Industrial Production Dives and It's Not All Strike Related

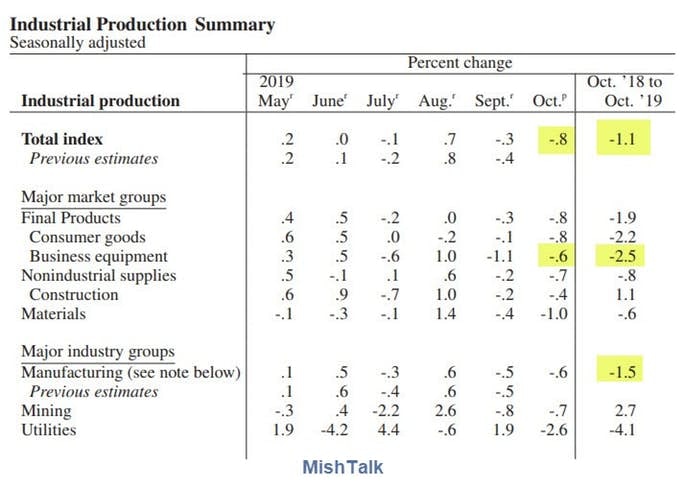

Industrial production was down 0.8% in October with Manufacturing down 0.6%. Motor vehicles were down a whopping 7.1%.

Industrial Production and Capacity Utilization declined much more than expected 0.8%in October according to the Fed report. Economists at Econoday forecast a 0.4% decline.

Key Points

- Industrial production fell 0.8 percent in October after declining 0.3 percent in September.

- Manufacturing production decreased 0.6 percent in October. Much of this decline was due to a drop of 7.1 percent in the output of motor vehicles and parts that resulted from a strike at a major manufacturer of motor vehicles.

- It's not all strike-related. Weakness was across the board. Business equipment was down .06% month-over-month and a whopping 2.5% year-over-year.

- Construction is down for the third time in four months

Industrial Production vs Recessions

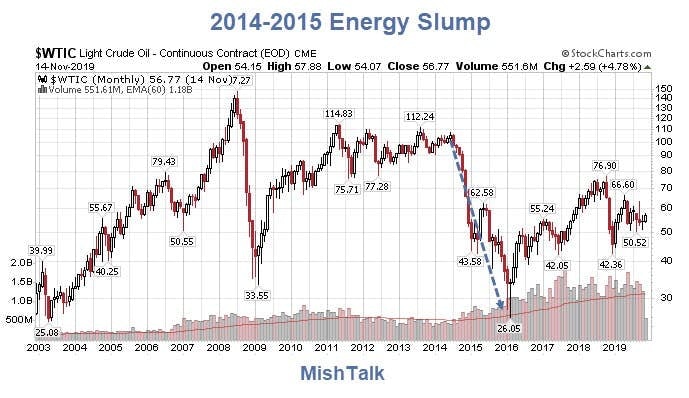

2014-2015 Energy Slump

This is not a replay of the 2014-2015 recession scare.

Trucking provide another recession warning: Freight Volumes Negative YoY for 11th Straight Month

Donald Broughton, founder of Broughton Capital and author the Cass Freight Index says the index signals contraction, possibly by the end of the year. That's just one one month away.

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc