Gold Weekly Forecast: Upward correction could be in the books during Fed's blackout

- Gold fell to its lowest level in nearly a year below $1,700.

- Investors will keep a close eye on data next week amid the Fed’s blackout.

- XAUUSD could fall toward $1,680 if $1,700 is confirmed as resistance.

Gold suffered heavy losses for the fifth straight week and dropped below $1,700 for the first time in nearly a year. The broad-based US dollar strength and the worsening demand outlook for the yellow metal amid growing recession fears continue to weigh on the price. With the Fed going into the blackout period on July 16, investors will pay close attention to US data next week to figure out whether the US central bank will opt for a 100 basis points (bps) rate hike in July.

What happened last week?

Safe-haven flows dominated the financial markets at the start of the week. Renewed concerns over China imposing lockdowns to contain the spread of the highly infectious BA.5 omicron sub-variant forced investors to seek refuge. In Europe, Nord Stream 1 Gas Pipeline’s annual maintenance started, reviving fears about Russia deliberately delaying the reopening to further reduce the gas supply to Europe. The greenback preserved its strength on Monday and XAUUSD closed in negative territory.

Following Tuesday’s choppy market action, Gold Price fluctuated wildly on Wednesday. The data published by the US Bureau of Labor Statistics revealed that inflation in the US, as measured by the Consumer Price Index (CPI), jumped to its highest level in four decades at 9.1% on a yearly basis in June from 8.6% in May. This reading surpassed the market expectation of 8.8%. Although XAUUSD fell toward $1,700 with the initial reaction, it managed to stage a rebound in the late American session and ended up posting small daily gains.

Nevertheless, the US dollar rally picked up steam on Thursday with investors reassessing the Fed’s rate outlook on the hot inflation report. When asked whether the FOMC would consider a full percentage point rate hike after the latest CPI figures, “everything is in play,” Atlanta Fed President Raphael Bostic responded. The CME Group’s FedWatch Tool showed that the probability of a 100 bps rate hike in July jumped above 80% from 10% only a week ago. In turn, the US Dollar Index (DXY) reached its highest level in nearly 20 years above 109.00 and gold touched its lowest level since August 2021 at $1,697.

Commenting on the latest market developments, Federal Reserve Governor Christopher Waller argued that markets may have gotten ahead of themselves by pricing a 100 basis points (bps) rate hike in July. Waller further elaborated by saying that he was in favour of a 75 bps hike in July but added that he could lean toward a bigger rate increase if retail sales and housing data come in stronger than expected. Following these comments, the probability of a 100 bps hike in July retreated to 50% and the USD went into a consolidation phase, allowing gold to stay afloat slightly above $1,700.

On Friday, the US Census Bureau reported Retail Sales rose by 1% on a monthly basis to $680.6 billion in June. Although this print surpassed the market forecast of 0.8%, the US dollar continued to lose interest. After hinting at a 100 bps hike just a day ago, Bostic changed his tone on Friday and said moving too dramatically could undermine the positive aspects of the economy and add to the uncertainty. The DXY extended its downward correction with the 100 bps rate hike probability for July declining toward 30%.

Next week

The US economic docket will not be featuring any high-impact data releases at the start of the week. On Monday, market participants might react to the NAHB Housing Market Index data for July, which is expected to edge higher to 68 from 67 in June. Policymakers are paying close attention to housing market conditions and a weak reading could cause the US dollar to weaken and vice versa. On the same note, Housing Starts data on Tuesday will be looked upon for fresh impetus.

On Thursday, the European Central Bank (ECB) will announce its policy decisions. The bank is widely expected to raise the key rates by 25 bps and signal a 50 bps hike for September. The ECB remains well behind the tightening curve and the US dollar could capitalize on outflows out of the euro if the bank fails to convince markets that it is prepared to tighten its policy aggressively.

On Friday, S&P Global will release the preliminary Manufacturing and Services PMI reports for July. Investors expect the business activity in the private sector to continue to expand at a modest pace. In case either of these PMIs falls below 50 and points to a contraction, USD could stay on the back foot ahead of the weekend.

In short, investors will have only a few mid-tier data releases to factor in when assessing the size of the Fed’s July rate hike. Hence, XAUUSD might find it difficult to make a decisive move in either direction.

