 15760 has forced leveraged buyers to bail out, stirring up volatility in the process.

The momentum is typical of a catalyst-driven sell-off. Below 15150 the index is testing the psychological level of 15000. The RSI’s oversold situation has attracted a ‘buying-the-dips’ crowd in the demand zone.

Further down, 14820 is a key floor to maintain the uptrend. 15530 has become the closest resistance in case of a rebound.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.