Gold Weekly Forecast: XAU/USD could test 200-day SMA on hot US CPI

- Surging US yields didn't allow gold to gain traction this week.

- US inflation report could impact the dollar's market valuation significantly.

- XAU/USD's technical outlook suggests that sellers could dominate the action in the near term.

Gold fell sharply at the beginning of the week and touched its weakest level since mid-February at $1,850. Although the yellow metal managed to stage a rebound in the second half of the week, the broad-based dollar strength didn’t allow XAU/USD to snap its two-week losing streak. Ahead of next week’s key US inflation data, gold might find it difficult to make a decisive move in either direction.

What happened last week?

The risk-averse market atmosphere provided a boost to the greenback on Monday and the US Dollar Index, which tracks the dollar’s performance against a basket of six major currencies, erased the losses it suffered the previous Friday. Chinese PMI data revealed that the activity in the private sector continued to contract in April. Additionally, Beijing announced a ban on all restaurants and ordered residents to provide proof of a negative COVID test to enter public venues, further weighing on sentiment. Finally, the data from the US showed that the manufacturing sector expanded at a softer pace than expected in April, but it had little to no impact on the dollar’s valuation.

Ahead of the US Federal Reserve’s policy announcements, markets remained relatively quiet on Tuesday and gold fluctuated in a tight range below $1,900 after having lost nearly 2% on Monday.

On Wednesday, the FOMC hiked its policy rate by 50 basis points to the range of 0.75%-1.00%, as expected. The Fed also unveiled that it will begin trimming the balance sheet on June 1, starting with a $47.5 billion cap on monthly runoff and rising to $95 billion monthly after three months. Experts were anticipating the US central bank to reduce its holdings by $95 billion from June.

During the press conference, FOMC Chairman Jerome Powell dismissed the possibility of 75 basis points rate hikes in the upcoming meetings, saying that they were not “actively considering” them. Furthermore, Powell refrained from determining what the neutral rate would be and said that they had a good chance for a “softish landing.”

The benchmark 10-year US Treasury bond yield turned south after the Fed event while the greenback came under strong selling pressure, opening the door for a decisive rebound in XAU/USD. With the dollar selloff picking up steam during the Asian trading hours on Thursday, gold climbed to a five-day high of $1,909 but ended up closing the day in negative territory at $1,877.

The Bank of England (BOE) raised its policy rate by 25 bps for the fourth straight time in May but noted in its policy statement that the UK economy was expected to go into recession in 2022, with inflation rising above 10%. The BOE’s recession warning reminded investors of the fact that the Fed can afford to continue to tighten its policy at a more aggressive pace than the BOE and the ECB before it needs to shift its priority to promoting growth from taming inflation. In turn, the dollar regained its bullish momentum and forced XAU/USD to turn south.

The US jobs report revealed on Friday that Nonfarm Payrolls rose by 428,000 in April, compared to the market expectation of 391,000. Underlying details of the publication showed that the Labor Force Participation Rate declined to 62.2% from 62.4% in March and the annual wage inflation, as measured by the Average Hourly Earnings, stayed virtually unchanged at 5.5%. With these figures confirming tight labor market conditions, the 10-year US T-bond yield climbed to its strongest level since November 2018 above 3.1%, forcing gold to lose its recovery momentum ahead of the weekend.

