Gold surges past $2,500 on rate cut countdown, political heat

Gold prices breached the $2500 mark at the start of the London trading session on Thursday. This surge came as traders eagerly awaited key US economic data, namely the ADP Employment Change and ISM Services PMI, released later that day.

Rate cut countdown is on

The decisive move up is buoyed by the growing anticipation of a more aggressive interest rate cut by the US Federal Reserve in its upcoming September meeting. Markets are now pricing in a 45% chance of a 50 basis points rate cut, a significant jump from 31% at the start of the week according to the CME Group’s FedWatch tool. This shift in expectations has been fueled by a combination of factors.

Recent economic data has painted a picture of a cooling US economy. The US Job Openings survey released on Wednesday showed a drop to a 3-1/2-year low in July, suggesting a softening labour market. This, coupled with the weaker-than-expected ISM Manufacturing PMI, has reinforced the narrative of an economic slowdown.

Adding to the mix are the dovish remarks from San Francisco Fed President Mary Daly, who indicated the need for a rate cut to counter falling inflation and a slowing economy. However, she also stressed the importance of upcoming data, including Friday's job market report and next week’s CPI, in determining the size of the cut.

The US Dollar has been on the back foot due to these factors, making gold, which is priced in dollars, more attractive to investors holding other currencies. This has further fueled the rally in gold prices.

Looking ahead, the US Nonfarm Payrolls and wage inflation data due on Friday will be closely watched by market participants. A weaker-than-expected report could solidify expectations of a larger Fed rate cut, potentially pushing gold prices even higher.

Ballot to bullion: US politics could swing price action

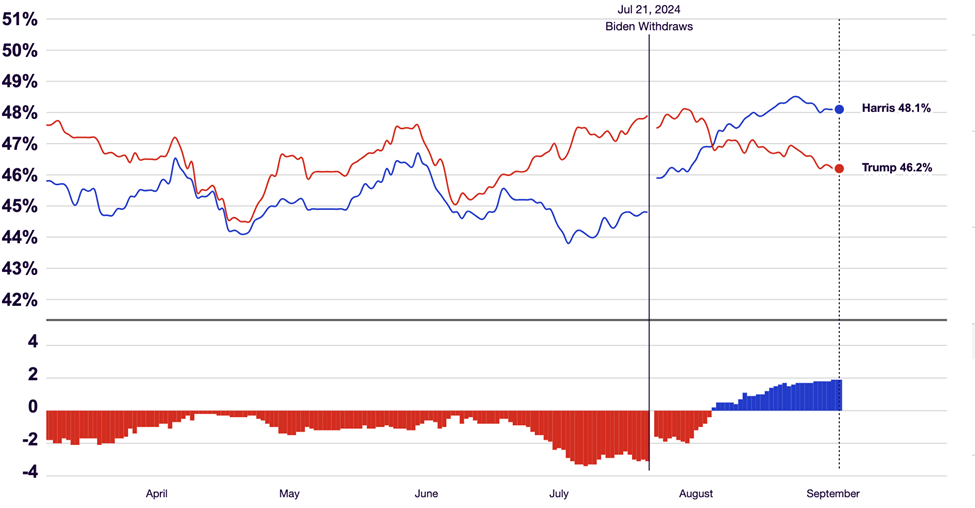

Another important factor is November’s US polls, which is heavily in-focus with the presidential debate slated on September 10. The debate comes soon after data from RealClearPolitics shows Harris having a “knife-edge” advantage over Trump.

Source: RealClearPolitics

A Harris win, with the expectation that she will continue Biden's fiscal and monetary policies, could provide a supportive environment for gold prices. Historically, Democratic administrations have been associated with higher government spending, which often leads to increased deficits and a weaker U.S. dollar. A weaker dollar typically boosts gold prices, as it makes the metal more affordable for foreign investors.

