If gold continues its uptrend, junior miners will benefit

Despite stocks' slight recent fall, their short-term outlook remains bullish. Unless gold truly plunges, junior miners have a chance to rise soon.

Bullish indications

Overall, the precious metals sector didn’t do much last week. Gold was up by 1.4%, silver was up by 0.12%, GDX was down by 0.7%, and the GDXJ was up by 2.46%.

Junior miners are the bullish exception that reacts to gold’s recent strength. Seniors and silver are not really participating in the rebound – at least not yet. As a reminder, the above is not necessarily a sign that junior gold and silver miners are particularly strong – it’s likely the case that they have simply fallen the most recently, and therefore their rebound is the strongest.

As you may recall, silver tends to outperform gold close to the end of a given rally, and we haven’t seen this phenomenon this time, except for the last rally that ended on July 18. However, that was too early in the rally to really call this type of performance something close to the end of the rally – it was too close to its beginning.

Consequently, it could be the case that we’re going to see more strength in the precious metals market before the big move lower continues.

What we saw in the general stock market confirms this scenario.

Stocks declined somewhat on Friday, but overall, they ended last week visibly above their declining short-term trend channel and above their 50-day moving average. That’s simply a bullish combination for the short run.

This tells us that silver and mining stocks (and especially junior mining stocks) are likely to move higher unless gold truly plunges.

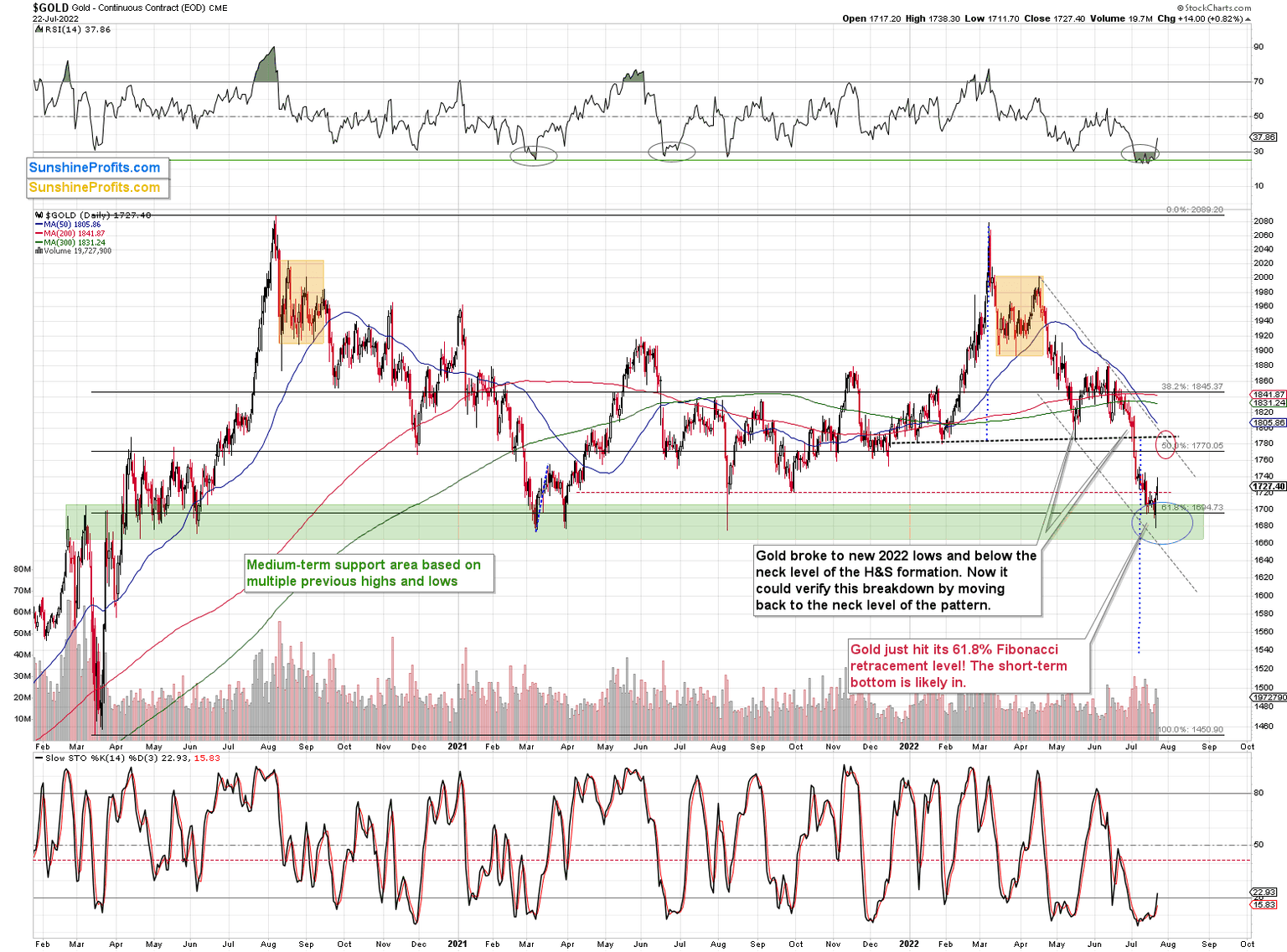

Gold hasn't stop yet

Gold is likely to move higher in the short term, not plunge. The reason is that it just invalidated the breakdown below its mid-2021 lows and the 61.8% Fibonacci retracement level based on the entire 2020 rally. The yellow metal did so after bottoming right in the middle of my target area, close to its previous lows.

Besides, in all recent cases when gold rallied after its RSI was below or very close to the 30 level, it then rallied at least until the RSI was close to 50. That’s not the case yet, so it doesn’t seem that gold is done rallying yet.

All in all, gold is likely to move higher within the next several days, and the same goes for the general stock market. Both are likely to contribute to higher prices in junior mining stocks. The latter are likely to rally, top, and then start another very powerful move lower. For now, however, the short-term outlook remains bullish.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!

Author

Przemyslaw Radomski, CFA

Sunshine Profits

Przemyslaw Radomski, CFA (PR) is a precious metals investor and analyst who takes advantage of the emotionality on the markets, and invites you to do the same. His company, Sunshine Profits, publishes analytical software that any