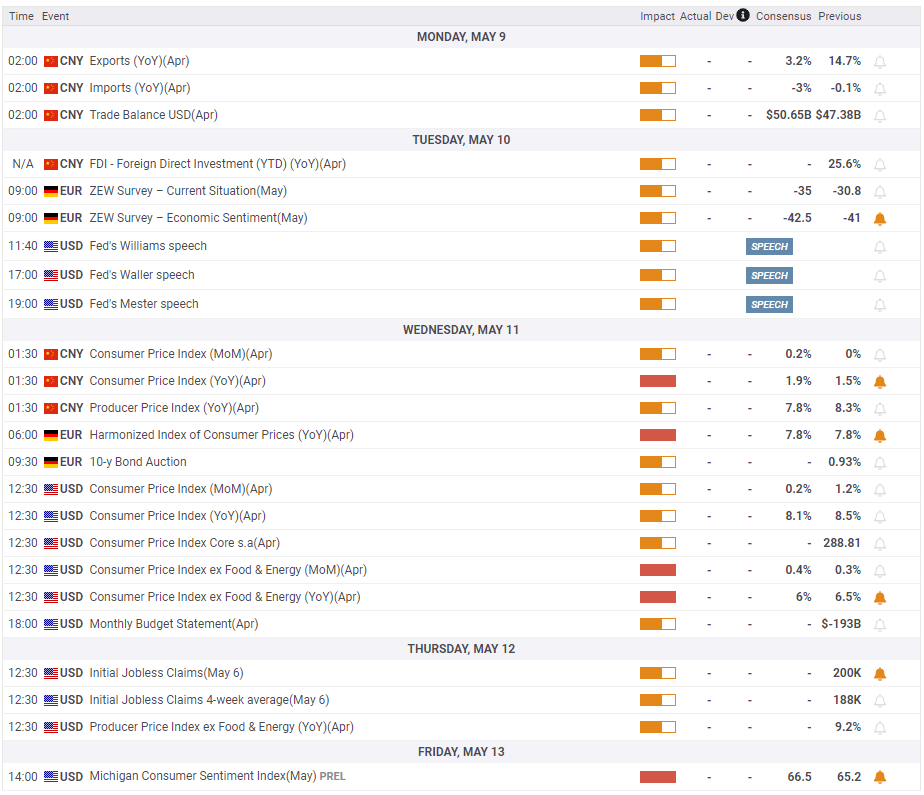

Next week

China will release the April international trade figures on Monday. In case the data shows the negative impact of the coronavirus-related restrictions on the trade balance, the negative shift in risk sentiment could help the dollar find demand and cause XAU/USD to start the new week on the back foot.

On Wednesday, the US Bureau of Labor Statistics will publish the April Consumer Price Index (CPI) data. On a yearly basis, CPI is expected to edge lower to 8.4% from 8.5% in March. The Core CPI, which excludes volatile food and energy prices, is forecast to fall sharply to 6% from 6.5%.

Although FOMC Chairman Powell pushed back against 75 bps rate hikes, the CME Group FedWatch Tool shows that markets are still pricing in an 87% probability of a 75 bps hike in June. If CPI figures confirm the view that inflation may have already peaked in March, the dollar could face renewed selling pressure with investors reassessing the Fed’s rate decision in June. In such a scenario, US T-bond yields are likely to decline and fuel a leg higher in gold. On the flip side, markets should stick to the view of a 75 bps hike in June if CPI data surprises to the upside.

Meanwhile, investors will pay close attention to Fedspeak and fresh developments surrounding the lockdowns in China and the Russia-Ukraine conflict. A relaxation of coronavirus restrictions in China could help the yellow metal gain traction on improving demand outlook and vice versa.

