Gold: The buyers are looking to bounce back [Video]

![Gold: The buyers are looking to bounce back [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/gold-nuggets-14424039_XtraLarge.jpg)

Gold

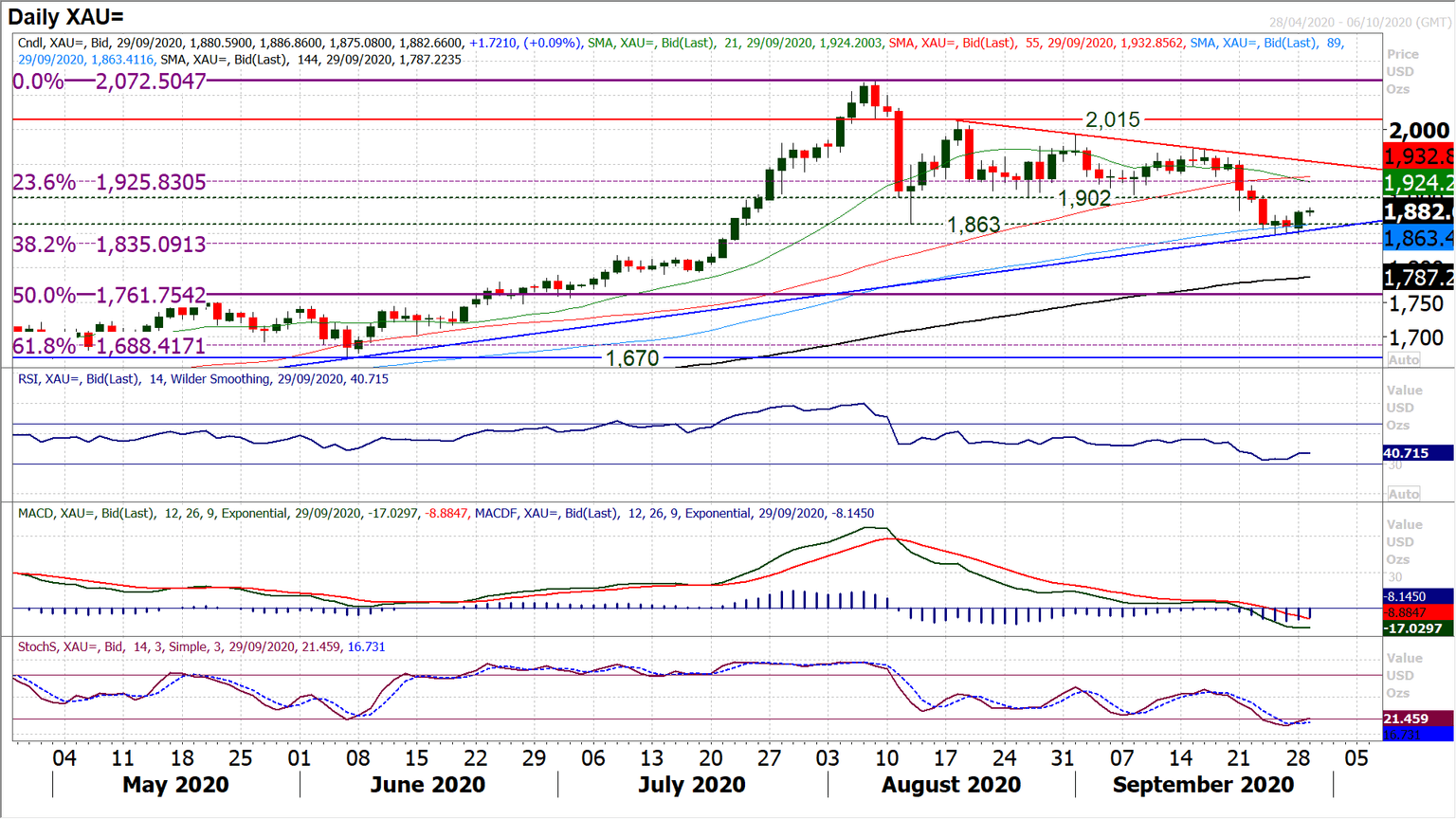

Gold has been in decisive correction mode recently, but this move has slowed in recent days. Now, having posted a “bullish engulfing” one day candlestick, the buyers are looking to bounce back. The question is whether this is a sustainable recovery. This leaves the outlook at an intriguing stage. Key supports were broken during the correction, to leave old bulls sitting in stale positions. How they respond to a rebound could be key, as a near term rally could simply be seen as a chance to close these old long positions. The daily chart shows resistance above $1902 from the old August into September range, whilst nearer term the hourly chart shows resistance around $1882/$1894. Gold needs to post a series of positive candles to improve confidence once more. Another positive candle today would help, but this resistance band needs to be broken, this means a close above $1902. The hourly chart shows holding above $1866/$1878 is needed to sustain the near term rally. A renewed bull failure today would put support at $1848 back under pressure along with the 6 month uptrend.

Author

Richard Perry

Independent Analyst