Gold: There still seems to be an appetite to support gold into near term weakness [Video]

![Gold: There still seems to be an appetite to support gold into near term weakness [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/gold-bars-50657756_XtraLarge.jpg)

Gold

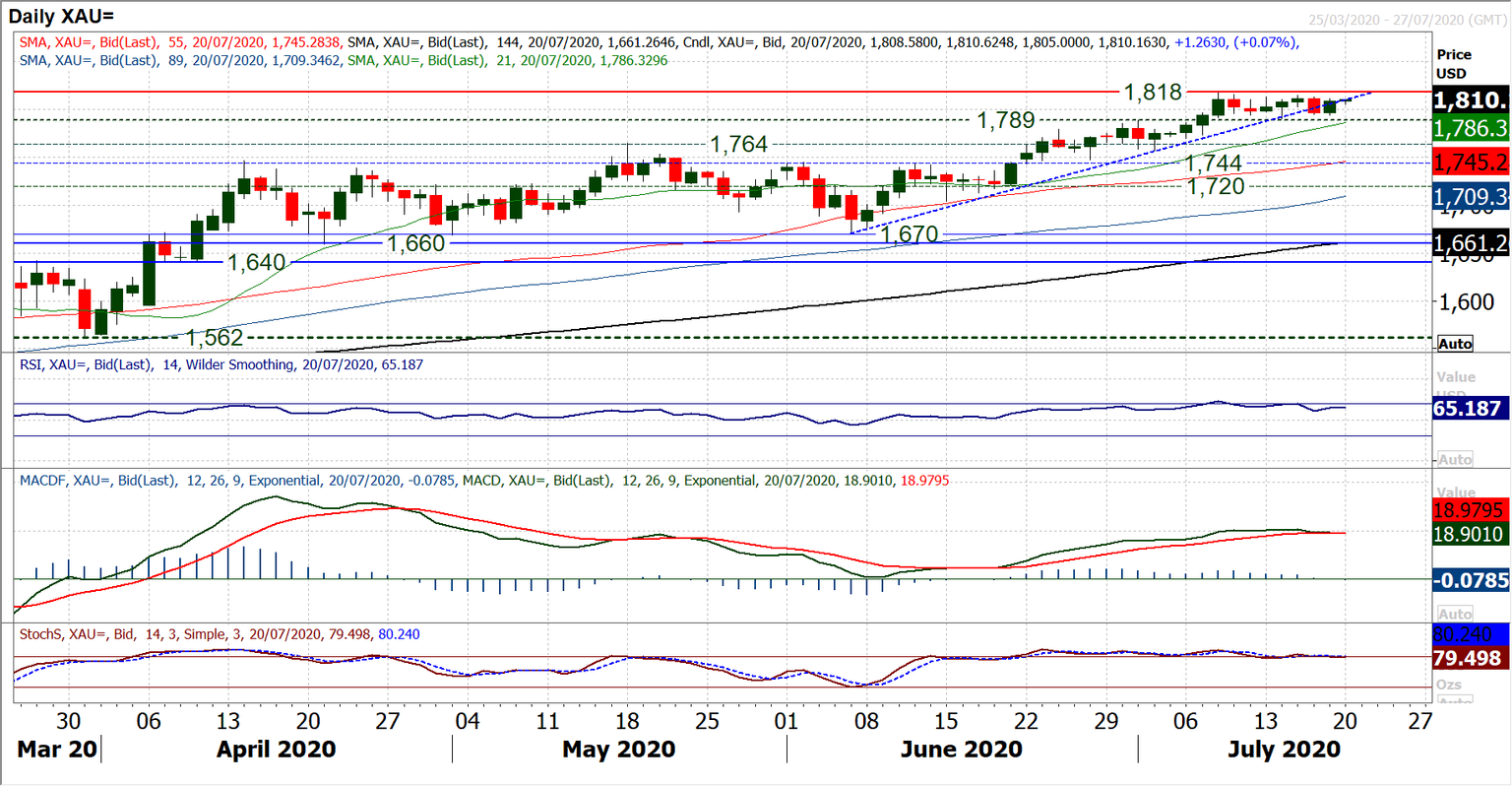

For the past week and a half since the breakout above $1789, a consolidation has been developing on gold. This has taken the formation of a mini-trading range between $1790/$1818. The consolidation has broken a five week uptrend and resulted in strong momentum indicators just losing their impetus. However, there still seems to be an appetite to support gold into near term weakness. Since the big March volatility surge, gold has been consistently building foundations at higher levels for the next push into multi-year highs. There have been phases of near term weakness, lasting usually around a week, but time and again, the bulls return stronger than before. We still see further upside in the gold run higher, with implied targets from the April to June trading range breakout, implying anything from $1820 (on a conservative basis) towards $1868. In the coming weeks. Holding support at $1789 would be strong, but any supported weakness to between $1764/$1789 would be bullish too. It would be a move below $1744 which would seriously question the bullish outlook. This is key breakout support from the old range, but also now below the rising 55 day moving average (currently $1745) which has so rarely been breached over recent months.

Author

Richard Perry

Independent Analyst