How could the UK election influence BoE policy?

- Polls show the Labour party is likely to win the July 4 UK general election.

- The election outcome could have consequences for the UK economy, the Bank of England policy and the Pound Sterling valuation

- Some economists have suggested tiered remuneration at the BoE could be a source of extra revenue for the government.

The UK election will arrive on July 4 and will probably be dressed in red. According to bookmakers, the left-leaning Labour party has a 90% chance of winning. While this suggests a significant political change after almost 15 years of conservative-led governments, analysts doubt there will dramatically alter the outlook for the economy.

Still, any nuances over economic policy could shift growth expectations, the Bank of England (BoE) interest-rate outlook and thus impact the Pound Sterling (GBP) valuation.

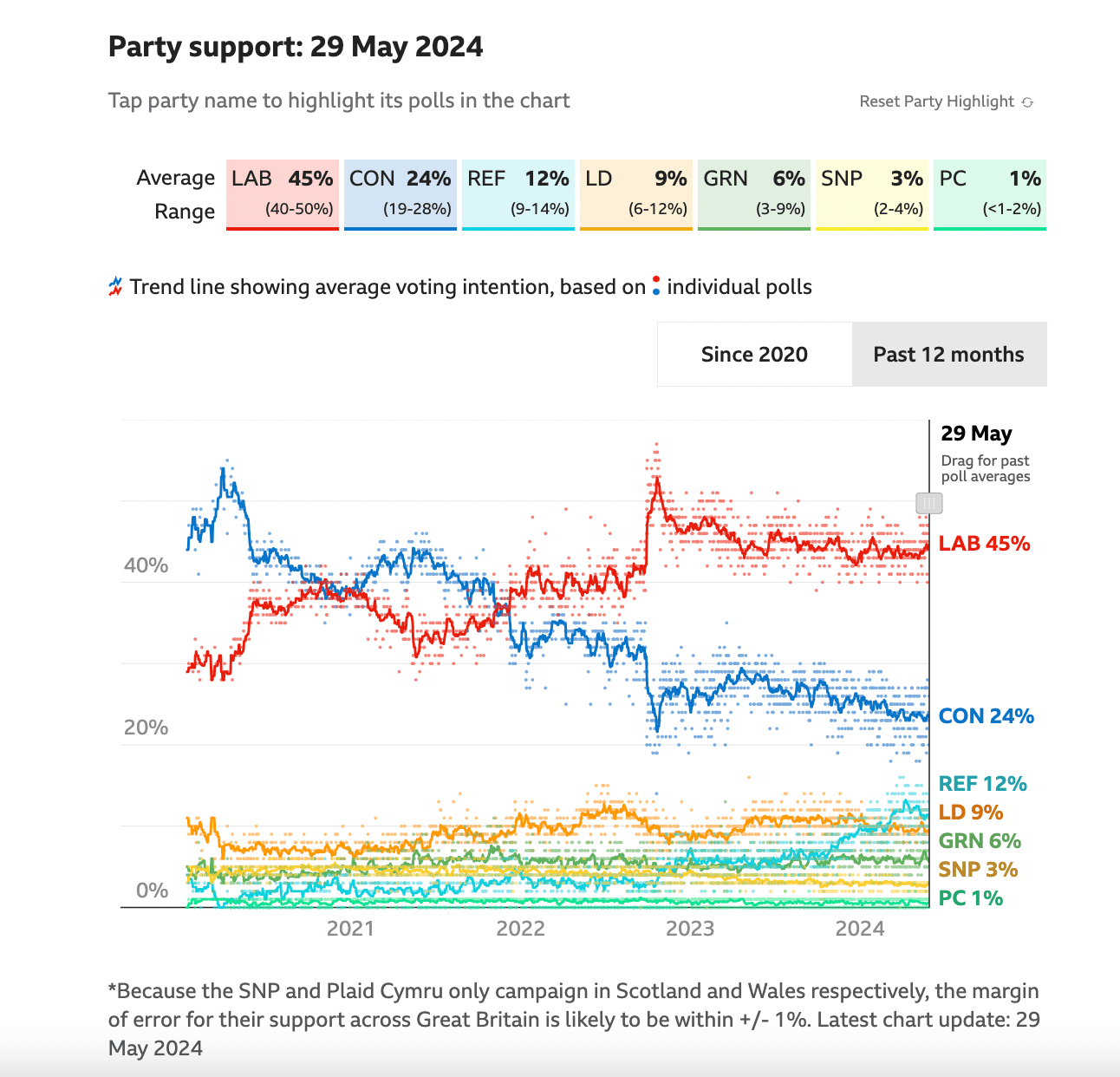

The latest poll by the BBC puts Labour in the lead with 45% and the Conservatives second with only 24% – a 21 percentage-point difference.

