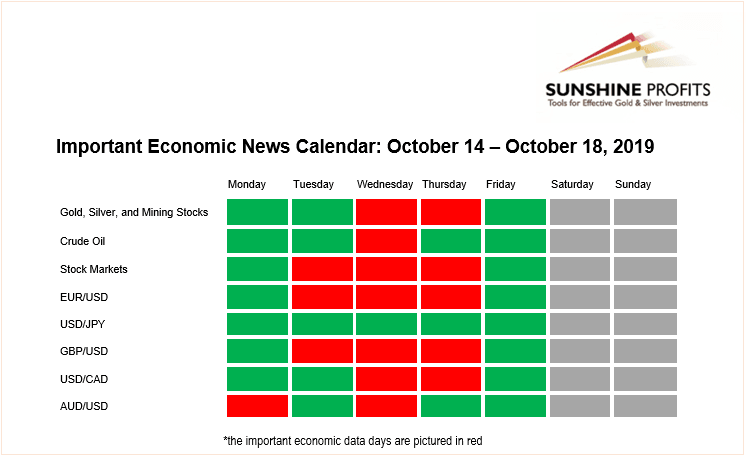

Important Economic News Calendar: October 14 – October 18, 2019

The markets basically ignored the Fed talk last week, as U.S. - China trade war developments stole investors’ attention away from the scheduled news releases. But it was worth paying attention to our last week’s News Calendar that highlighted U.K.’s economic data preceding end of week GBP rally. This week, we will have some potentially moving news releases too. So let’s take a look at those events.

The week behind

Last week’s Fed talk on Monday, Tuesday and on Wednesday didn’t result in any spectacular volatility spikes, as investors payed more attention to U.S. – China trade war developments. However, end of the week brought huge British Pound rally. The rally followed Thursday’s U.K.’s GDP, Manufacturing Production data releases and a speech from the BOE Governor Carney.

The week ahead

What about the coming week? The important U.S. economic data will come on Wednesday and on Thursday. The earnings season is starting and we will see the first important quarterly earnings releases in the middle of the week. Last but not least, the German and Chinese data will be released on Tuesday and on Thursday. On Wednesday, we could see an increased oil prices volatility following weekly inventories figures.

- Wednesday’s Retail Sales number and Thursday’s Philly Fed Manufacturing Index will be the most anticipated U.S. economic news releases this week.

- The third-quarter earnings season is coming! We will see important releases in the middle of the week.

- The other noteworthy releases will include German ZEW Economic Sentiment and China’s GDP number. This week’s economic news from Australia, Canada and U.K. are also worth mentioning, as they will likely affect exchange rates.

- Wednesday will be important for the oil, as we will get the weekly API stock number and the Crude Oil Inventories.

You will find this week’s the key news releases below (EST time zone). For your convenience, we broken them down per market to which they are particularly important, so that you know what to pay extra attention to, if you have or plan to have positions in one of them. Moreover, we put the particularly important news in bold. This kind of news is what is more likely to trigger volatile movements. The news that are not in bold usually don’t result in bigger intraday moves, so unless one is engaging in a particularly active form of day trading, it might be best to focus on the news that we put in bold. Of course, you are free to use the below indications as you see fit. As far as we are concerned, we are usually not engaging in any day trading during days with “bold” events on a given market. However, in case of more medium-term trades, we usually choose to be aware of the increased intraday volatility, but not change the currently opened position.

Gold, Silver, and Mining Stocks

Tuesday, October 15

- 5:00 a.m. Eurozone - German ZEW Economic Sentiment

- 8:30 a.m. U.S. - Empire State Manufacturing Index

Wednesday, October 16

- 8:30 a.m. U.S. - Retail Sales m/m, Core Retail Sales m/m

- 8:30 a.m. Canada - Consumer Price Index, Core Consumer Price Index m/m

- 2:00 p.m. U.S. - Beige Book

- 8:30 p.m. Australia - Employment Change, Unemployment Rate

Thursday, October 17

- 8:30 a.m. U.S. – Philadelphia Fed Manufacturing Index, Building Permits, Housing Starts, Initial Claims

- 2:00 p.m. U.S. – FOMC Members Bowman, Evans, Williams Speeches

- 10:00 p.m. China – GDP y/y

Crude Oil

Monday, October 14

- 8:30 p.m. Australia - Monetary Policy Meeting Minutes

- 9:30 p.m. China – Consumer Price Index y/y, Producer Price Index y/y

Tuesday, October 15

- 5:00 a.m. Eurozone - German ZEW Economic Sentiment

Wednesday, October 16

- 10:30 a.m. U.S. - Crude Oil Inventories

- 4:30 p.m. U.S. - API Weekly Crude Oil Stock

Thursday, October 17

- 8:30 a.m. U.S. – Philadelphia Fed Manufacturing Index, Building Permits, Housing Starts, Initial Claims

- 9:15 a.m. U.S. - Industrial Production m/m, Capacity Utilization Rate

- 10:00 p.m. China – GDP y/y

Stock Markets

Monday, October 14

- 9:30 p.m. China – Consumer Price Index y/y, Producer Price Index y/y

- All Day, U.S. – Bank Holiday

Tuesday, October 15

- 5:00 a.m. Eurozone - German ZEW Economic Sentiment

- Before Open U.S. - JPM, C, GS, JNJ Quarterly Earnings

- 8:30 a.m. U.S. - Empire State Manufacturing Index

Wednesday, October 16

- Before Open U.S. - BAC Quarterly Earnings

- 8:30 a.m. U.S. - Retail Sales m/m, Core Retail Sales m/m

- 2:00 p.m. U.S. - Beige Book

- After Close U.S. – NFLX, IBM Quarterly Earnings

Thursday, October 17

- Before Open U.S. – MS, HON Quarterly Earnings

- 8:30 a.m. U.S. – Philadelphia Fed Manufacturing Index, Building Permits, Housing Starts, Initial Claims

- 9:15 a.m. U.S. - Industrial Production m/m, Capacity Utilization Rate

- 10:00 p.m. China – GDP y/y, Industrial Production y/y, Fixed Asset Investment, Retail Sales y/y, Unemployment Rate

Friday, October 18

- Before Open U.S. – KO, AXP, SLB Quarterly Earnings

EUR/USD

Monday, October 14

- All Day, U.S. – Bank Holiday

Tuesday, October 15

- 5:00 a.m. Eurozone - German ZEW Economic Sentiment

- 8:30 a.m. U.S. - Empire State Manufacturing Index

Wednesday, October 16

- 8:30 a.m. U.S. - Retail Sales m/m, Core Retail Sales m/m

- 2:00 p.m. U.S. - Beige Book

Thursday, October 17

- 8:30 a.m. U.S. – Philadelphia Fed Manufacturing Index, Building Permits, Housing Starts, Initial Claims

- 9:15 a.m. U.S. - Industrial Production m/m, Capacity Utilization Rate

- 2:00 p.m. U.S. – FOMC Members Bowman, Evans, Williams Speeches

- 10:00 p.m. China – GDP y/y

USD/JPY

Wednesday, October 16

- 8:30 a.m. U.S. - Retail Sales m/m, Core Retail Sales m/m

Thursday, October 17

- 8:30 a.m. U.S. – Philadelphia Fed Manufacturing Index, Building Permits, Housing Starts, Initial Claims

- 10:00 p.m. China – GDP y/y

GBP/USD

Tuesday, October 15

- 4:30 a.m. U.K. - BOE Governor Carney Speech

- 4:30 a.m. U.K. - Average Earnings Index, Unemployment Rate

Wednesday, October 16

- 4:30 a.m. U.K. – Consumer Price Index y/y

- 8:30 a.m. U.S. - Retail Sales m/m, Core Retail Sales m/m

- 9:00 a.m. U.K. - BOE Governor Carney Speech

Thursday, October 17

- 4:30 a.m. U.K. - Retail Sales m/m, BOE Credit Conditions Survey

- 8:30 a.m. U.S. – Philadelphia Fed Manufacturing Index, Building Permits, Housing Starts, Initial Claims

- 10:00 p.m. China – GDP y/y

Wednesday, October 16

- 8:30 a.m. Canada - Consumer Price Index, Core Consumer Price Index m/m

- 8:30 a.m. U.S. - Retail Sales m/m, Core Retail Sales m/m

- 10:30 a.m. U.S. - Crude Oil Inventories

- 4:30 p.m. U.S. - API Weekly Crude Oil Stock

Thursday, October 17

- 8:30 a.m. Canada - Manufacturing Sales m/m, ADP Non-Farm Employment Change

- 8:30 a.m. U.S. – Philadelphia Fed Manufacturing Index, Building Permits, Housing Starts, Initial Claims

- 10:00 p.m. China – GDP y/y

AUD/USD

Monday, October 14

- 8:30 p.m. Australia - Monetary Policy Meeting Minutes

- All Day, Australia – Bank Holiday

Wednesday, October 16

- 8:30 a.m. U.S. - Retail Sales m/m, Core Retail Sales m/m

- 8:30 p.m. Australia - Employment Change, Unemployment Rate

- 10:30 a.m. U.S. - Crude Oil Inventories

- 4:30 p.m. U.S. - API Weekly Crude Oil Stock

Thursday, October 17

- 8:30 a.m. U.S. – Philadelphia Fed Manufacturing Index, Building Permits, Housing Starts, Initial Claims

10:00 p.m. China – GDP y/y

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Paul Rejczak

Sunshine Profits

Paul Rejczak is a stock market strategist who has been known for the quality of his technical and fundamental analysis since the late nineties.