Gold’s weekly update: Gold traders focus on the Fed’s interest rate decision

Since our last report, gold’s price overall remained relatively stable. In today’s report we intend to focus on the release of the Fed’s interest rate decision tomorrow but also have a look at whether the negative correlation of the USD with gold is still active, as well as geopolitical issues that could affect gold’s price. For a rounder view we are also to provide a technical analysis of gold’s daily chart.

Fed’s interest rate decision to in the focus of Gold traders

We highlight the Fed’s interest rate decision tomorrow as the main issue for the week, for gold traders. The bank is widely expected to cut rates by 25 basis points and currently Fed Fund Futures imply a probability of 89% for the bank to do so, while they even imply that the market expects the bank to proceed with two more rate cuts to come in the coming year. Hence, despite the even should the bank deliver the expected rate cut tomorrow, the market expects more easing, which implies a dovish inclination. Hence should the bank deliver the rate cut as expected, we may see the market’s attention turning towards the bank’s forward guidance in search of further clues regarding the Fed’s intentions. The bank’s forward guidance is to be expressed practically in four elements, the first would be the accompanying statement and should it be characterised by a hawkish tone, we may see gold’s price losing some ground. The second would be the bank’s new dot plot which is included in the bank’s projections and shows the expectations of Fed policymakers for the level of interest rates in 2026, 2027 and beyond. Should the new dot plot show that Fed policymakers expect rates to land lower than what the market currently expects, say below the 3.25%-3.50% range, we may see gold’s price getting some support as it would be perceived as a dovish signal. Also the bank’s macroeconomic projections could affect the market’s expectations especially for inflation and the US employment market. Should the bank’s expectations be for inflation to remain resilient, possibly higher than the bank’s 2% target, it could weigh on gold’s price as such expectations could allow for the bank to keep rates higher for longer. On the other hand expectations by the Fed for the US employment market to ease considerably, could provide support for gold’s price as it could be perceived as a dovish signal. Finally we highlight Fed Chairman Powell’s press conference as major mover for gold’s price. Should the Fed Chairman’s views about the outlook of the Fed’s monetary policy lean more on the hawkish side, underscoring a relative stability for rates or implying a difficulty to ease its monetary policy further, we may see gold’s price getting some support.

Venezuela and Ukraine could still affect Gold’s price

On a more geopolitical level, we continue to monitor developments on two issues. The first would the war in Ukraine and we express our frustration for the ongoing negotiations which were not able to reach a possible deal for an agreed peace plan. We had noted in a past report our worries given the lack of incentive from both, the Ukraine and Russia, to reach a deal. Currently the Russians seem to be making moderated gains on the ground of operations yet Ukraine is causing an asymmetric cost for Russia, for each square meter. Nevertheless, should we see some progress in the peace negotiations, with some possible more concrete results we may see gold’s price losing some ground as it could ease the market’s worries. On the flip side a possible escalation of the war could provide support for gold’s price. The same principle applies for the situation in Venezuela. We have noted the closing of the Venezuelan airspace in our last report, a situation that some could characterise as an act of war and a situation that could escalate further and should we see such further escalation, like a possible US military operation on the ground of Venezuela, we may see gold’s price getting some support and vice versa, albeit we do not see what could thaw the tensions at the current stage.

Negative correlation of USD and Gold inactive

Over the past week, we note that gold’s price remained relatively stable with the USD remaining also rather stable not allowing for a clear indication that the negative correlation of the USD with gold’s price is active. Also we note that the gold’s price remained relatively stable despite the rise of US Bond yields over the past week. Hence the failure of rising bond yields to shift safe haven investments from gold, highlight how US Bonds at the current stage do not pose an alternative for gold.

Technical analysis

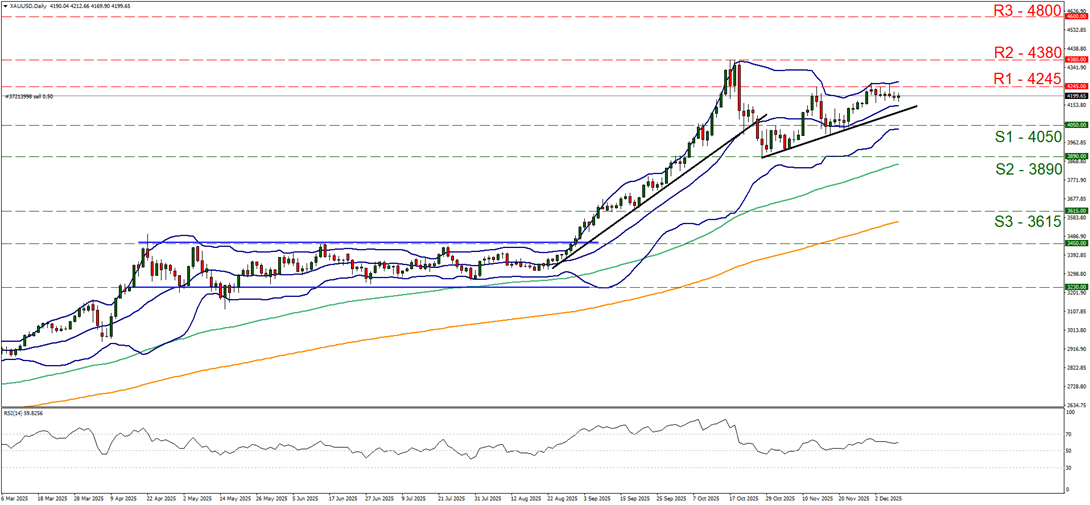

XAU/USD four-hour chart

- Support: 4050 (S1), 3890 (S2), 3615 (S3).

- Resistance: 4245 (R1), 4380 (R2), 4800 (R3).

Since our last report gold’s price remained relatively stable just below the 4245 (R1) resistance line, despite presenting some very subtle bearish tendencies which for the time being remain unconvincing. The upward trendline remains intact reminding traders of the possibility of a revival of the bullish movement. Also the RSI indicator remains between the readings of 50 and 70 implying a bullish predisposition of the market. Yet on the other hand the relative stability of gold’s price action over the past week, in combination of the narrowing Bollinger Bands, which suggests lower volatility, tends to imply a possible continuation of the current sideways motion of gold’s price. For a bullish outlook to re-emerge, we would require gold’s price to form a new, higher peak thus it has to break the 4245 (R1) resistance line and start aiming for the 4380 (R2) resistance base, marking the All Time High level for the precious metal’s price. For a bearish outlook to be adopted, which currently we consider as a remote scenario, we would require gold’s price to drop, break the prementioned upward trendline, in a first signal of a definite interruption of the upward movement, continue to break the 4050 (S1) support level and start aiming for the 3890 (S2) support barrier.

Author

Peter Iosif, ACA, MBA

IronFX

Mr. Iosif joined IronFX in 2017 as part of the sales force. His high level of competence and expertise enabled him to climb up the company ladder quickly and move to the IronFX Strategy team as a Research Analyst. Mr.