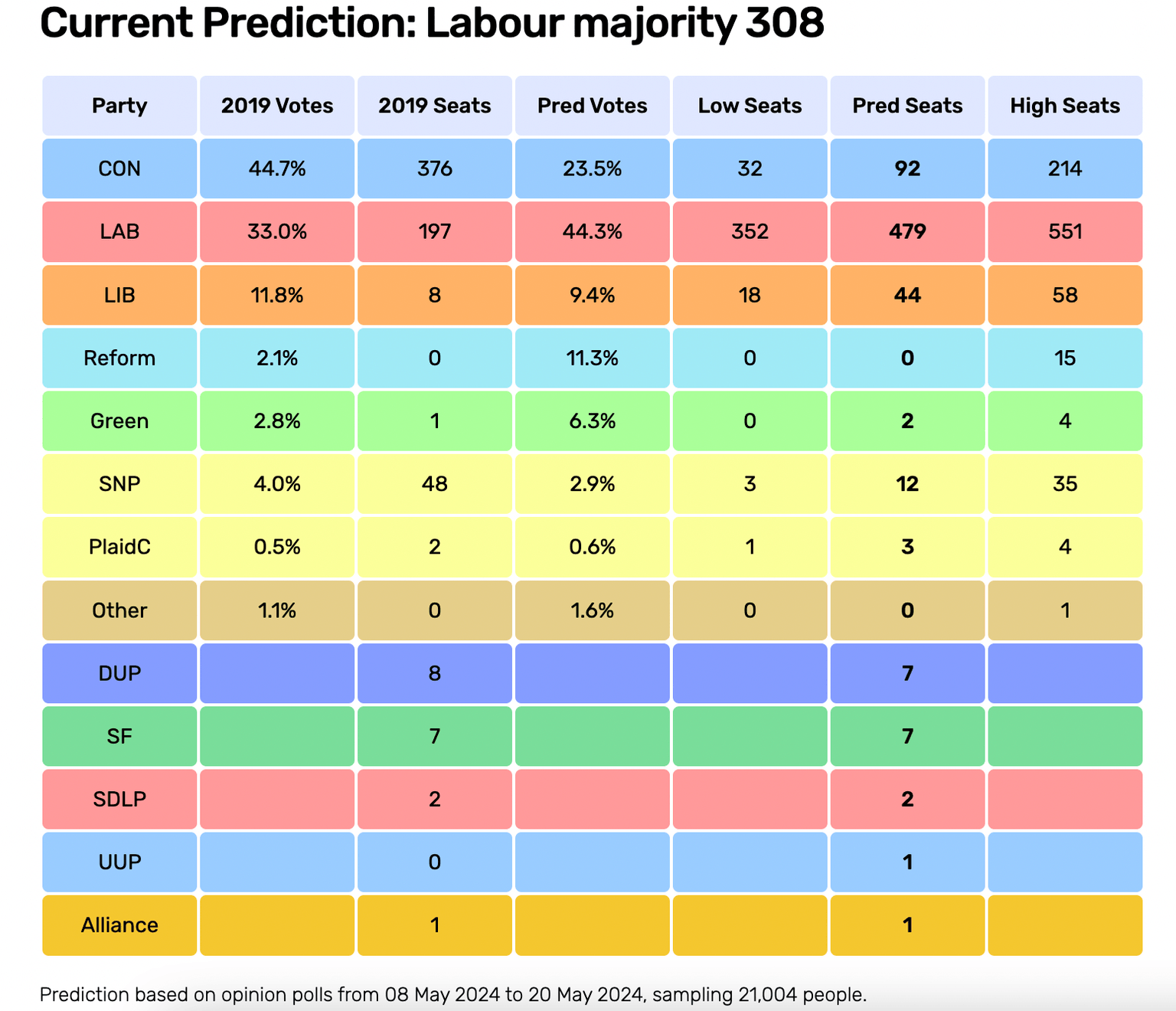

The UK’s “first past the post” voting system tends to unduly reward the winning party when it comes to the alchemy of transforming votes into seats. This means if Labour actually gets 45% of the vote it will win a landslide victory. According to Electoralcalculas, with 44.3% of the vote, Labour would win 479 out of the 650 seats in the UK Parliament – a healthy majority.

Whilst the UK election result is looking like a done deal, what will it mean for the Bank of England (BoE) and its monetary-policy trajectory? Further, how might it affect the Pound Sterling (GBP), and financial markets in general?

UK election: Impact on Bank of England policy

Despite the UK election looking like an easy win for Labour, the party has announced scant details of its fiscal policy intentions, making it difficult to assess what – if any impact – the election will have on markets. Apart from a recent pledge to reduce National Health Service (NHS) waiting lists to a maximum of 18 weeks by the end of its first term, it has not released any detailed spending plans.

Labour does, however, support the BoE’s plans to launch its own central bank digital currency, the “digital pound”, according to investment app Stocklytics.

A Labour-party win is unlikely to alter market expectations around BoE monetary policy on interest rates, according to experts, who say that whichever party wins, will have to show a high degree of fiscal restraint.

