Gold strengthens on Fed rate cut bets, Dollar weakness, and US deadlock

Gold (XAUUSD) remains in focus as investors respond to rising expectations of U.S. rate cuts and mounting political uncertainty. Markets are now pricing in cuts for both October and December, following the Fed’s September minutes. At the same time, the prolonged government shutdown is shaking investor confidence, weakening the Dollar, and increasing demand for gold as a safe-haven asset. Geopolitical tensions, including developments in Gaza and Ukraine, are adding to the pressure. In the absence of official economic reports, markets are relying on central bank commentary, which continues to strengthen gold’s bullish setup.

Gold benefits from weak Dollar, Fed dovish signals, and political uncertainty

Gold’s upward momentum is being supported by rising expectations of additional interest rate cuts from the U.S. Federal Reserve. The September minutes highlighted strong support for policy easing, reflecting growing worries about labor market weakness. With markets now factoring in high probabilities of rate cuts in both October and December, gold remains firmly positioned as a favored safe-haven asset.

Meanwhile, the extended U.S. government shutdown is deepening uncertainty, as repeated Senate failures to approve funding bills continue to reduce investor confidence. The continued political gridlock is weighing on the U.S. Dollar and supporting demand for gold as a safe-haven. With the deadlock showing no signs of resolution, market anxiety is growing over the potential economic fallout and labor disruptions. This environment continues to push investors toward safe-haven assets, such as gold.

Moreover, geopolitical developments are weighing on the market outlook. Although U.S. President Donald Trump announced progress in Gaza peace talks, which prompted some profit-taking in gold. Russia issued a warning against U.S. missile supplies to Ukraine, further unsettling market confidence. Meanwhile, with official economic data still unavailable due to the shutdown, market focus has shifted to upcoming central bank commentary. The remarks may provide fresh clues on the policy outlook and could strongly influence both gold and the Dollar.

Gold nears key breakout zone backed by strong technical structure

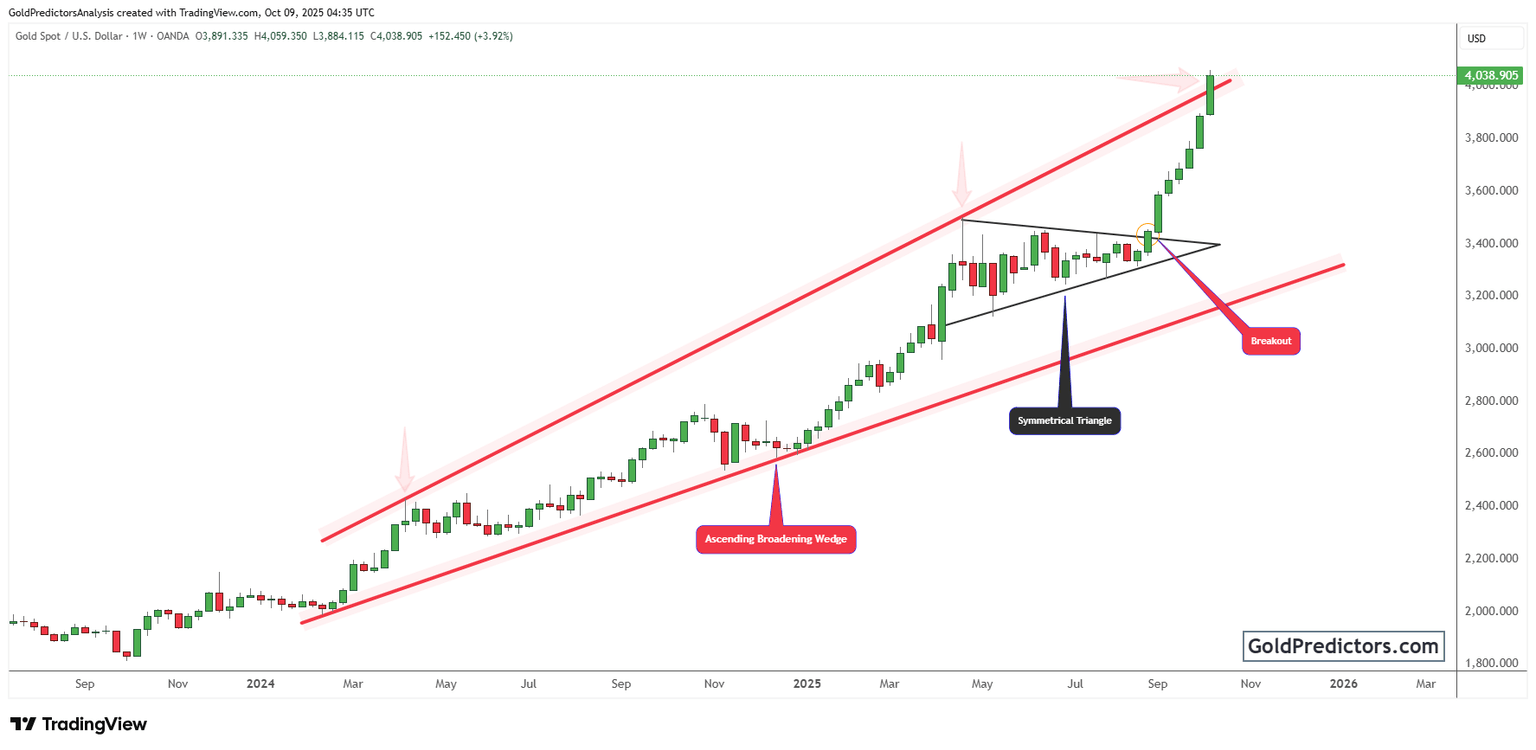

The gold chart below shows an ascending broadening wedge formation, with the price trading at the edge of a potential breakout. That move marked the beginning of a sustained bullish phase, setting the stage for a strong uptrend as price action consistently respected key technical levels. A confirmed breakout from this structure would likely open the door for further upside momentum.

In mid-2025, gold entered a symmetrical triangle pattern, signaling short-term consolidation after the previous rally. The structure represented temporary indecision but ultimately acted as a continuation pattern. A clean breakout above the $3,400 level confirmed the bullish trend and triggered a sharp rally, propelling gold toward the $4,000 area.

Furthermore, the breakout was confirmed by strong volume and a clean price formation. Following this move, gold advanced rapidly toward the upper boundary of its pattern. Bullish momentum remains intact, and a brief consolidation around the breakout area could strengthen the base for the next leg higher.

Gold outlook: Strong fundamentals and technicals support further upside

Gold maintains a strong position as both macro drivers and technical signals support further gains. Rate cut expectations, political uncertainty, and ongoing geopolitical risks continue to drive safe-haven demand. At the same time, bullish chart patterns point to further upside if price breaks out decisively. Momentum stays strong, and any consolidation near current levels could prepare the market for the next advance.

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Unlock exclusive gold and silver trading signals and updates that most investors don’t see. Join our free newsletter now!

Author

Muhammad Umair, PhD

Gold Predictors

Muhammad Umair is a financial markets analyst and investor who focuses on the forex and precious metals markets.