Gold trades at major yearly resistance

The gold price has fallen from yearly pivotal resistance of $1,975 below the $1,900 region. However, the support level of $1,878 is maintained, and the price goes up by 2% to $1,945 per troy ounce. Investors appear to have significant safety concerns in the face of the escalating conflict between Russia and Ukraine. The high level of risk aversion among market participants is reflected in tumbling stock markets and significantly lower bond yields, both of which make gold appealing as safe haven. This week’s economic calendar is packed with events, the most important of which is Non-Farm Payrolls (NFP) data, which is required for gold to react appropriately.

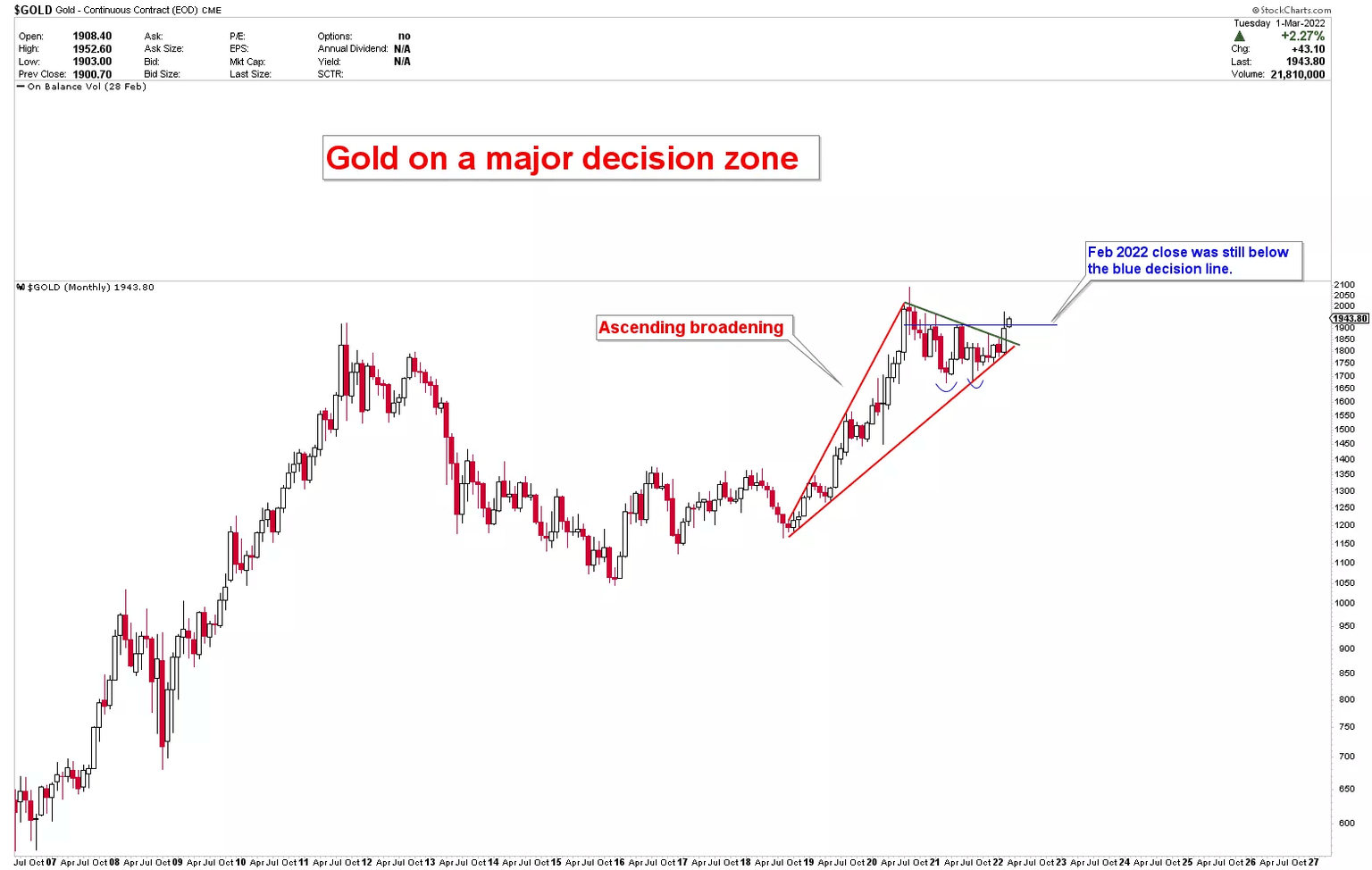

Aside from the demands for safe heaven, the Russia-Ukraine conflict puts financial markets at risk due to the increasing crisis between these two countries. Because of these risks, the trading environment has become extremely dangerous for traders. As a result, the price is highly uncertain. Investors are becoming more fearful as a result of this uncertainty. The chart below depicts the formation of a triangle that was broken in February 2022. However, the February 2022 closing level was below the decision line (blue), indicating that the breakout is still not confirmed. On the other hand, the worsening situation in Europe calls the gold breakout into question until further confirmations by more price candles. During these crises, prices typically mislead investors with fictitious breakouts.

The chart below, which was presented in the premium update a few weeks ago, mentioned the targets of $1,920 and $1,975 from the breakout of a symmetrical triangle. Prices rise to $1,975 before reversing sharply from the yearly pivotal resistance to mark the short-term top. Prices have re-entered the market after rebounding from the $1,880 region’s supports. Silver, on the other hand, is struggling to make the $25.75 region a major decision zone for bulls. For the last few months, premium members have been discussing the level of $25.75, which has become the pivot for medium-term breakouts.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.