“The markets don’t need to fret about the election leading to a sudden reduction in long-term productivity as they did ahead of the 2017 and 2019 elections. And as there won’t be much room for maneuver on fiscal policy for either party after the election, the fiscal plans of the winner are unlikely to significantly alter market interest rate expectations or Gilt yields,” Ruth Gregory, Deputy Chief UK Economist at Capital Economics, told FXStreet.

Gregory is not the only person expecting minimal market impact from the UK election.

“Implied Sterling volatility may rise before the vote, but the implication of the election outcome for Sterling and Gilts should be trivial,” says in a research note Kenneth Broux, FX Strategist at Societe Generale (SocGen).

A tail risk for Sterling and debt markets would be a hung parliament, “where no party wins a majority, and would be negative for the currency and rates,” says SocGen.

UK election manifestos will be key

It is only in an event where either party were to show “fiscal profligacy” in their manifestos, that financial markets might react.

“Investors will assess the election manifestos for signs of fiscal profligacy and for answers to the implausible scheduled squeeze on public spending. Our assumption is that a fall in CPI inflation below the 2.0% target will prompt the Bank of England to reduce interest rates from 5.25% now, to 3.00% in 2025. We think that will lead to 10-year gilt Yields falling from 4.23% now to around 3.50% by the end of this year and the Pound to weaken from $1.28 now to $1.22 by the end of the year,” says Gregory.

That either party will announce radical tax cuts is unlikely. Labour is more likely to raise rather than slash taxes as memories are still fresh of how such policies backfired on Liz Truss’s administration. That said, if the two parties “get embroiled in a race to the bottom on tax policies”, the Pound could weaken from $1.28 (GBP/USD) to a below-forecast $1.22, adds Gregory.

Going to the banks cap in hand: “Tiered Remuneration”

One change to BoE policy that might find the extra money for Labour if it wins is “Tiered Remuneration” or “Reserve Tiering”.

Tiered remuneration involves reducing the interest the BoE pays commercial banks that hold reserves with them. These reserves, totalling an estimated £830 billion, were built up by UK banks from the BoE’s Quantitative Easing (QE) programe between 2009-2021. QE involved the BoE buying mainly government bonds from banks to provide them with liquidity during the credit crisis.

Under the current state of affairs, the BoE pays interest on the full amount of these reserves at Bank Rate (5.25%). Interest payments are backed by a state guarantee signed by the UK government in 2009.

The scheme worked well when interest rates were low.However, since 2019 when the BoE began raising interest rates to combat inflation, the scheme has made a loss – a loss the UK government has had to plug with taxpayer money.

“The crux is that QE creates money that goes onto banks’ balances (reserves) at the Bank of England, and those reserves are being fully remunerated at the central bank’s policy rate (Bank Rate),” explains Economist Paul Tucker, former Deputy Governor of the Bank of England for Financial Stability.

“Given the outstanding stock of QE (£838 billion), that has effectively shifted a large fraction of UK government debt from fixed-rate borrowing (where debt-servicing costs are ‘locked in’) to floating-rate borrowing (where debt-servicing costs rise and fall with Bank Rate). Increases in Bank Rate therefore lead immediately to higher debt-servicing costs for the government, leaving the British state with a large risk exposure to rising interest rates,” Tucker says in Chapter 7 of his 2022 book “Quantitative easing, monetary policy implementation, and the public finances.”

In “Tiered Remuneration”, however, the BoE would only pay interest on a fraction of these reserves, removing the government’s burden. The system is used by the European Central Bank (ECB), the Swiss National Bank (SNB), and the central banks of Denmark and Sweden.

Retired MP and Prime Minister Gordon Brown has floated the idea to use this extra money as a way of funding a reduction in the high levels of child poverty currently being experienced in the UK. Labour party leader Keir Starmer, however, has not formally adopted it. It was rejected by the current Chancellor of the Exchequer Jeremy Hunt because it could “impact the competitiveness of UK Banks,” and the Governor of the Bank of England, Andrew Bailey, once described it as a “tax on banks”.

Over £100 billion in savings

According to the Office of Budgetary Responsibility (OBR), however, a policy of reserve tiering would save the government £103 billion.

If introduced, it could make savings of between 1.2% and 1.6% of GDP in 2022-2023 and 2024-2025 respectively, according to Tucker. This is equivalent to 63%-84% of average UK government debt-servicing costs, or between 7.6% and 10.5% of the UK’s annual spending on defense, health and education.

Bank profits would take a hit as a consequence, however, according to Jason Napier, an equities analyst at Swiss lender UBS. A UK version of the ECB model, for example, would cost the major UK banks about £200 million each a year, the analyst adds.

Paul de Grauwe, a Professor of political economy at the London School of Economics, however, argues that tiered remuneration would sharpen the transmission of monetary policy and help restrain inflation, according to Bloomberg News.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.