Moreover, Harris's continued focus on the green energy transition could drive up energy costs and inflation. This inflationary pressure, combined with the potential for further fiscal stimulus under her administration, might increase the appeal of gold as a hedge against inflation. Additionally, any continuation of dovish monetary policy by the Federal Reserve, aligned with Harris's economic goals, could maintain low interest rates, further supporting gold prices.

On the other hand, a Trump victory could introduce more volatility to the gold market. While Trump's proposed tariffs on all U.S. imports and significant tariffs on Chinese goods could lead to inflationary pressures, which might boost gold, his policies could also strengthen the U.S. dollar, creating headwinds for the metal.

Trump’s reported intentions to fire Federal Reserve Chairman Jerome Powell and push for a more aggressive monetary stimulus could ignite a rally in equities and commodities, potentially benefiting gold. However, this scenario could also lead to higher interest rates if inflation rises too quickly, which would dampen the attractiveness of non-yielding assets like gold.

Additionally, if Trump dismantles Harris's ongoing green energy policies and expands fossil fuel production, it could lead to cheaper energy costs and disinflation, which might reduce the urgency for investors to seek gold as a safe haven.

Technical analysis: How high can Gold go?

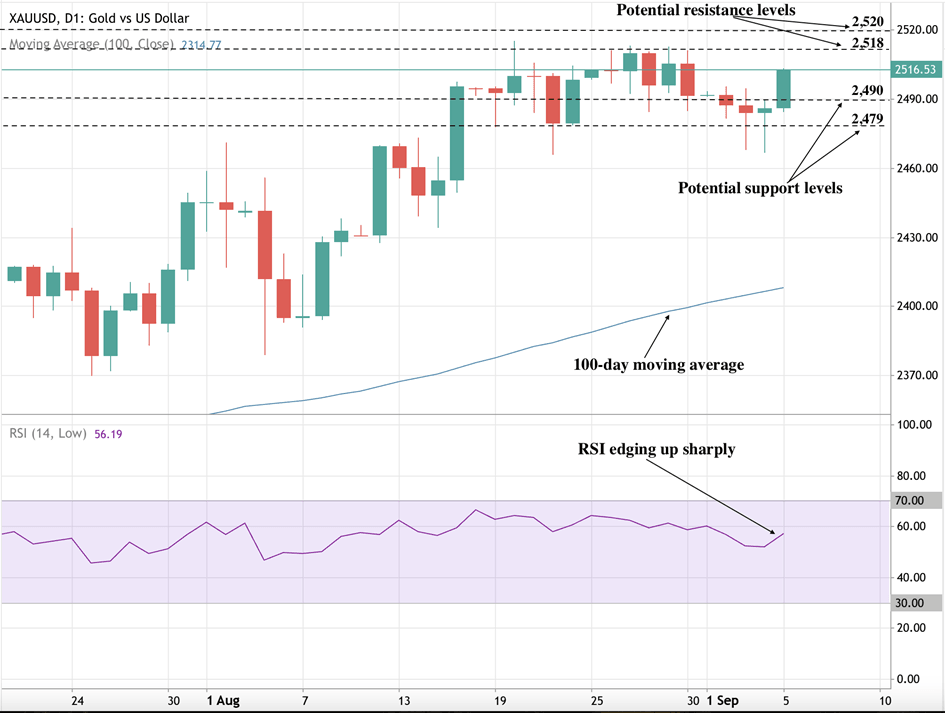

At the time of writing, Gold is touching highs of $2515 potentially on the road to unprecedented highs. There’s an evident bullish bias on the daily chart as prices surge past $2500 while well above the 100-day moving average. The RSI edging up sharply towards 60 also adds to the bullish narrative.

Buyers could encounter hurdles around the $2,518 and $2,520 levels. On the downside, sellers could find support around the $2,490 price level incase of a slump. A further move down could be held at the $2,479 support level.

Source: Deriv MT5

Author

Prakash Bhudia

Deriv

Prakash Bhudia, HOD – Product & Growth at Deriv, provides strategic leadership across crucial trading functions, including operations, risk management, and main marketing channels.