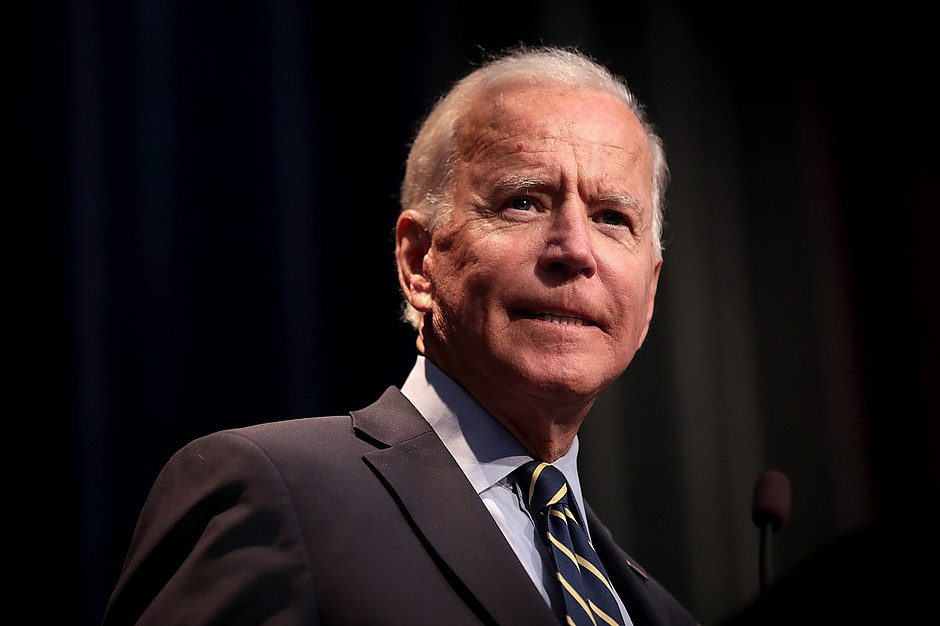

Indices recover ahead of Biden stimulus plan

The FTSE 100 is enjoying a solid morning, while US futures have picked up as investors await details of Joe Biden’s stimulus plan.

-

Markets finally begin to make gains after lacklustre week.

-

Trump impeachment ignored by investors.

-

Dunelm & Tesco edge back after results.

A more positive tone in markets has developed ahead of the expected stimulus announcement from Joe Biden, investors hoping that the president-elect will move quickly and in substantial form to secure a new package that will bolster the US economy as the vaccine programme moves into a higher gear. The week has seen little real movement across most markets, the small bounce in the dollar notwithstanding, and the hope for traders will be that the Biden news will at least inject some more excitement into what has been a dull few days for markets. The impeachment of the sitting president has been mostly ignored, investors remembering that an actual Senate trial is unlikely to start before Biden’s inauguration, although the risk of civil unrest cannot be discounted. The arrival of US bank earnings tomorrow will also act to keep sentiment in check, especially following the strong gains in the sector made since the vaccine announcements in early November.

UK retailers have been issuing Christmas statements all week, but the news has come through thick and fast today. The saying, ‘it is better to travel than to arrive’ has been demonstrated once again in the case of Tesco and Dunelm, winners from the past year’s shift back to big supermarket shops and the explosive growth of online shopping respectively. But with the good news now factored into the price, both firms will need to find new stories to justify continued gains, and in Dunelm’s case the prospect of further growth in an already-crowded UK market seems a challenging one.

Ahead of the open, we expect the Dow to start at 31,182, up 122 points from Wednesday’s close.

Author