Industrial production whiffs in September, down for Q3 as a whole

Summary

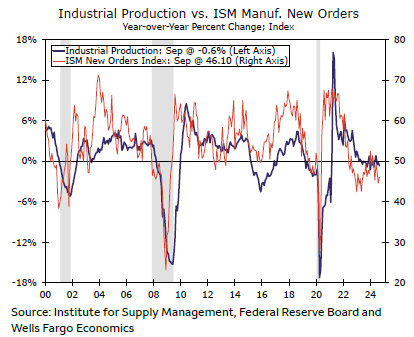

Industrial production fell in September as capacity utilization dropped to a three-year low. There were mitigating factors at play, but it is emblematic of the dire straits in the manufacturing sector today that one-off factors can derail output rather than just slow it

Industrial sector cannot take a punch

Industrial production fell 0.3% in September, reversing a gain of the same magnitude in August. Factor in a drop in output in July and the third quarter as a whole was a bust for industrial production, falling at an annual rate of 0.6% (chart).

There are some mitigating factors to consider here such as a strike at a major domestic aircraft manufacturer and the negative impact of hurricanes. The Federal Reserve reckons these factors together exerted an overall drag of 0.6% on September production.

In a better manufacturing environment, these one-off factors would merely be headwinds holding back the pace of output growth; in today's stall-speed climate, they are enough to make output contract.

Manufacturing output in particular was down 0.4%. That makes this the third monthly decline in factory production in the past four months. The fact that orders figures from survey data have not been particularly buoyant in recent months means that while the news is dreary, it is not surprising.

Author

Wells Fargo Research Team

Wells Fargo