Intraday market analysis: USD sees limited rebound

USD/CHF tests resistance

The US dollar inched higher after Fed Chairman Jerome Powell commented that it was time to taper. A bearish MA cross on the daily chart weighs on overall sentiment.

Nonetheless, the pair has found some buying interest in the short-term over the daily support at 0.9150. A bullish RSI divergence was the first sign that the downward pressure might have eased for now.

A break above 0.9200 would prompt sellers to cover, opening up the path to the key resistance at 0.9250. A bearish breakout would send the price to 0.9100.

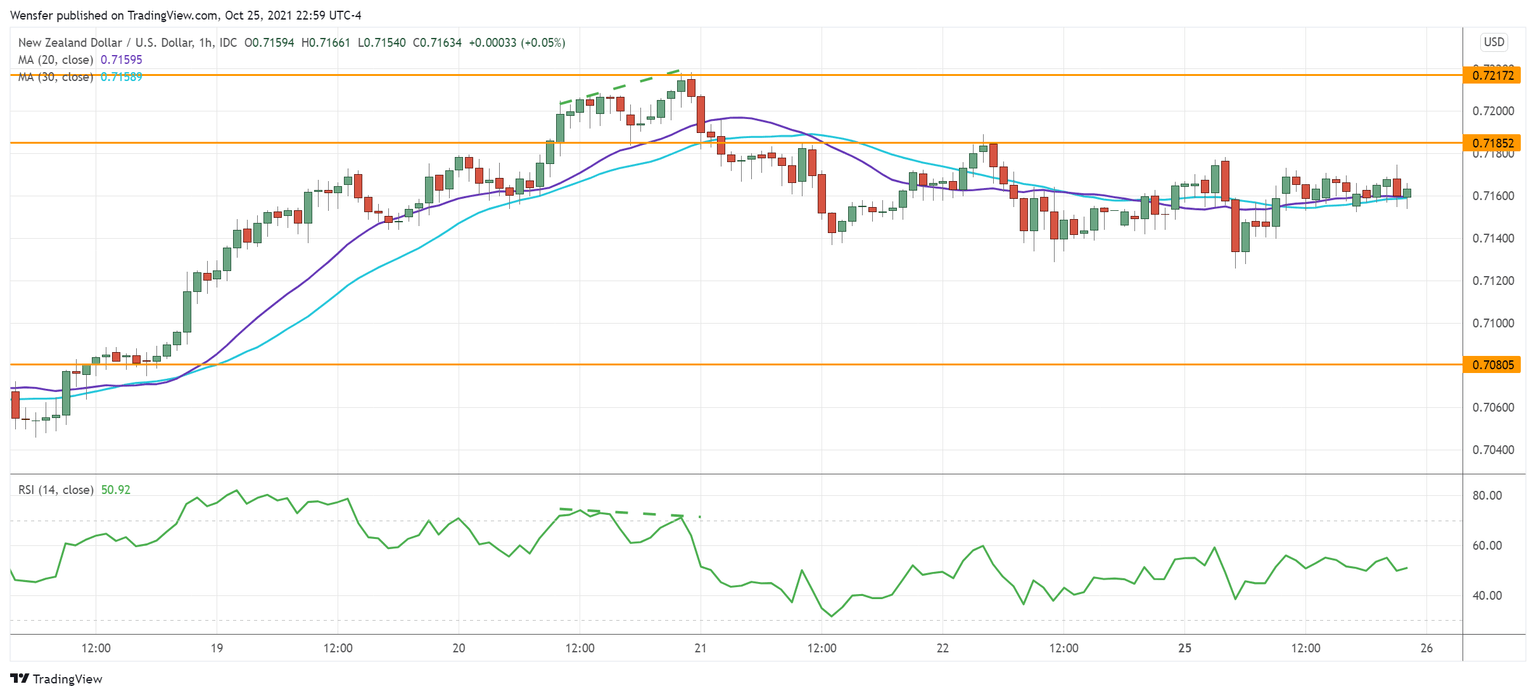

NZD/USD seeks support

The US dollar recovers across the board thanks to rising Treasury yields. The Kiwi’s breakout above the daily resistance at 0.7150 may have put it back on a bullish trajectory.

However, a repeatedly overbought RSI and its bearish divergence indicate that the bulls have struggled to follow up.

Buyers are likely to be waiting on the sidelines and a pullback towards 0.7080 could be an opportunity. 0.7020 would be the second line of defense in case of a deeper correction.

A rebound above 0.7185 may resume the rally.

NAS 100 aims at an all-time high

The Nasdaq 100 bounced higher as investors hope to see solid earnings from the Big Tech companies.

The index has consolidated its recent gains after it broke above the daily resistance at 15400. The bulls have pushed above the major step at 15550 which was the origin of the September sell-off. This would take out the selling interest and put the uptrend back on track.

The all-time high at 15700 is the next resistance. An overbought RSI may cause a temporary pullback to 15280 where the bulls may look to accumulate.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.