In the Eurozone, inflation is also a monetary phenomenon

The quantitative theory of money — the idea that inflation in an economy depends on the quantity of means of payment in circulation — is a very old one. It is generally attributed to the French philosopher and jurist Jean Bodin, who, around the middle of the 16th century, was the first to have the intuition that the causes of the "rise in the price of all things" in Europe were to be found in the influx of precious metals from the New World.

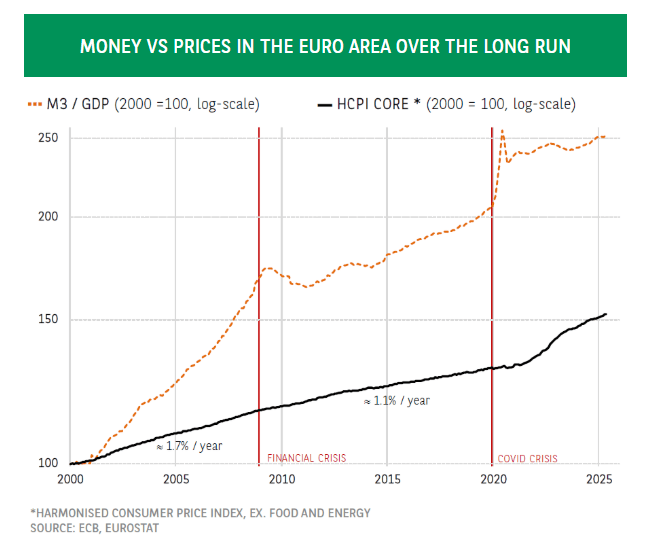

Today, monetary aggregates continue to be closely monitored by the European Central Bank (ECB), a sign that, despite the passage of time and the increasing complexity of financing circuits, quantitative theory remains relevant. In his speeches, former ECB Executive Board member Benoît Cœuré (now Chairman of the OECD's Competition Authority) sometimes used to remind that the link between money and inflation had not disappeared. If anything, our chart this week supports this observation.

It traces the different inflation regimes experienced in the Eurozone over the past twenty-five years, as well as the evolution of the money supply "M3" relative to real GDP over the same period. The first break occurred at the turn of the 2010s, when the major financial crisis and the sovereign debt crisis hit in quick succession. The subsequent tightening of prudential standards for banks, coupled with the deleveraging efforts of economic agents (many of them governments and households in southern Europe), led to a marked slowdown in money and credit aggregates. Inflation, for its part, declined steadily: from an annual rate of 1.7% in the 2000s (excluding volatile elements), it fell to an annual rate of 1.1% in the 2010s.

Monetary hyperstimulation and price slippage: Parenthesis closed

It took a global health catastrophe and a war on Europe's doorstep for things to change again. To counter the depressive effects of Covid 19, central banks repurchased the ballooning government debt on a massive scale. By supporting demand during a period of supply shortages, these suddenly ample monetary conditions helped to kick-start inflation.

While the scale of the price slide may have been surprising, it was nonetheless transitory. The central bank "closed the bar" in stages from 2022, when it began to raise interest rates and then reduce the size of its balance sheet. Inflation has now returned to the 2% target, while the M3/GDP ratio has more or less returned to its pre-pandemic trend. As for the future, in a world where instability is becoming the norm, further price swings are to be expected. However, with monetary fuel now less abundant, the risk of a general surge appears low.

Author

BNP Paribas Team

BNP Paribas

BNP Paribas Economic Research Department is a worldwide function, part of Corporate and Investment Banking, at the service of both the Bank and its customers.