Gold, Silver and Platinum anticipate volatility shift ahead of PCE data

Precious metals are trading in mixed fashion this Friday, May 30, as market participants position ahead of the Core PCE Price Index report set to be released in the North American session. This data remains the Federal Reserve’s preferred inflation measure and holds strong potential to shift market sentiment across gold, silver, and platinum.

- Gold falls 0.9% intraday but holds above 4-hour 100 EMA support.

- Silver trades inside range while EMAs suggest upside pressure building.

- Platinum volatility narrows further as PCE data could trigger breakout.

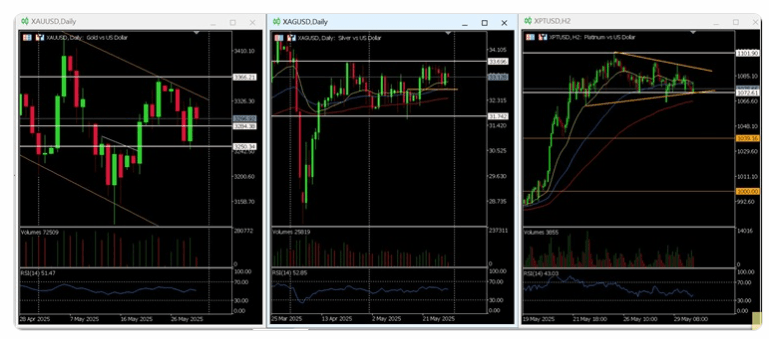

Gold opened today at $3,318 and slipped to a low of $3,287.46 during the European session. This marks a 0.9% decline from the open, although the slide found support at the 100 EMA on the 4-hour chart, allowing price to recover slightly to around $3,297.2. The failure to follow through yesterday’s bullish price action indicates weakening momentum, though not a total breakdown.

Gold, Silver, and Platinum price dynamics (March-May 2025). Source: MT4

Price action remains technically sensitive. A break below the 4-hour 100 EMA could push gold back to test the $3,280 support level. However, the daily RSI is still positioned slightly above neutral, suggesting that broader bullish momentum may stay intact. If support holds, buyers may aim for a return toward yesterday’s high at $3,322.7.

Silver and Platinum breakout potential rises as volatility tightens and EMAs align

Silver continues to move within a well-defined short-term range between $33.70 resistance and $32.62 support. Price currently trades near $33.17 after falling earlier in the Asian session and recovering on support from the 20-day EMA during the European hours. Still, silver posts a daily loss of 0.4%, having opened at $33.32.

Week to date, silver is down more than 0.7% as it trades below this week’s open at $33.43. RSI on the 4-hour chart stands at neutral, reflecting indecision. However, the alignment of the 20 and 50-day EMAs at the base of consolidation makes a bullish breakout more likely, particularly if the PCE data supports a weaker dollar.

Platinum is showing the least volatility of the three metals. Price continues to oscillate within a tight symmetrical triangle, bounded by support at $1,058 and resistance at $1,100. Volatility has narrowed further today, suggesting a breakout may be imminent once the PCE data is released.

Technical structure supports a long-term bullish breakout. EMAs are trending upward, and the daily RSI sits in bullish territory. If buyers take control, the first target is $1,100 and beyond. If price fails to move higher, a retest of $1,058 could materialise.

Today’s PCE inflation print will be the key driver into the monthly close. Strong inflation data could weigh on gold and silver while reinforcing dollar strength. A softer print could revive bullish interest in metals, especially for gold and silver that are testing key support zones. Platinum’s breakout path also hinges on this catalyst, as it moves closer to the apex of its tightening triangle.

Gold and silver bounced after early losses as the dollar eased from its tariff-driven strength. Platinum held steady in narrow range after last week’s sharp rally.

Author

Traders Union

Traders Union

Traders Union is a leading financial portal dedicated to empowering traders and investors with essential information to maximize their success in the financial markets.