Gold technical outlook

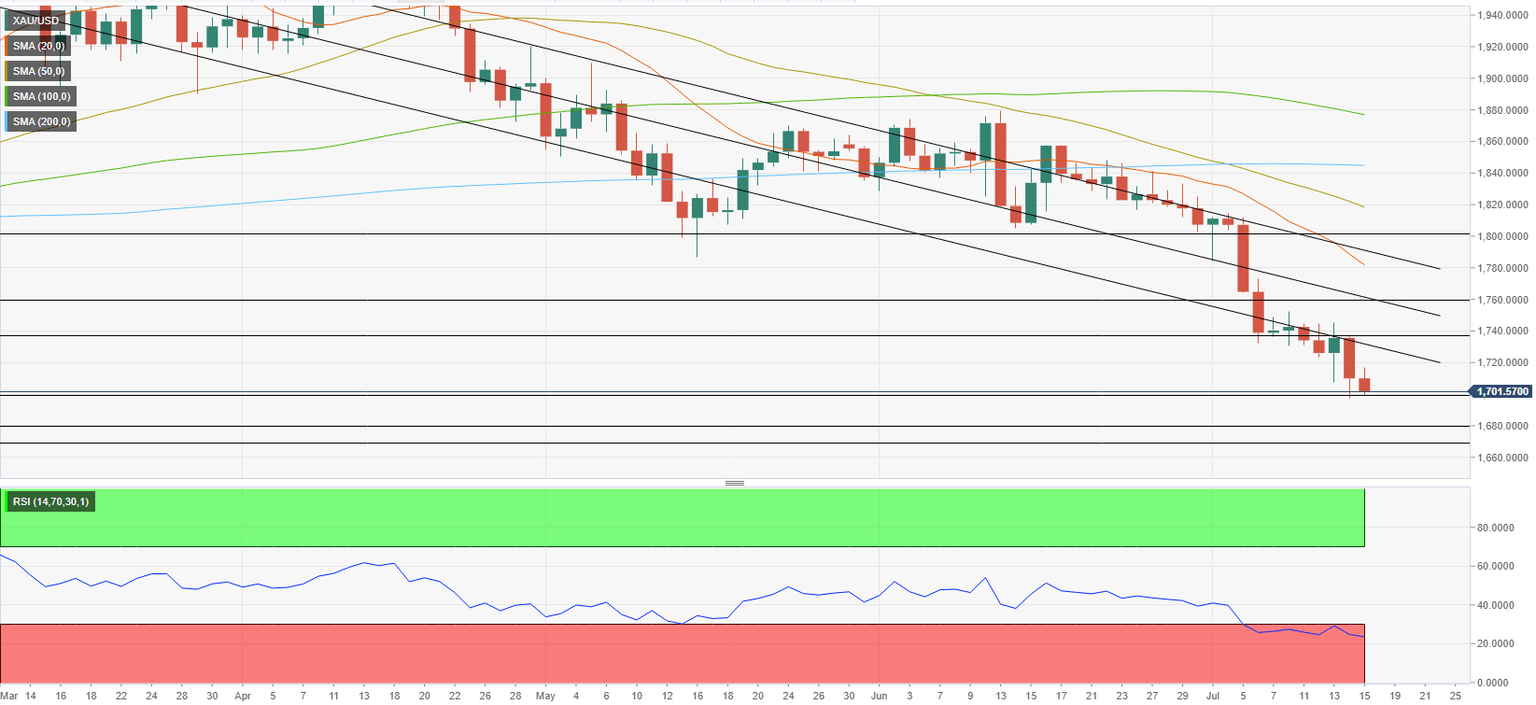

The technical picture shows that gold remains extremely oversold with the price staying below the lower limit of the long-term descending regression channel. Additionally, the Relative Strength Index (RSI) indicator on the daily chart stayed below 30 for the 10th straight trading day on Friday.

$1,740 (static level) aligns as the first resistance before $1,760 (mid-point of the descending regression channel) in case gold stages a technical correction next week. On the downside, additional losses toward $1,680 (static level from March 2021) and $1,670 (static level from May 2020) could be witnessed if sellers manage to turn $1,700 (static level, psychological level) into resistance.

Gold sentiment poll

FXstreet Forecast Poll shows that half of the polled experts see gold price edging lower over the next week. The average one-week target of $1,691, however, suggests that losses are expected to remain relatively limited. The one-month outlook paints a mixed picture, while the one-quarter outlook stays overwhelmingly bullish.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.