Gold testing 61.8% Fibonacci support after bearish ABC

-

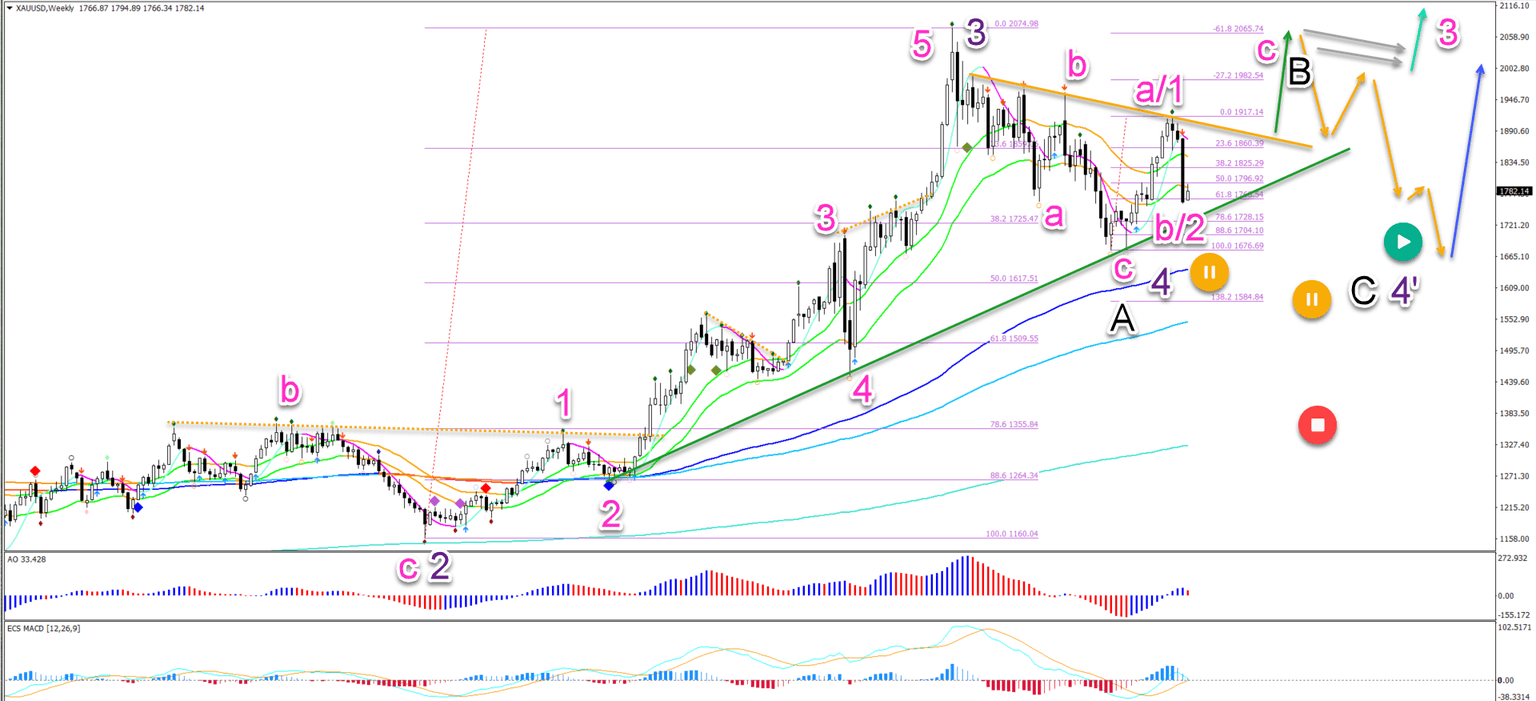

The XAU/USD chart was unable to break above the resistance trend line (orange) and is now testing the support trend line (green).

-

Price action seems to be building 3 corrective waves down after 5 impulsive waves up. Now an ABC zigzag pattern seems to be taking place in wave 2 or B.

-

The target is the previous top. A break below the 100% Fib places the bullish ABC or 123 (pink) on hold (orange sign).

The XAU/USD (Gold) weekly chart made a bearish reversal contrary to our previous analysis. This indicates that price action has either completed a wave 1 or A (pink).

This article analyzes what to expect from the wave 4 retracement (purple).

Price charts and technical analysis

The XAU/USD chart was unable to break above the resistance trend line (orange) and is now testing the support trend line (green):

-

A bullish bounce at the support line (green) and 61.8%, 78.6% or 88.6% Fibonacci retracement levels of the wave B/2 (pink) could confirm one more bullish swing.

-

The target is the previous top. A break below the 100% Fib places the bullish ABC or 123 (pink) on hold (orange sign).

-

If price action gets close to the previous top, then the price reaction will be very important.

-

A bull flag (grey arrows) pattern could indicate more uptrend (aqua blue arrow).

-

A bearish reversal (orange arrows) could indicate a bearish ABC (black) pattern in wave 4’ (purple).

-

Any deeper retracement places the uptrend on hold (orange and red signs).

On the 4 hour chart, price action seems to be building 3 corrective waves down after 5 impulsive waves up:

-

The 5 bullish waves (grey) completed a wave 1 or A (pink).

-

Now an ABC (grey) zigzag pattern seems to be taking place in wave 2 or B (pink).

-

A bearish breakout (orange arrows) below the support line (green) could aim at the 78.6% Fibonacci level.

-

A bullish bounce (blue arrow) at the deep Fibonacci retracement levels is expected.

-

A bullish breakout above the long-term moving averages could indicate the end of the bearish ABC (grey) as well and the start of a bullish price swing.

The analysis has been done with the ecs.SWAT method and ebook.

Author

Chris Svorcik

Elite CurrenSea

Experience Chris Svorcik has co-founded Elite CurrenSea in 2014 together with Nenad Kerkez, aka Tarantula FX. Chris is a technical analyst, wave analyst, trader, writer, educator, webinar speaker, and seminar speaker of the financial markets.