Have you noticed gold rises in a risk on market?

This short article is to point out a relationship with gold and the dollar. It does pay from time to time to point out the obvious and this may be a relationship that you have missed if you are not heavily absorbed in the markets day to day. Well, you probably know that gold is an anti-dollar commodity. The USD has the biggest impact on the gold. If you take a look at the chart below you can see how the recent relationship between the spot gold price and the dollar index has played out.

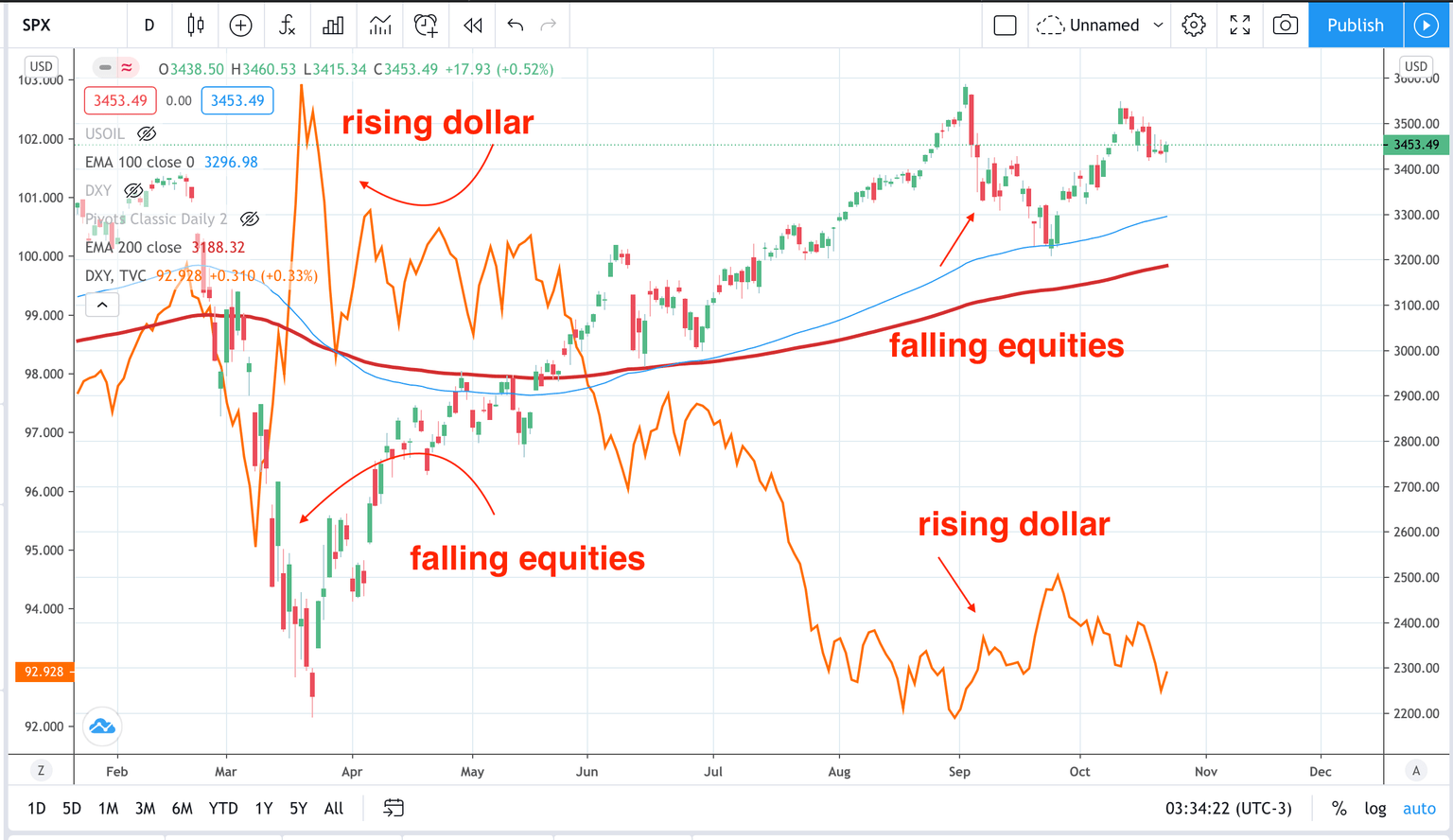

When the dollar falls, gold rises and vice versa. Now during the COVID-19 crisis the USD has been operating like a safe haven currency and gaining strength during risk off sessions. This is key to understanding the way that the USD has been impacting gold. If you take a look at the chart below of the S&P500 (candlesticks) and the DXY (yellow line) you can see the relationship. As the S&P500 falls, so does gold and vice versa.

The above means that gold is trading like a ‘risk-on’ commodity. When markets are trading risk on, gold rises. If you would like some help in recognising what a ‘risk on’ market looks like check out this video. This is also why gold is still expected to keep rising in the medium term as a weak USD picture is anticipated on an expected Biden victory in the US elections. So, this explains the near term drivers of gold, the anti-use commodity.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.