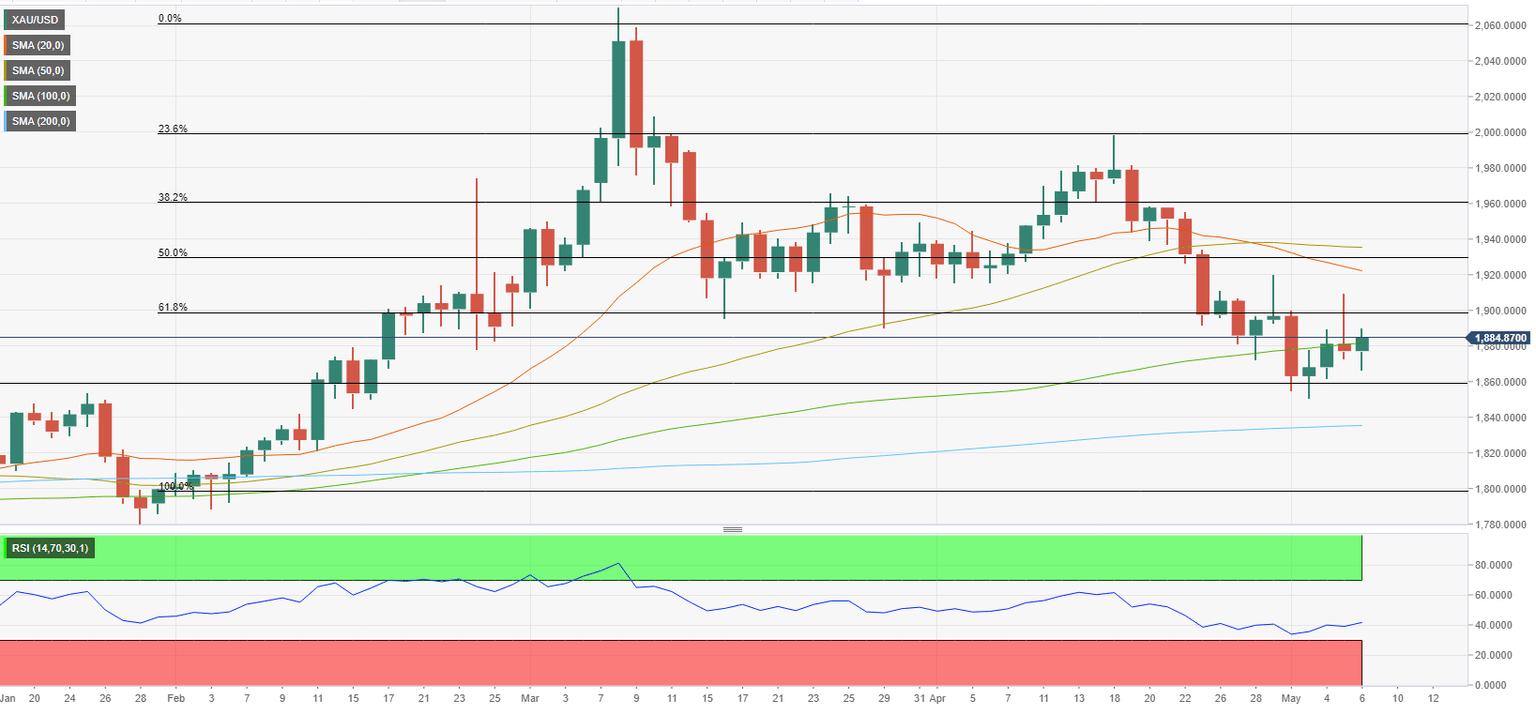

Gold technical outlook

The technical outlook suggests that gold's bearish bias remains intact despite the modest rebound witnessed in the second half of the week. The Relative Strength Index (RSI) indicator on the daily chart stays below 50 and the price struggles to pull away from the 100-day SMA, which is currently located at around $1,880.

In case XAU/USD starts using $1,880 as support, it could extend its recovery toward $1,900. Only a daily close above the latter could open the door for additional gains toward the $1,920/$1,930 area (Fibonacci 50% retracement of the latest uptrend, 20-day SMA, 50-day SMA).

On the downside, key support seems to have formed at $1,860 (static level). In case this level fails, gold is likely to test the 200-day SMA at $1,840.

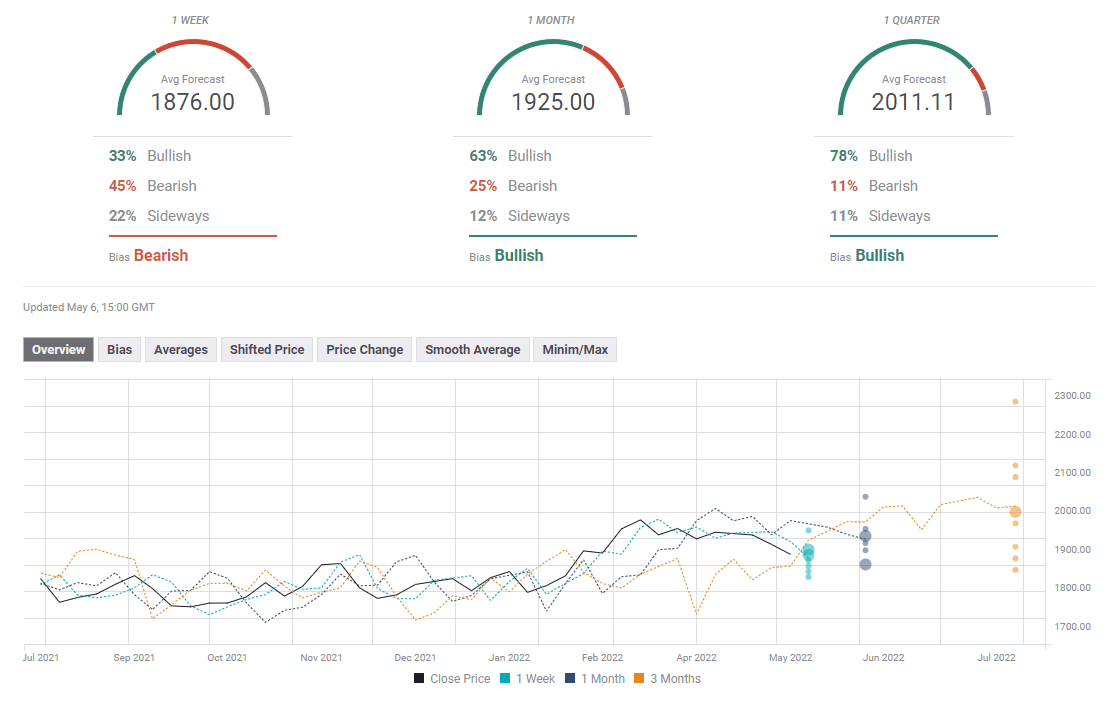

Gold sentiment poll

The FXStreet Forecast Poll shows that almost half of polled experts see gold edging lower next week. The one-month outlook, however, points to a bullish shift with the average target sitting at $1,925.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.