Huge spike in long-term unemployment

The percentage of those unemployed for 15 weeks or longer spiked to 5.0% in July. And it will be much worse next month.

Long-Term Unemployment 1950 Through August 2020

What's Going On?

The above chart shows long-term unemployment is typically a very lagging indicator. This happens because layoffs increase as recessions grow in length.

U1 is 15 weeks or longer so it took this long to kick in.

BLS Reference Period

The BLS reference period for the household survey which sets the official unemployment rate is the week that contains the 13th of the month.

The reference period for the July Jobs report thus reflects conditions July 12- 18. That is about 15 weeks from the start of this mess.

U-1 Lag

In every instance since 1950 the U-1 Unemployment rate peaked well after the recession was over.

It is unprecedented for U-1 to jump this fast. Normally businesses cut hours, then more hours before mass layoffs begin.

The huge spike in July reflects the immediate economic shutdown.

Number Unemployed 5 Weeks or Less

Number Unemployed 15 Weeks or More

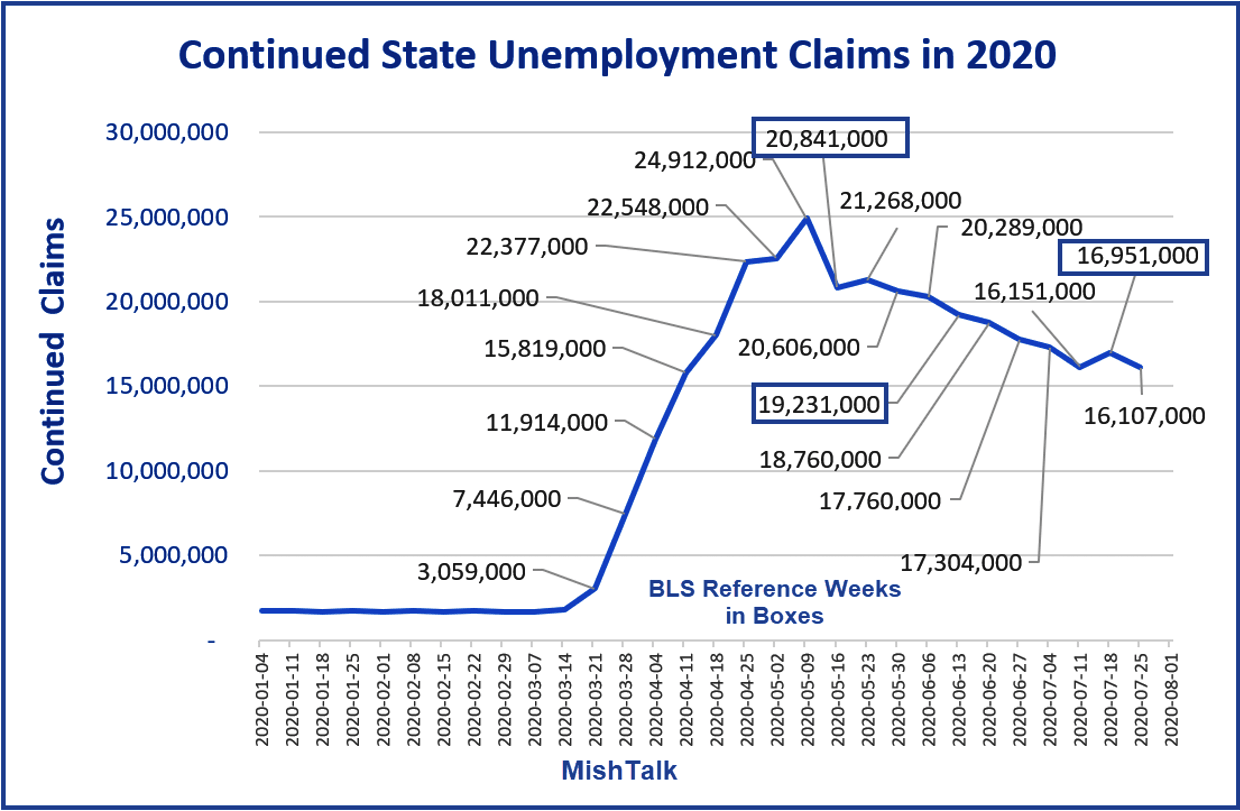

Continued Unemployment Claims

As noted on August 6, Continued Unemployment Claims Are Still Above 16 Million.

For the August report (due September 4), I expect those unemployed 15 weeks or long to spike above 10 million.

If so, that would exceed the previous record set in the Great Recession.

Number Unemployed 27 Weeks or Longer

27 weeks is a key number to watch because most state unemployment benefits last 26 weeks.

I estimate we are another 6 weeks away for that to happen.

Ominous Setup

- Over 30 million people are on pandemic assistance.

- At least 16,107,000 people are not working any hours.

- An additional 15,201,678 people do not qualify for state unemployment insurance but have been collecting $600 weekly assistance checks.

- An unknown number of those 15+ million are working part-time.

Pandemic Checks Stopped

On July 25 the Clock Ran Out on $600 in Weekly Unemployment Benefits as Republicans and Democrats bickered over the next round of stimulus.

On July 29, Trump announced "So Far Apart on Covid Deal That We Don't Really Care"

On August 5, I commented Trump Weighs Imposing His Stimulus Plan, Constitution be Damned

Those 30 million people will miss there second $600 weekly check tomorrow.

Talks between Republicans and Democrats over continued pandemic benefits have stalled.

It is likely that any deal will be retroactive, but meanwhile, many millions have no means in which to pay their bills.

Mish

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc